QUANTITATIVE BROKERS AND RISKVAL TO DELIVER ADVANCED FIXED INCOME TRADING PLATFORM

Published by Gbaf News

Posted on February 4, 2015

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on February 4, 2015

2 min readLast updated: January 22, 2026

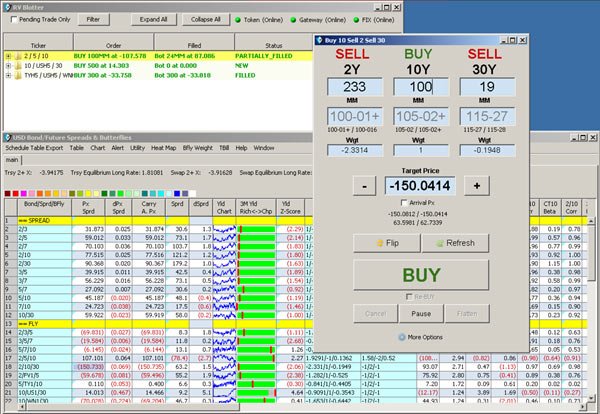

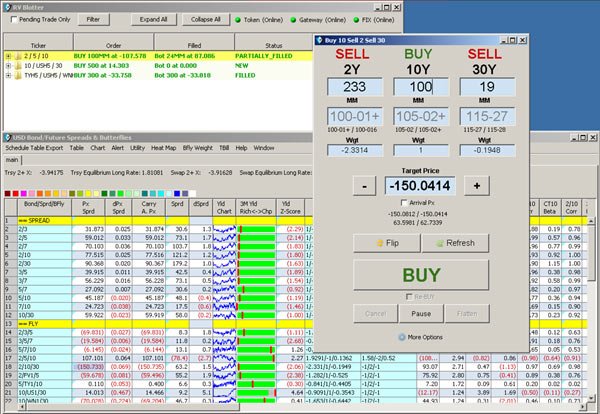

Quantitative Brokers (“QB”), the world’s leading provider of agency algorithms for fixed income and futures markets, announced that it has partnered with RiskVal Financial Solutions, the industry standard provider of trading analytics and real-time risk management, to create a unified platform for advanced fixed income trading. The new platform combines powerful real-time analytics with seamless access to QB algorithms for best execution.

The integration of QB algorithms and RiskVal trading analytics provides traders with real-time control and transparency into their outright and relative value executions. RiskVal and QB have developed screens that can route orders to Legger, QB’s multi-leg execution strategy, for basis and relative value trading. QB’s Legger algorithm intelligently executes user-defined structures with any ratio and number of legs across cash US Treasury and futures markets. A detailed transactional cost analysis (“TCA”) report is generated for each execution, providing full post-trade transparency on the order and slippage performance.

“Fixed income traders are continually looking for better ways to actively manage their enterprise-wide risk,” said Christian Hauff, CEO and co-founder of QB. “By marrying QB’s best execution algorithms with RiskVal’s proven relative value analytics, we have created a unique platform that integrates powerful trade discovery with superior execution tools.”

“The fixed income markets are rapidly evolving, and traders are seeking access to smarter and more transparent execution,” said Jordan Hu, founder and CEO of RiskVal. “As the market structure evolution continues, we are excited to address some of the key issues that fixed income traders face in the move to a more electronically-driven model.”

In 2014, the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC) approved QB as a broker-dealer for government securities.

Explore more articles in the Trading category