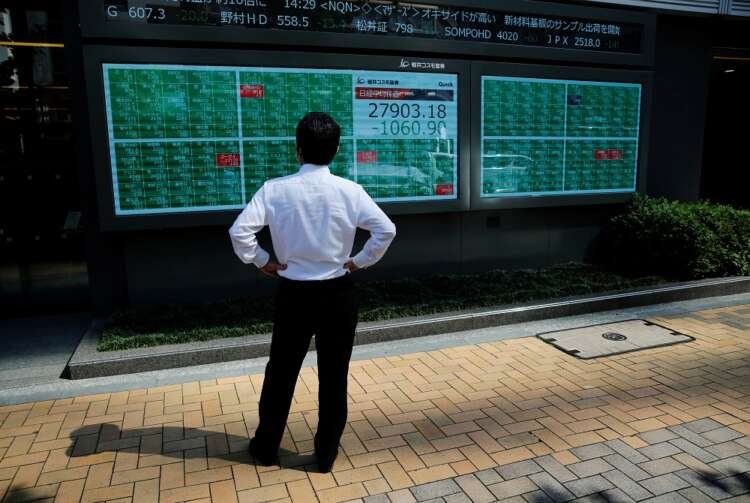

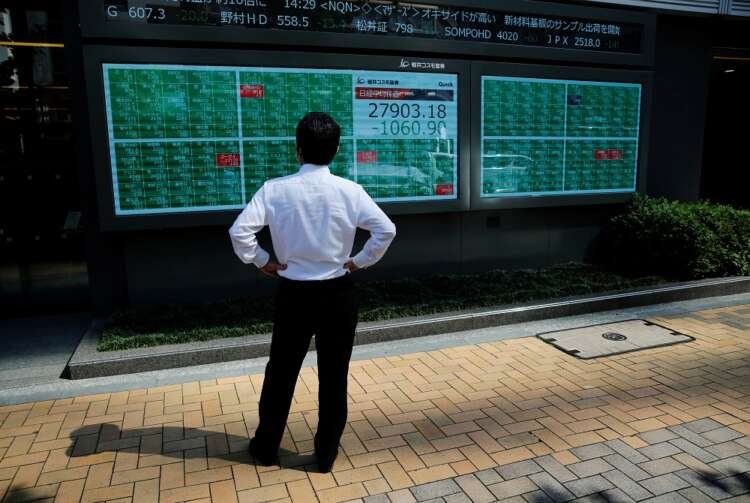

Investors seek safer havens while eyeing Delta’s economic impact

By Pete Schroeder

WASHINGTON (Reuters) -Major stock indexes slid and defensive investments posted gains amid fears about an uneven economic recovery in the United States and the continuing spread of the Delta coronavirus variant.

Wall Street slid sharply Tuesday, led by declines in mega-cap technology-related stocks and Home Depot <HD.N , which reported weaker than expected earnings as do-it-yourself projects during the height of pandemic lockdowns declined.

Safe-haven demand helped boost other risk-averse sectors, as the U.S. dollar gained on other currencies for the second straight session.

The Commerce Department reported Tuesday morning that U.S. retail sales fell by much more than expected by economists, injecting fresh concern into how the world’s largest economy will emerge from the pandemic as it grapples with supply chain disruptions and consumer concern over Delta’s spread.

After posting record highs last week, the Dow Jones Industrial Average fell 1.26% Tuesday, while the S&P 500 lost 1.20% and the tech-heavy Nasdaq Composite dropped 1.4%.

The MSCI world equity index, which tracks shares in 45 countries, fell 1.05%.

“While we expect marginal growth in retail sales in August, there are downside risks. … We have seen a clear pullback in spending on travel,” said Bank of America Securities analysts in a note. “The main story is slowing consumption coupled with pandemic-related disruptions to global supply chains which disrupt trade flows and keep inventories restrained.”

Concerns about weakening travel demand and potential new lockdown restrictions to combat the spread of Delta weighed on oil markets Tuesday, as prices weakened for a fourth straight session. Brent crude was last down 0.45% at $69.2 a barrel, while U.S. crude was down 0.79%, at $66.76 per barrel.

Going forward, the U.S. Federal Reserve will give investors fresh fodder to consider on Wednesday when it releases minutes from its July policy-setting meeting. Markets will be looking for indications of how quickly the Fed will move to step back its unprecedented stimulus as it eyes job gains and inflation.

Boston Federal Reserve Bank President Eric Rosengren said Monday the Fed could begin reducing monthly asset purchases in September if it sees one more strong jobs report.

