Insolvencies: We’ll be back

Business insolvencies are projected to rebound by 15% in 2022 as state support measures are withdrawn, with varying impacts across regions.

Executive summary

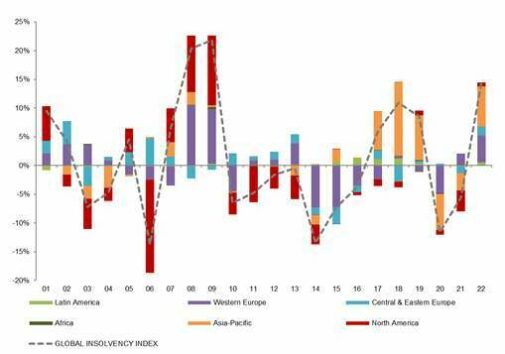

Figure 1: Euler Hermes Global insolvency index and regional indices, yearly level, base 100 in 2019

Sources: Euler Hermes, Allianz Research

Figure 2: Euler Hermes insolvency indices by region – contribution to the yearly change in Global Insolvency Index

Sources: Euler Hermes, Allianz Research

Massive state intervention and a strong economic catch-up helped suppress insolvencies since 2020

Despite sparking a slump in global GDP and trade in 2020, the Covid-19 shock did not translate into a wave of insolvencies. In fact, our Global Insolvency Index not only ended 2020 with a -12% y/y drop, but the decline remained steady and broad-based all along the year. Thirty-five out of the 44 countries of our sample (80%) recorded a decline for the full year – the latter reaching double-digit figures in three out of four cases (see statistical appendix). The exceptions were mainly the emerging economies of Central and Eastern Europe (+4% in Bulgaria, +13% in Turkey and +32% in Poland), Latin America (+2% in Colombia and +11% in Chile) and China (+1% to 11,826 cases), where insolvencies quickly returned to pre-Covid-19 levels in H2 2020 after a noticeable but temporary surge in Q2 (+21% y/y). The largest declines were seen in India (-62% to 735 cases only, notably due to the specific duration of the suspension of courts) and in Western Europe overall (-18% for the regional index to the lowest level since 2007, with an above -30% drop seen in Austria, France, Italy and Belgium, see Figure 4).

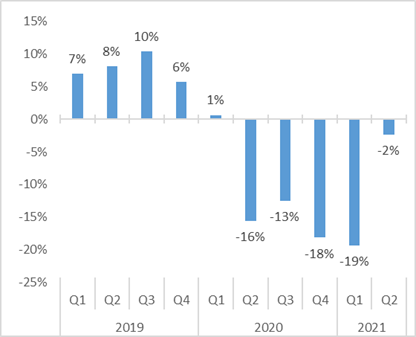

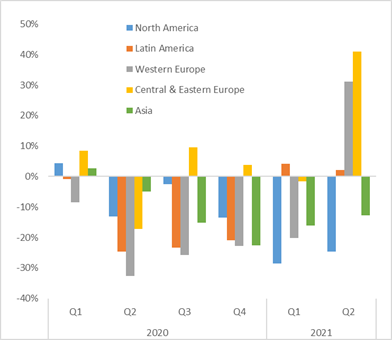

Figure 3: Global (left) and regional (right) insolvency index – quarterly changes, y/y in %

Sources: Euler Hermes, Allianz Research

Figure 4: 2020 GDP growth and insolvencies in Western Europe

Sources: National sources, Euler Hermes, Allianz Research

What explains the prolonged low level of insolvencies? First, the rapid implementation of multiple support measures for companies (see box). Emergency packages helped companies cope with the unprecedented impact of lockdowns by preventing a liquidity crisis, notably among the sectors most severely affected by restrictions. De facto, the IMF estimates that the first packages of public support provided for 60% of firms’ increased liquidity needs and mitigated the increase in illiquid firms — with better results for advanced economies compared to Emerging Europe. Secondly, their renewal towards the end of 2020 and then the first half of 2021, albeit to a lesser extent, has also been crucial to avoid the cliff-edge effect and keep insolvencies under control. Third, the strong catch-up of the global economy mechanically gave substantial support to firms, especially in a context of generally accommodative monetary policy, which helped mitigate the risk of insolvencies induced by a too fast bouncing-back of activity.

Looking at the historical sensitivity of insolvencies to macroeconomic trends, we estimate ceteris paribus that the global economic shock could have resulted in a +40% surge in worldwide insolvencies in 2020. But since 2020 ended with a -12% decrease in insolvencies, it means that the massive state interventions and further extensions of ‘whatever it takes’ policies prevented more than 35% of insolvencies globally, at least temporarily. This number of ‘spared’ insolvencies is slightly lower in the US (32% i.e. 10,400 cases) and Germany (33% i.e. 7,800 cases), two countries that both started 2020 with a low number of cases and ended the year with a ‘limited’ decrease in insolvencies. On average, we estimate that ‘spared’ insolvencies represent one out of two cases in Western Europe, but a (much) higher proportion in countries that implemented large state interventions, notably France (56% i.e. 41,000 cases) and the UK (55% i.e.18,900 cases, see Figure 5).

