WORLD ECONOMICS WORLD PRICE INDEX

Published by Gbaf News

Posted on June 17, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 17, 2014

4 min readLast updated: January 22, 2026

UK POUND’S OVER VALUATION AT 19 MONTH HIGH

The World Price Index

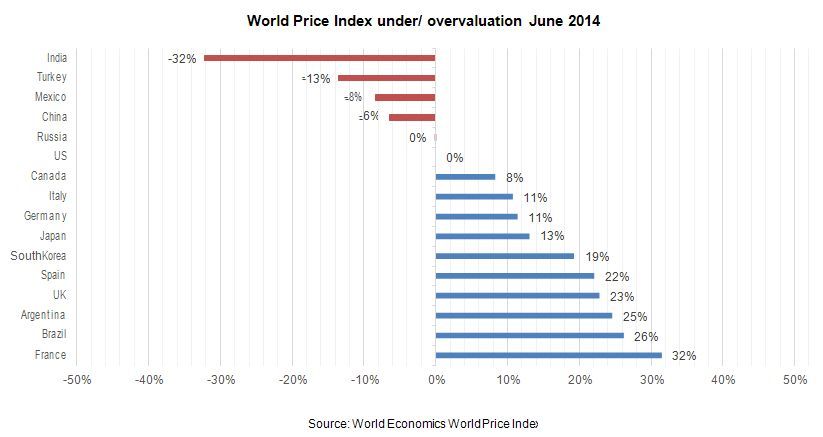

The World Price Index (WPI) measures the value of an urban selection of goods and services at purchasing power parity, reflecting the real purchasing power of different nations, allowing for Rapid and accurate international price comparisons. Under/ Overvaluation data is based on the difference between the exchange rate value of a currency and that of the US Dollar in Relation to the World Price Index calculated exchange rate.

UK Pound

The World Price Index Sterling PPP value for June is 0.73, compared to the market nominal exchange rate of 0.60. The overvaluation of the Pound against the US$ rose by 2.3% from May reflecting the continued real growth in the UK economy. The level of overvaluation has increased steadily for three successive months rising to a 19 month high. The nominal rate is unlikely to rise to correct this discrepancy between relative prices in the UK and the US until there are some clear signals that the Bank of England will raise interest rates pushing up the nominal market rate.

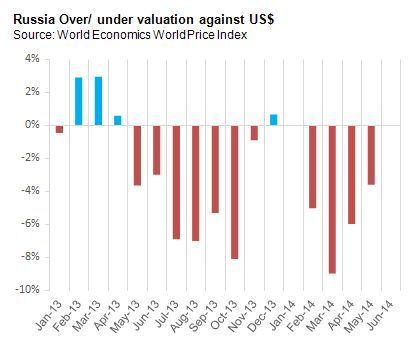

Russia Over/ Undervaluation against US$

Russia

The Russian Rouble has risen by nearly 4% in purchasing power parity terms to reach parity with the US Dollar. The currency’s Relative under valuation has been falling for four successive months mainly due to short-term currency market influences.

The Rouble had been undervalued from February until May and for most of the second half of 2013.The combination of ambiguous moves by Putin to ease the crisis in the Ukraine, the potential of a long-term supply of energy to China and the in effectiveness of Western sanctions, has negated the negative currency market causes of the Rouble’s previous undervaluation.

Russia Over/ Undervaluation against US$

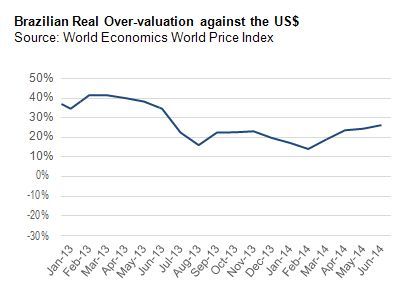

Brazilian Real

The Brazilian Real’s overvaluation against the US dollar has risen By 1.85% in June continuing a four month trend as anticipation of the FIFA World Cup and its imminence has pushed up domestic prices, particularly for hotels, relative to the US. This short-term upward trend is contrary to the longer-term fall in the Real’s value relative to the dollar which persisted throughout 2013. This trend could resume after the short-term boost provided by the tournament to Brazilian GDP is over.

Brazilian Real Over-valuation against the US$

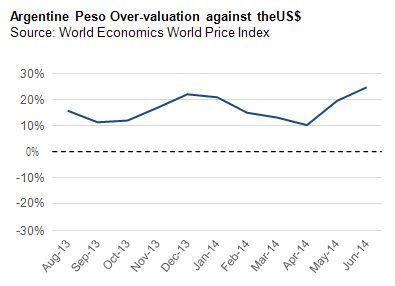

Argentine Peso

According to the WPI, Argentina’s peso should be at an exchange Rate of 10.09 to the US $. The official market rate is 8.10 suggesting an overvaluation of the market rate of 24.6% in June, up by 5.19% on the rate in May. The market rate was overvalued in Q4 2013 due to government interventions in the currency markets which reversed a devaluation of 20% in January which was found to be necessary to mitigate the impact on the country’s commodity exports. Unfortunately, the dual effect of continuing high inflation artificial restrictions on the supply of the currency and government support using official reserves, has meant that the Peso’s return to overvaluation has reduced the positive impact of the devaluation on competitiveness. The parallel, illegal or ‘blue’ exchange rate, stood at 11.55 pesos to the dollar on 5 June 2014, signaling a similar level of overvaluation to that suggested by the WPI data. The official rate does not look to be sustainable in the longer term.

Argentine Peso Over-valuation against the US$

…

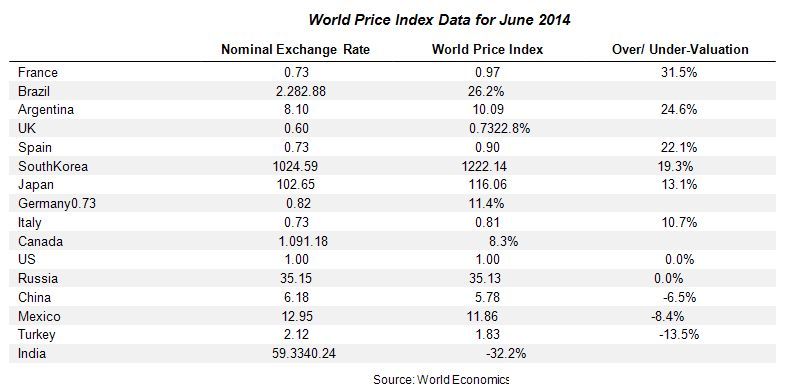

World Price Index Data for June 2014

About World Economics

World Economics is an organization dedicated to producing analysis, insight and data relating to questions of importance in understanding the world economy. Currently our primary research objective is to encourage and assist the development of better and faster measures of economic activity. In cases where we believe we can contribute directly, as opposed to through highlighting the work of others, we are producing our own measures of economic activity. Our work is mainly of interest to investors, organizations and individuals in the financial sector and to significant corporations with global operations, as well as governments and academic economists.

The World Price Index has been developed by World Economics, a leading provider of original economic data and comment. Sister products include the World Economics Journal, the Sales Managers’ Indexes ,the Global Marketing Index

World Economics welcomes your feedback, which should be addressed to Amelia.Myles@worldeconomics.com.

You can follow World Economics on Twitter and Facebook

Explore more articles in the Investing category