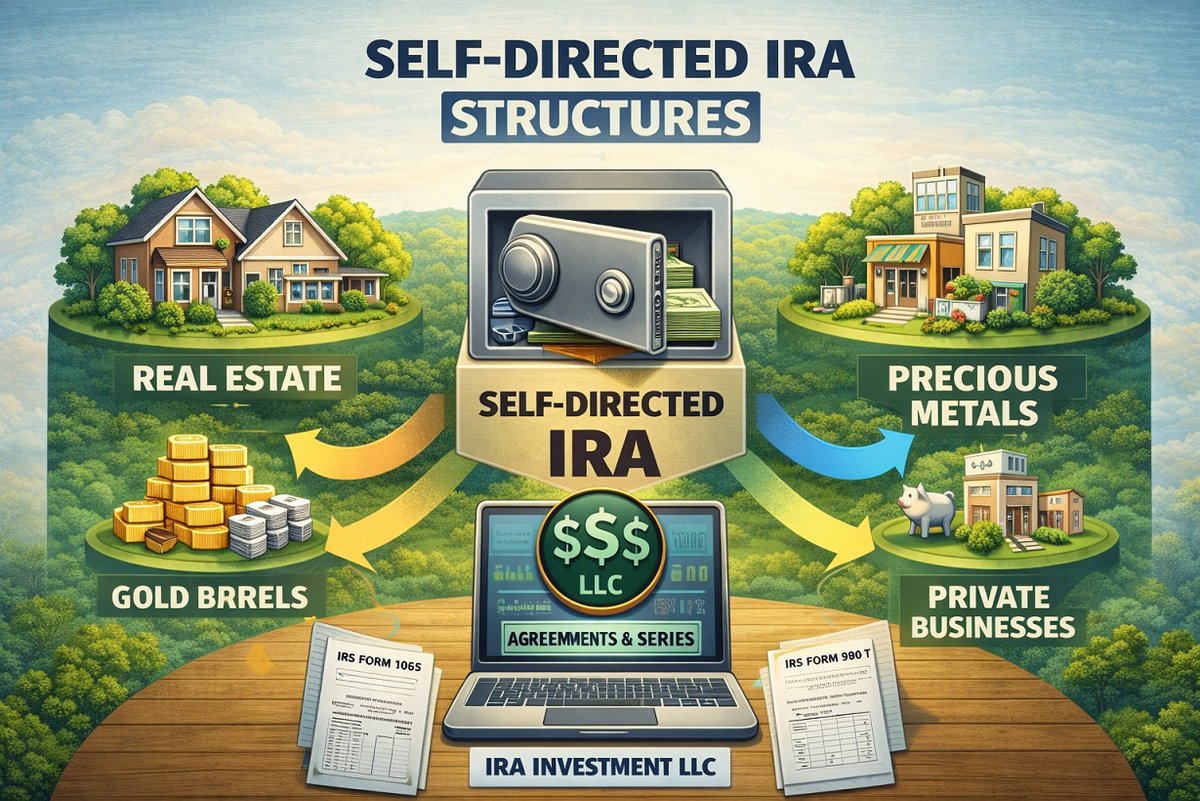

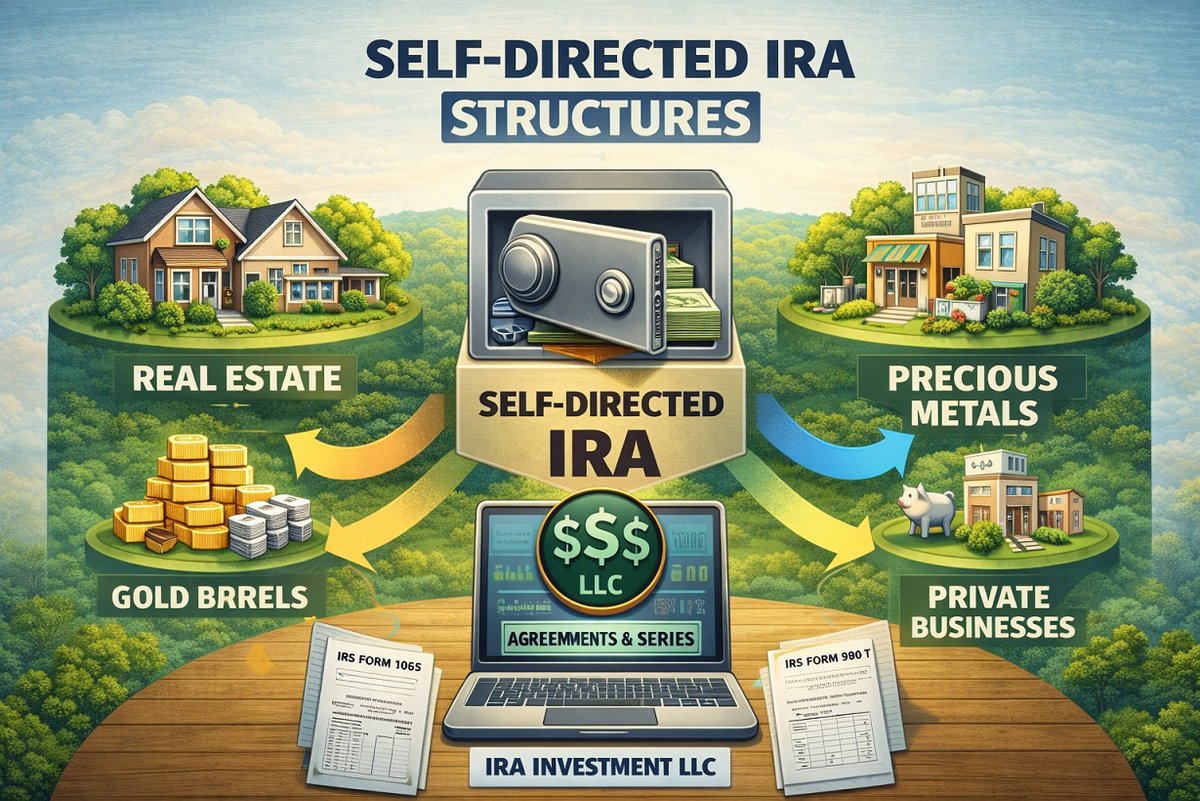

Understanding Self-Directed IRA Structures and Platform Models

Retirement planners preparing for a new life season historically turn to a mix of

Retirement planners preparing for a new life season historically turn to a mix of investments, which usually include mutual funds, index exchange-traded funds and corporate bonds. Those looking for greater autonomy also consider real estate, startups, digital assets and self-directed individual retirement accounts (SDIRAs). The way an SDIRA is structured, in particular, becomes a critical choice because it shapes control and day-to-day responsibilities. Understand the different SDIRA structures and platforms before committing.

Investors need a clear view of the two key operating models, as this will influence everything, from how quickly a deal closes to who handles record-keeping and compliance. Most SDIRA platforms build their services on one of two approaches, or a hybrid.

Under a traditional self-directed IRA model, a custodial firm — or a regulated trust — holds the investor's assets, and the investor decides what the IRA buys or sells. Because the custodian is the legal owner of the IRA's assets, every action flows through it. This means the investor identifies an investment, then submits instructions and supporting documents, while the custodian reviews these for completeness and compliance, signs documents and sends funds from the IRA.

Companies using this model are called directed custodians, meaning they execute investor instructions in accordance with Internal Revenue Service (IRS) guidelines, including restrictions on collectibles and prohibited transactions in Internal Revenue Code §4975.

Supported account types under the custodian-controlled approach include traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs. Many providers also extend similar processes to Solo 401(k)s and other qualified plans, though those follow separate IRS rules.

The advantages of custodian-controlled SDIRAs include strong compliance oversight, simpler ongoing administration processes for investors and convenience for those seeking structured workflows. However, this approach can slow down time-sensitive deals, especially in competitive real estate or private placement markets. Cost schedules may also include per-transaction charges, asset-based fees or both, which can add up for active investors.

