NZD/USD TRADING GUIDE: TRADE BALANCE

Published by Gbaf News

Posted on March 27, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 27, 2014

2 min readLast updated: January 22, 2026

(March 26, 2014)

(March 26, 2014)

New Zealand is scheduled to release its trade balance for February in the upcoming Asian trading session. Analysts project the trade surplus to widen from January’s 306 million NZD surplus to 595 million NZD, reflecting better trade activity for the past month.

A quick look at NZD/USD’ reaction to mixed data back when the January figures were release still reflects underlying Kiwi strength. Back then, the actual figure came in stronger than the estimated 230 million NZD reading but the previous month’s surplus was revised down from 523 million NZD to 493 million NZD, showing that the initially reported trade activity was not as strong.

Despite that, NZD/USD managed to hold on to its gains during the February 26 release date and even go for more. The currency pair was kept on its uptrend mostly by interest rate hike expectations from the RBNZ (Reserve Bank of New Zealand).

Despite that, NZD/USD managed to hold on to its gains during the February 26 release date and even go for more. The currency pair was kept on its uptrend mostly by interest rate hike expectations from the RBNZ (Reserve Bank of New Zealand).

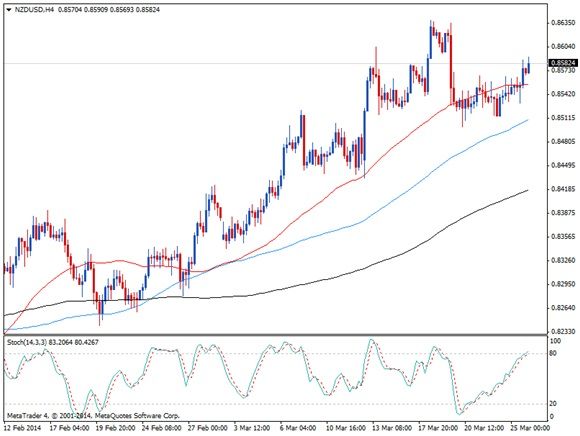

NZD/USD is currently testing a short-term uptrend line visible on its 4-hour and 1-hour time frames, indicating that further rallies could be in the cards if the actual figure comes in better than expected. Bear in mind that NZD/USD is supported by a positive interest rate differential between the Fed and the RBNZ. However, weakening risk appetite is preventing the pair from staging significantly strong rallies for now.

On the other hand, a smaller than expected trade surplus or a deficit might lead to a downside break from the trend line. This might usher in a short-term selloff for the pair, as the RBNZ has been blaming Kiwi strength for the weakness in the country’s exports lately. If the trade balance reflects this slowdown, RBNZ officials might grab the opportunity to jawbone the Kiwi later on.

To keep yourself updated with the latest financial news, visit the official website of Capital Trust Markets

Capital Trust Markets is an online Forex brokerage firm, headquartered in New Zealand. It was established in 2013, with an emphasis on providing the most excellent customer services in the industry. The trading environment offered to investors and traders is unparalleled – devoid of all common mistakes usually prevalent in the financial trading industry. The focused determination to provide the highest quality products, services, and support to clients and customers is what truly sets Capital Trust Markets apart from every other major brokerage firm.

Explore more articles in the Trading category