South Africa and Britain to strengthen trade and defence ties

JOHANNESBURG (Reuters) – South Africa and Britain have agreed to boost trade and defence cooperation, the two countries’ foreign ministers said after meeting on Tuesday.

South Africa is already Britain’s biggest trading partner on the African continent and Britain is among the top five destinations for South African exports, which include precious metals, cars and agricultural products.

Bilateral trade between the two countries totalled about 133 billion rand ($7.62 billion) last year, according to South African Revenue Service data.

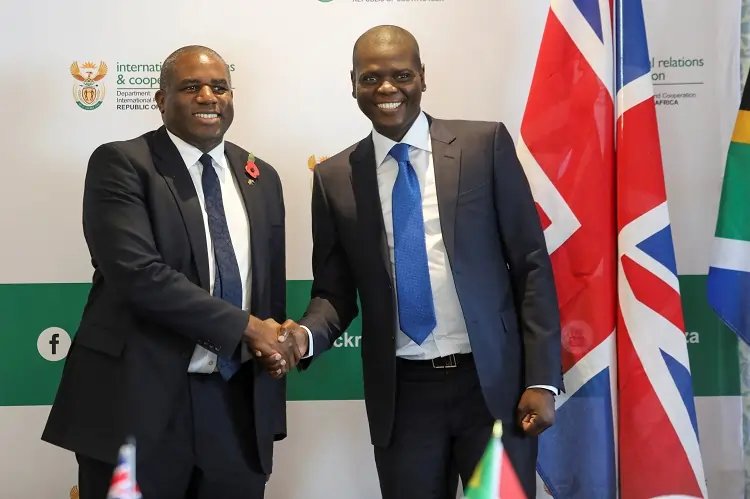

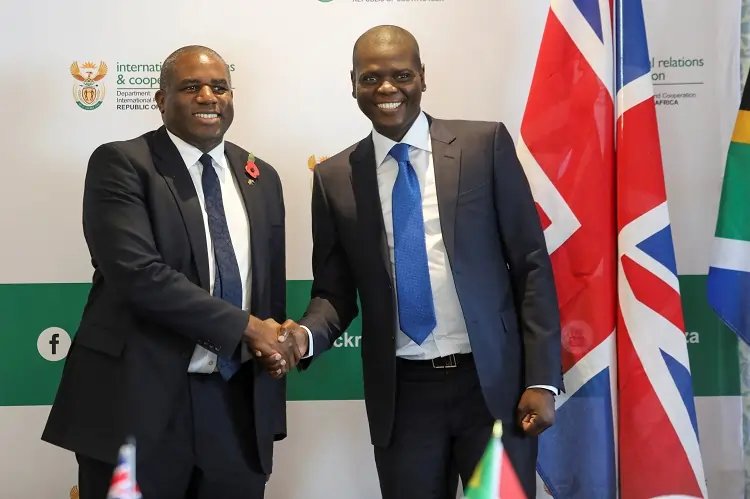

“We’ve committed to a UK-South Africa growth plan that will drive economic development and deepen our trade and investment ties,” British Foreign Secretary David Lammy said, speaking alongside his South African counterpart Ronald Lamola.

He did not give details about the plan, although his office had said it would include a programme to increase the number of agricultural jobs in rural South Africa, boosting exports to Britain.

Lamola said ahead of the meeting that the countries’ trade and investment relationship had stagnated due to the COVID-19 pandemic and other challenges and that it needed a “reset”.

“I am pleased that we have reaffirmed the importance and the strength of our bilateral trade and investment relationship,” he said.

On defence, the two countries committed to deepen their cooperation on counter-terrorism and also discussed their shared goals for a just energy transition, Lammy said.

Lammy, who is on his first official visit to Africa as foreign secretary, visited Nigeria on Monday where he also agreed to strengthen economic and security ties.

($1 = 17.4621 rand)

(Reporting by Bhargav Acharya and Nellie Peyton; Editing by Alexander Winning and Alison Williams)

Precious metals are rare metallic elements that have high economic value, commonly including gold, silver, platinum, and palladium, often used in jewelry and as investment assets.

An export is a good or service sold by one country to another. Exports are crucial for a country's economy, contributing to its gross domestic product (GDP).

A growth plan outlines strategies and actions aimed at increasing a country's economic development, often focusing on sectors like trade, investment, and job creation.

Explore more articles in the Investing category