For example, imagine an investor wants to buy a single-family rental, performs due diligence and negotiates a purchase agreement naming XYZ IRA as the buyer. The investor submits an investment direction form and supporting documents to the custodian. The custodian reviews the documents and then signs on behalf of the IRA. Funds flow from the IRA to the closing agent, and then the property title is recorded in the IRA's name. Every related expense is paid by the custodian from the IRA cash at the investor's direction.

In this approach, the IRA does not buy each asset directly. Instead, the IRA invests in a newly-formed single-member LLC or a trust. The retirement account owns 100% of this LLC, and the investor is usually the manager and controls its bank account.

The investor opens an SDIRA with a provider that supports checkbook structures, then the provider facilitates the creation of an IRA-owned LLC in a chosen state. The IRA funds the LLC as its sole investment. The investor, acting as the LLC's manager, uses the LLC's bank account to write checks or send wires for investments.

Because transactions occur at the LLC level, the investor can fund deals without waiting for a custodian to review them, as long as they comply with IRS rules. The supported accounts under this model are the same as the custodian-controlled IRAs.

The advantage of this approach is swift execution, because the manager can wire money or write checks directly from the LLC account. No custodian sign-off is needed. Fees are often flat and predictable, based on account or entity administration rather than on asset value.

On the downside, the investor carries a greater compliance burden and improper use can lead to disqualification of the IRA. The setup is also more complex as it involves entity formation and a business bank account. The custodian's involvement occurs primarily at the IRA and LLC ownership levels, not at the deal level.

Reviewers track SDIRA providers in the same way they monitor online brokers, highlighting differences in fees, supported assets and account structures. Seven platforms stand out in the market for their range of service styles and models. (This list is for informational purposes only and does not constitute an endorsement)

Accuplan has a custodian-controlled model and offers self-directed IRAs that can hold real estate, private equity, private lending and digital assets through a directed process. It supports an array of alternative assets and manages custodial functions and paperwork for investors looking for broad access with structured oversight.