Further weighing on investor optimism were new restrictions from China on its technology sector as Beijing tightens its grip on internet platforms. Adding to concerns was continued turmoil out of Afghanistan, although Deutsche Bank analysts said in a note the impact on the developed world appears limited so far.

However, they noted the longer-term risk is Afghanistan becoming a haven for terrorist groups, whose attacks can carry serious market ramifications. Another risk is the events in Afghanistan could complicate U.S. President Joe Biden’s push to pass his economic proposals and raise the debt ceiling.

Risk aversion among investors was seen in the dollar, which gained for the second straight session. The U.S. dollar index rose 0.54% to 93.122.

“The dollar is on a roll as global risks rise,” said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Treasury yields bounced from session lows Tuesday, shaking off an earlier yield drop on concerns about global economic growth. Benchmark 10-year note yields US10YT=RR were last at 1.245%, up on the day, after earlier falling as low as 1.217%.

However, gold prices eased after several days of gains Tuesday, with spot gold dropping 0.15% to $1784.68 an ounce. U.S. gold futures GCv1 were down 0.15% at $1,787.10 per ounce. [GOL/]

(Editing by Richard Pullin, Jacqueline Wong, Susan Fenton, Timothy Heritage, Dan Grebler and Jonathan Oatis)

By Pete Schroeder

WASHINGTON (Reuters) -Major stock indexes slid and defensive investments posted gains amid fears about an uneven economic recovery in the United States and the continuing spread of the Delta coronavirus variant.

Wall Street slid sharply Tuesday, led by declines in mega-cap technology-related stocks and Home Depot <HD.N , which reported weaker than expected earnings as do-it-yourself projects during the height of pandemic lockdowns declined.

Safe-haven demand helped boost other risk-averse sectors, as the U.S. dollar gained on other currencies for the second straight session.

The Commerce Department reported Tuesday morning that U.S. retail sales fell by much more than expected by economists, injecting fresh concern into how the world’s largest economy will emerge from the pandemic as it grapples with supply chain disruptions and consumer concern over Delta’s spread.

After posting record highs last week, the Dow Jones Industrial Average fell 1.26% Tuesday, while the S&P 500 lost 1.20% and the tech-heavy Nasdaq Composite dropped 1.4%.

The MSCI world equity index, which tracks shares in 45 countries, fell 1.05%.

“While we expect marginal growth in retail sales in August, there are downside risks. … We have seen a clear pullback in spending on travel,” said Bank of America Securities analysts in a note. “The main story is slowing consumption coupled with pandemic-related disruptions to global supply chains which disrupt trade flows and keep inventories restrained.”

Concerns about weakening travel demand and potential new lockdown restrictions to combat the spread of Delta weighed on oil markets Tuesday, as prices weakened for a fourth straight session. Brent crude was last down 0.45% at $69.2 a barrel, while U.S. crude was down 0.79%, at $66.76 per barrel.

Going forward, the U.S. Federal Reserve will give investors fresh fodder to consider on Wednesday when it releases minutes from its July policy-setting meeting. Markets will be looking for indications of how quickly the Fed will move to step back its unprecedented stimulus as it eyes job gains and inflation.

Boston Federal Reserve Bank President Eric Rosengren said Monday the Fed could begin reducing monthly asset purchases in September if it sees one more strong jobs report.

Further weighing on investor optimism were new restrictions from China on its technology sector as Beijing tightens its grip on internet platforms. Adding to concerns was continued turmoil out of Afghanistan, although Deutsche Bank analysts said in a note the impact on the developed world appears limited so far.

However, they noted the longer-term risk is Afghanistan becoming a haven for terrorist groups, whose attacks can carry serious market ramifications. Another risk is the events in Afghanistan could complicate U.S. President Joe Biden’s push to pass his economic proposals and raise the debt ceiling.

Risk aversion among investors was seen in the dollar, which gained for the second straight session. The U.S. dollar index rose 0.54% to 93.122.

“The dollar is on a roll as global risks rise,” said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Treasury yields bounced from session lows Tuesday, shaking off an earlier yield drop on concerns about global economic growth. Benchmark 10-year note yields US10YT=RR were last at 1.245%, up on the day, after earlier falling as low as 1.217%.

However, gold prices eased after several days of gains Tuesday, with spot gold dropping 0.15% to $1784.68 an ounce. U.S. gold futures GCv1 were down 0.15% at $1,787.10 per ounce. [GOL/]

(Editing by Richard Pullin, Jacqueline Wong, Susan Fenton, Timothy Heritage, Dan Grebler and Jonathan Oatis)

Explore more articles in the Investing category