RESEARCH SHOWS LINK BETWEEN CUSTOMER SERVICE AND REVENUE STILL OVERLOOKED BY UK ORGANISATIONS

Published by Gbaf News

Posted on July 1, 2014

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 1, 2014

5 min readLast updated: January 22, 2026

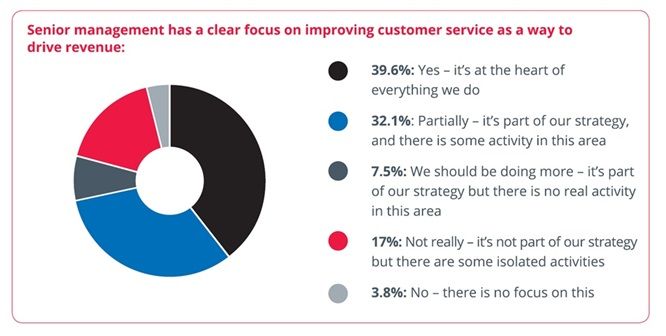

Contact Centre Association Research for KANA Suggests Only 40 Percent of Senior Managers Focused on Improving Customer Service

Research commissioned by customer service specialists KANA® Software, A Verint® Company (NASDAQ: VRNT), suggests many organisations are overlooking the potential for customer service improvements that could drive revenue.

The survey of UK Contact Centre Association (CCA) members included a diverse mix of industry sectors, from financial services, to local government and retail. It reveals that only 40 percent (39.6 percent) believe senior management places a clear focus on customer service as a way to drive revenue; noting one-fifth of respondents (20.8 percent) think there is little or no focus on customer service at a senior level.

The survey also found that the majority of respondents are unconvinced of the link between customer service and the bottom line. Well below half (41.5 percent) take a keen interest in revenue loss resulting from poor customer service. According to the data, one-in-10 management teams pay no attention to the financial implications of a poor customer service experience.

The survey also found that the majority of respondents are unconvinced of the link between customer service and the bottom line. Well below half (41.5 percent) take a keen interest in revenue loss resulting from poor customer service. According to the data, one-in-10 management teams pay no attention to the financial implications of a poor customer service experience.

Improving quality and reducing the “cost to serve” are currently seen as primary challenges in today’s organisations. The research also highlights what call centre agents perceive as key barriers to providing a better service: outdated systems, lack of investment, agent skills gaps and a lack of understanding or support at a senior level.

“Unfortunately, the contact centre is often seen as an operational expense and nothing more,” says Steven Thurlow, head of worldwide product strategy for KANA. “Often, senior management will review functional aspects, such as speed of handling times and resolution times. This approach is unlikely to drive further investment and instead maintains a focus on efficiency above all else. Fast service and good customer experiences are not always the same thing. Strategic investments in people, processes and the technology platforms that can aid them should be considered by the C-suite and across organisations.”

Thurlow adds, “The commercial value of an effective call centre, balanced against mitigating and eliminating the potential damages of poor customer service, should not be overlooked. A contact centre is not an unavoidable cost – it can be an invaluable tool.”

Read the full summary paper: Why Customer Service Success is a Critical Boardroom Issue

About the Research

Steven Thurlow

The Contact Centre Association (CCA) surveyed a representative sample of its 5,000 senior practitioner members in the UK during November 2013 to determine current attitudes and behaviours. The margin of error—which measures sampling variability—is +/- 5%. Responses were received from 82 member organisations, including private and public sectors, outsourcers and in-house contact centres. Respondents were from a range of industry sectors. Survey findings were analysed and interpreted in a desk research phase alongside contextual information from other studies, expert insights gleaned from external sources, views of senior industry figures within the CCA network, and material within CCA’s extensive research archive.

About KANA

KANA®, A Verint® Company, is a leading provider of cloud and on-premises customer service solutions. KANA helps global organizations—including many of the Fortune 500, mid-market businesses and public sector agencies—optimize their engagements with consistent and contextual customer journeys across agent, web, social and mobile experiences. Using KANA solutions, organizations can reduce operational costs, increase resolution rates and improve brand loyalty. Learn more at www.kana.com.

About Verint Systems Inc.

Verint® (NASDAQ: VRNT) is a global leader in Actionable Intelligence® solutions. Actionable Intelligence is a necessity in a dynamic world of massive information growth because it empowers organizations with crucial insights and enables decision makers to anticipate, respond and take action. Verint Actionable Intelligence solutions help organizations address three important challenges: customer engagement optimization; security intelligence; and fraud, risk, and compliance. Today, more than 10,000 organizations in over 180 countries, including over 80 percent of the Fortune 100, use Verint solutions to improve enterprise performance and make the world a safer place. Learn more at www.verint.com.

This press release contains forward-looking statements, including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-looking statements are not guarantees of future performance and they are based on management’s expectations that involve a number of risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. For a detailed discussion of these risk factors, see our Annual Report on Form 10-K for the fiscal year ended January 31, 2014 and our Quarterly Report on Form 10-Q for the quarter ended April 30, 2014 and other filings we make with the SEC. The forward-looking statements contained in this press release are made as of the date of this press release and, except as required by law, the Company assumes no obligation to update or revise them or to provide reasons why actual results may differ.

VERINT, ACTIONABLE INTELLIGENCE, MAKE BIG DATA ACTIONABLE, CUSTOMER-INSPIRED EXCELLENCE, INTELLIGENCE IN ACTION, IMPACT 360, WITNESS, VERINT VERIFIED, KANA, LAGAN, VOVICI, GMT, VICTRIO, AUDIOLOG, ENTERPRISE INTELLIGENCE SOLUTIONS, SECURITY INTELLIGENCE SOLUTIONS, VOICE OF THE CUSTOMER ANALYTICS, NEXTIVA, EDGEVR, RELIANT, VANTAGE, STAR-GATE, ENGAGE, CYBERVISION, FOCALINFO, SUNTECH, and VIGIA are trademarks or registered trademarks of Verint Systems Inc. or its subsidiaries. Other trademarks mentioned are the property of their respective owners.

Explore more articles in the Business category