SECURE CHIP TECHNOLOGY INDUSTRY ACHIEVES INTEROPERABILITY MILESTONE

Published by Gbaf News

Posted on November 6, 2015

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on November 6, 2015

3 min readLast updated: January 22, 2026

150th Secure Component Qualified by the GlobalPlatform Compliance Program

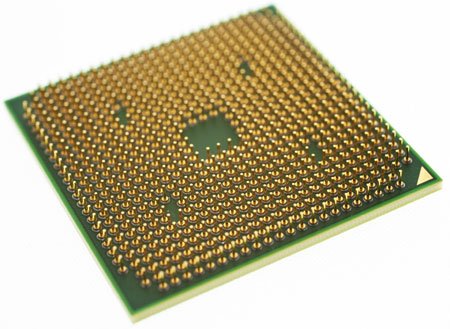

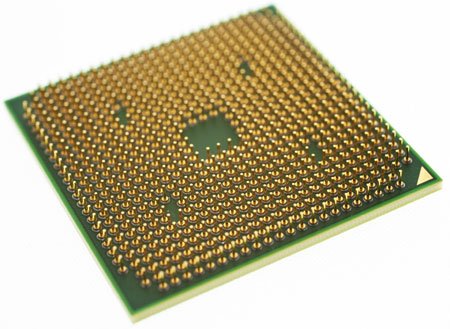

In a development which reflects the advanced level of interoperability and stability that now exists within the secure chip industry, the 150th secure component has received independent laboratory qualification to confirm it functionally complies with GlobalPlatform Specifications and other industry requirements.

The GlobalPlatform Compliance Program qualifies a range of secure components, such as secure elements (SE) and trusted execution environments (TEE), from a number of international manufacturers. Its test tools are also purchased and used by manufacturers to ensure product compliancy throughout the product development process. The program provides a foundation for interoperability, stability and confidence in the secure chip industry by evaluating the functional behavior of products against GlobalPlatform requirements. This lowers the cost of progress by industry players such as application developers, hardware manufacturers and software developers by removing barriers caused by interoperability issues.

“The industry clearly recognizes that interoperability is essential to enable mass market deployments,” comments Gil Bernabeu, Technical Director of GlobalPlatform. “The ability to validate that secure chip products are compliant to the specifications helps developers to reduce costs and time to market for their applications. Through our work, there are now 151 compliant products available for service providers to utilize. The result is that service providers can now deploy their services with confidence that the secure chip products they are using will behave exactly as intended and deliver a consistent end-user experience each and every time.”

To enable the smooth running of its compliance program, GlobalPlatform qualifies independent third-party laboratories and test tools. There are currently five qualified test tools available from five different providers and 16 accredited laboratories which contribute to the development of an open and thoroughly evaluated compliance ecosystem.

“Compliance is fundamental to the success of any technology,” adds Gil. “To illustrate this, consider that there are a number of SE form factors, developed by numerous companies and used by a multitude of organizations all over the world. These SEs are incorporated into hundreds of different devices and loaded with different applications aimed at a global customer base. Consumers reject products and services that do not function properly and, without compliance, all of this technology would not work together. Compliance is not only business critical, its industry critical.”

GlobalPlatform has invested in compliance since 2002 to evaluate the alignment of smart cards and SEs to GlobalPlatform Specifications. In 2012, GlobalPlatform expanded its compliance scope to incorporate the TEE to drive its standardization work in this area. Further additions were made in 2014, which enabled mobile handset manufacturers to confirm that products align with SIMalliance’s Open Mobile API (OMAPI) Specification and the GlobalPlatform Secure Element (SE) Access Control (AC) Specification, contributing to seamless NFC deployments for application developers and service providers.

GlobalPlatform’s Compliance Program infographic

Explore more articles in the Technology category