Top 5 Reasons Investors Choose Royal Mint Gold Bars

Do you reckon investing in gold bars? If you are a novice or a veteran, you would have always considered: Royal Mint gold bars! The sheer market demand and beauty of these gold bars are fascinating.

Do you reckon investing in gold bars? If you are a novice or a veteran, you would have always considered: Royal Mint gold bars! The sheer market demand and beauty of these gold bars are fascinating.

For investors, investing in gold is always the first option, especially for those who are constantly searching for dependable and secure strategies to increase their capital. Royal Mint gold bars are one of the best choices among other gold options. Because of their high reputation and excellent grade of gold, these bars are a reliable investment option.

The top five reasons that should consider in your decision as a clever investor while including Royal Mint gold bars in their portfolios will be discussed here.

Let's get started.

1. Unbreakable Trust of Experience

With more than 1,100 years of history, the Royal Mint is renowned across the world for its exquisite designs and workmanship. From the traditional Britannia portrayal to the legendary Star Wars bars, the Royal Mint gold bars are basically beloved by everyone.

As "The Original Maker," they honor their unparalleled heritage and dedication to quality. Every product, along with royal mint gold bars, is made in a special style that demonstrates accuracy and pride in workmanship. Although the production has changed, their commitment to excellence has not.

2. Purest and Timeless: Mesmerising designs in 99.99% Gold

Royal Mint gold bars are made with 99.99% pure gold, ensuring the highest quality and value. This level of purity means the bars are nearly free of impurities, making them ideal for investment or collection.

But, How is that executed?

The design of these gold bars is simple yet elegant, focusing on timelessness. They often feature the Royal Mint logo, the bar’s weight, and its purity. Some bars also include the stunning symbols such as Britannia, representing British heritage and strength.

The craftsmanship ensures the gold bars have a polished finish with clean, sharp edges, giving them a premium appearance. Their minimalistic design appeals to both first-time buyers and experienced investors, ensuring they remain desirable over time.

3. Globally Recognized and Easy to Sell Anywhere

Royal Mint gold bars are trusted worldwide because they come from one of the oldest and most respected mints. Their quality, purity (999.9 fine gold), and official branding make them easy to recognize and authenticate. Since they are globally trusted, you can sell them almost anywhere, whether in your country or overseas.

How does that benefit you?

Gold buyers, banks, and dealers accept Royal Mint gold bars because they know their high standards and reliability. This makes it convenient to turn your gold into cash or trade it when needed.

The global recognition also gives you confidence that your investment is valuable and easy to manage. Whether you are planning to preserve the bars for the future or to sell them, Royal Mint gold bars are a smart choice for easy liquidity and universal acceptance.

4. Excellent Resale Value and Bank Account Friendly!

Royal Mint gold bars are a great choice because they are both affordable and hold their value well. They come in various sizes, like 1 gram or 1 ounce, making it easy for buyers with different budgets to invest. Smaller bars are especially budget-friendly, so you don’t need to spend a lot to start investing in gold.

Gold is a trusted and stable asset. Royal Mint gold bars are made of 24-carat gold, which is highly pure, and they are widely known. This makes them easy to sell when needed, often at a good price. Over time, gold prices generally increase, so these bars can provide strong resale value.

With their reputation and quality, Royal Mint gold bars are a smart way to own real gold, whether you’re starting small or building a larger collection.

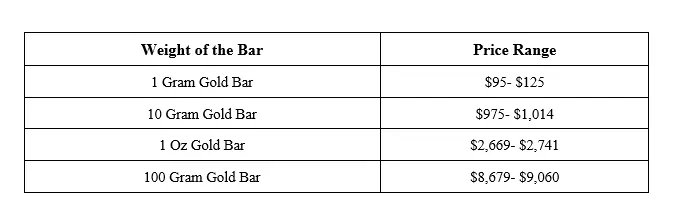

Below are some generic price ranges of these bars, which vary according to weight.

Pro Tip: If you are looking for the best price deal you may want to check out Bullion mentor. On Bullion Mentor you can easily find the best price on all bullion products.

5. Brings Balance to your portfolio!

If you decide to invest in Royal Mint gold bars, let us tell you that they are a smart way to balance and strengthen your portfolio. These bars offer a valuable and stable asset that can protect against market swings. The Royal Mint’s gold bars come in popular series, each with unique designs:

Britannia Gold Bars:

Featuring the iconic Britannia portrayal, who is the sheer embodiment of Britain profound history and its perseverance towards greatness. These gold bars, ideally, are the best investment choice one could make!

Star Wars Gold Bars:

Perfect for collectors, these bars showcase beloved Star Wars characters, combining investment value with pop culture appeal.

Bullion Gift Bars:

Designed for gifting purposes, these bars have elegant designs for special occasions, adding personal meaning to your investment.

Each series offers .9999 fine gold quality, blending beauty and financial security. Whether you’re diversifying your portfolio or giving a memorable gift, Royal Mint gold bars are a reliable and stylish choice.

Surely, the Royal Mint Gold Bars are a must-have for investors because of their purity, authenticity, and superior quality. These bars are trusted around the world that safeguard your investment during price inflation and economic volatility.

They come in a variety of sizes and are suitable for many investment options, as well as providing liquidity when required. Investing in Royal Mint Gold Bars will feel like meditating on a mountain top while your money is preserved, making them an excellent asset for diversifying and protecting capital during tumultuous market conditions.

Explore more articles in the Investing category