IPES: CapitalTracker Case Study

Published by Gbaf News

Posted on January 24, 2013

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on January 24, 2013

4 min readLast updated: January 22, 2026

“CapitalTracker now controls every aspect of our business. That’s why the partnership with Ballard Chalmers has been so important. The programmers work for me, but are supported by their full technical team – it’s the best of both worlds.” Tim Andrews, Director of Development, Ipes.

Ipes is ranked as one of the top five fund services providers globally based on private equity assets under administration. The firm administers over $50bn of investments for private equity clients including buyout, venture capital and listed funds. Many of Ipes’ competitors rely on off-the-shelf software packages, which Ipes found lacked the flexibility to fully meet client demands. Doubting that suppliers would be willing to provide the required enhancements, Ipes decided to invest in the development of their own platform, which would offer significant benefits to clients and to their internal operation.

Ipes wanted to enable their own staff, their clients and clients’ investors to have real-time views of investment activity, transfers, and multi-national bank transactions. Ipes also wanted the platform to include customisable live data views, reporting and document storage and have the ability to deal with all internal book-keeping and reconciliation functions.

For the first time clients would have web-based access to live banking information without the need for uploading to a presentation system. Client portals could also be customised depending on client requirements to include different levels of access and accommodate preferences in terms of layout and presentation. The platform would be well in advance of competitors offerings.

Having contracted consultants Ballard Chalmers previously for a SharePoint implementation project, Ipes asked for proposals. They were impressed by Ballard Chalmers’ response, which allowed for even greater customisation and flexibility than had been specified, and the competitive contract was awarded.

Ballard Chalmers provided 5 developers for the project, working as an embedded team within Ipes but with the pro-active guidance of Ballard Chalmers Chief Technical Officer Geoff Ballard, who had masterminded the proposal. Geoff’s deep experience with the Microsoft Application Platform (.NET, SQL, SharePoint and BizTalk) was a key factor in the architecture design and its implementation.

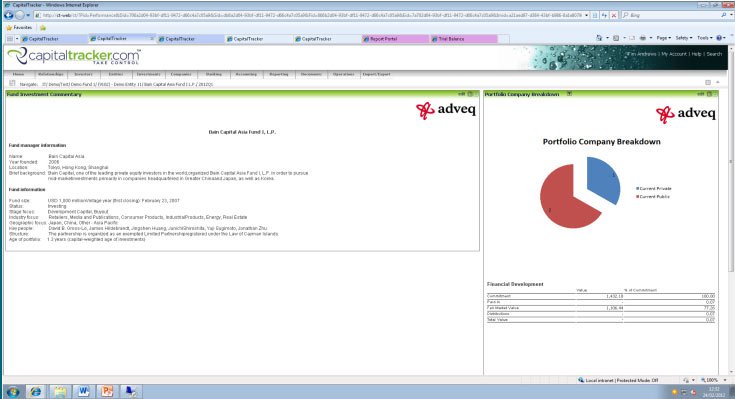

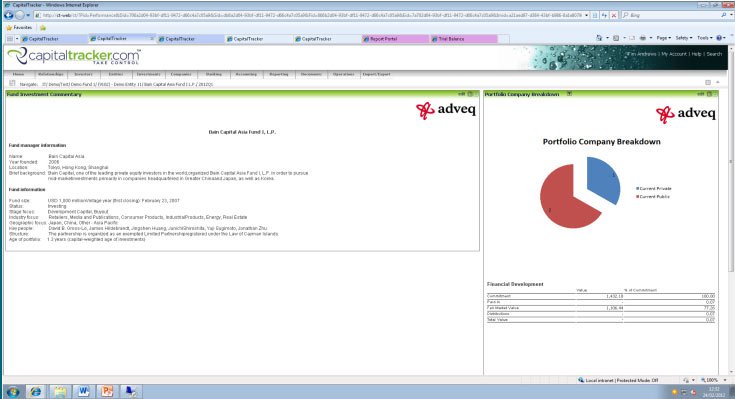

The result is CapitalTracker.com, the first entirely web-based system in the field, with a widget-based architecture enabling customised views of data in real time to all users. Investors can see live valuations, transfer information and obtain up to the second reports, clients can view the information for all their investors, and Ipes staffs have access to the same information across all funds being managed.

All banks subscribe to the SWIFT system for transfers, and Ipes became the first and only independent private equity fund services provider to join. CapitalTracker therefore directly accesses the same information as the banks.

CapitalTracker is also flexible enough to allow for branding by Ipes clients, who can then not only offer their investors financial statements and information relating to transactions but also document storage, partnership agreements and KYC compliance information. Additionally it handles secretarial work such as registration with local regulators. It is a single system with many views, all live.

There were further benefits to CapitalTracker in use. Tim Andrews continues: “Traditionally 2/3rds of transactions benefit from straight-through processing, the remainder requiring manual intervention within the banks. SWIFT membership and CapitalTracker now enjoy 95% straight-through processing. In turn this means the banks allow later cut-off times, and Ipes has been able to negotiate lower rates for clients. Transfers are liable to high pressure from investors and this has been much reduced.”

CapitalTracker.com was launched in the latter part of 2011 and has been instantly popular with all stakeholders. The Ballard Chalmers relationship continues and 2 developers have remained with Ipes under long-term contract to support the system and develop further enhancements.

“This gives us continuity at reasonable cost and maintains the relationship with Geoff and the Ballard Chalmers team. Its our software and we have the flexibility to add enhancements when we want, and we are well supported by Ballard Chalmers. “concludes Tim.

Explore more articles in the Investing category