Accuplan’s platform highlights online account management, transaction request workflows and customer service geared toward investors executing nontraditional deals regularly.

Equity Trust is one of the longest-standing SDIRA custodians. It uses the custodian-controlled approach for self-directed IRAs and variations such as a real estate checkbook IRA LLC for certain investors. Equity Trust is experienced with real estate, private placements, precious metals and cryptocurrency.

Its current account fee schedule outlines account setup, annual maintenance and asset-based fees. For investors looking for continuity and institutional robustness, Equity Trust often ranks highly in independent comparisons.

Rocket Dollar is an example of the checkbook-control model, offering self-directed IRAs and Solo 401(k)s built around direct control structures and subscription-based pricing. Its core service centers on creating the required LLC, opening the bank account and wiring IRA funds into that entity. This enables investors to allocate capital into crypto, startups, real estate or crowdfunding deals at their own pace.

IRA Financial built its brand around checkbook control and legal compliance. It was founded by tax attorneys and is known for publishing comprehensive content on SDIRAs, Solo 401(k)s and IRS rules for prohibited transactions. It also places notable emphasis on Solo 401(k)s, which can offer higher contribution limits and additional planning angles for self-employed investors.

For those pursuing more advanced strategies or seeking direct control with a strong legal framework, IRA Financial often ranks well in ratings versus most SDIRA providers.

uDirect IRA represents a service-centric approach based on the custodian-controlled model. The company positions itself as an educator and facilitator for SDIRA investors, particularly those focused on private notes, precious metals and real estate.

It works as a third-party administrator alongside custodians to process account openings and transactions, while guiding investors through rules around disqualified persons and prohibited transactions. uDirect IRA is best suited for those looking for one-on-one discussions and detailed form walk-throughs.

Alto IRA showcases a more modern take on the custodian-controlled model. While the custodian still holds the assets, Alto uses a technology platform that connects directly to investment sponsors, such as venture funds and alternative investment marketplaces.

It is frequently noted for its integrations, which enable investors to allocate to partner platforms with a more seamless workflow than traditional paperwork-driven custodians. The outcome feels similar to an online brokerage execution, even though the custodian stays in control of titling and related responsibilities. Alto IRA offers a practical middle ground for investors who prefer a curated list of alternative platforms and a modern UX over an open-ended checkbook structure.

Strata Trust is a traditional SDIRA custodian known for security, regulatory oversight and long-standing relationships with financial advisors and investment sponsors. It follows the custodian-controlled model, with a fee structure that covers annual account charges and transaction fees.

Strata often partners with advisers and platforms that bring alternative investments to clients, making it a common choice for investors who work through professionals rather than sourcing every deal themselves.

Here's a quick look at the seven leading self-directed IRA providers.

| Provider | Primary Structure | Annual Fee | Key Investment Focus |

| Accuplan | Custodian-controlled | Asset-based | Broad alternatives |

| Equity Trust | Custodian-controlled | Asset-based | Real estate, private placement, crypto, precious metals |

| Rocket Dollar | Checkbook control | Flat or menu-based | Real estate, Solo 401(k)s, complex structures |

| IRA Financial | Custodian-controlled | Flat or menu-based | Real estate, Solo 401(k)s, legal compliance, advanced strategies |

| uDirect IRA | Custodian-controlled | Asset-based | Real estate, notes, precious metals |

| Alto IRA | Custodian-controlled | Platform-based, account fees | Online alternative platforms, venture, private funds |

| Strata Trust | Custodian-controlled | Asset-based | Real estate, private placements, alternative funds |

Custodian-controlled SDIRAs tend to align with investors seeking broad access to alternatives with guardrails, a visible compliance layer and defined processes. Checkbook control arrangements usually resonate with investors who regularly execute deals and are comfortable shouldering more technical responsibilities for IRS rules.

After determining your preferred structure, compare fee models based on current schedules, identify each provider's strengths relative to your intended asset mix, and then weigh technology and customer service against your experience and time constraints.

Choosing between custodian-controlled and checkbook IRA arrangements sets the tone for your entire alternative investment strategy. The right fit is the one whose services and products align with your goals, appetite for hands-on involvement and risk tolerance.

Disclaimer: This article is not financial, tax, or legal advice. Readers should consult qualified professionals.

A self-directed IRA is a type of individual retirement account that allows investors to make their own investment decisions, including real estate, stocks, and other assets, rather than relying on a custodian.

Platform models refer to the different structures and services offered by financial institutions that facilitate self-directed IRAs, allowing investors to manage their retirement funds.

Self-directed IRAs offer investors greater control over their investment choices, potentially higher returns, and the ability to diversify their portfolios beyond traditional assets.

Capital gains are the profits earned from the sale of an asset, such as stocks or real estate, when the selling price exceeds the purchase price.

Retirement services encompass a range of financial products and advice aimed at helping individuals save and plan for their retirement.

Explore more articles in the Investing category