Figure 5: 2020 changes in insolvencies, ex post simulation vs observed figures, and ‘spared’ insolvencies, selected countries

Sources: Euler Hermes, Allianz Research

So far in 2021, there is still no sign of a trend reversal (see Figures 3 and 6). Our global index reached a new low in the first half of 2021 after two additional quarters on the downside (-19% y/y in Q1 and -3% y/y in Q2, respectively, i.e. -12% y/y for the first half of the year). Yet this outcome results from two opposing regional trends: on the one hand, North America and Asia both registering lower insolvencies and on the other, regions showing a pick-up in Q2 in annual comparison that is partly the materialization of the basis effect created by the impact of lockdown measures on business courts in the same period of 2020.

The first figures available for July and August indicate that the trend of low levels of insolvencies persists. This has kept the year-to-date number of insolvencies below 2020 figures in most countries in all regions, with the exception of Africa, where both Morocco and South Africa are already facing a significant rebound in insolvencies, as well as Hong Kong and India in Asia, Poland and Romania in Eastern Europe and Colombia in Latin America. The Western Europe picture is also mixed, with three clusters as of September 2021:

(i) A majority of countries with still lower insolvencies than in 2020 and in 2019, including the UK, despite the start of a noticeable trend reversal.

(ii) Two countries already facing more insolvencies than in 2020, namely Italy (+50% y/y as of end August) and to a lesser extent Switzerland (+1%).

(iii) The remaining two other countries already back above the 2019 level of insolvencies: Luxembourg (by +5% as of August) and more significantly Spain (by +34%). Note that the latter is one of the three European countries that recorded the largest declines in insolvencies prior to the pandemic.

Figure 6: Business insolvencies – figures available for 2021 (selected countries)

Sources: National sources, Euler Hermes, Allianz Research

The uneven trend across Europe is also hiding uneven intra-annual trends by sectors (see Figure 7) – even if the services sector remains the largest contributor to the number of insolvencies (73%), ahead of construction (16%), the manufacturing industry (10%) and agriculture (1%). Looking at Q2 2021 figures, Spain and Italy both quickly recovered their quarterly levels of insolvencies in most large sectors due to a broad-based trend reversal, but the latter is more homogeneous in Italy than in Spain. Spain is facing a noticeable pick-up in food and accommodation, transport and storage and construction. At the same time, insolvencies remain on the downside in food and accommodation in Germany, France and the Netherlands, but not in Belgium, and in trade in the Netherlands, France and Belgium, though they have stabilized in Germany. Conversely, insolvencies have moderately increased in construction in Belgium, France and Germany, and they plateaued at a low level in the manufacturing industry in most countries, except in Spain.

Figure 7: Insolvencies by sector in Western Europe, by quarter, base 100: Q1 2019, selected countries

Sources: National sources, Euler Hermes, Allianz Research

Under current circumstances, we expect business insolvencies to remain at a low level in most countries by the end of 2021 and the delayed normalization to gain traction only in 2022. Our Global Insolvency Index would post a +15% y/y rebound in 2022, after two consecutive years of decline (- 6% in 2021 and -11% in 2020), but business insolvencies would still remain below pre-Covid-19 levels in a majority of countries (by -4% in average).

Where are the hotspots?

Emerging Markets are already seeing a normalization of business insolvencies amid renewed restrictions in response to new waves of infections and less generous policy support. We expect those in Africa to largely exceed pre-Covid-19 levels as soon as 2021, and those in Central/Eastern Europe and Latin America to do so in 2022.

After a noticeable decline in 2020-2021 due to the faster exit from the pandemic and the corresponding economic recovery, most Asian countries will post higher insolvencies in 2022 (+18% y/y for the region). India in particular will see a strong surge (+69% y/y) due to the specific duration of the suspension of courts over 2020-2021. However, while most countries will return to the ‘natural’ number and trend in insolvencies related to their business demographic and economic outlook, the region overall will still record less insolvencies in 2021 than in 2019, unless a prolonged resurgence of the virus continues to disrupt ports, plants and supply chains.

Europe, excluding notably Germany and France, will see the bulk of insolvencies materializing in 2022. The region is set to post mixed trends, with three main clusters of countries:

(i) Those that will see a large recovery of insolvencies by 2022, notably in the south due to a higher share of sectors sensitive to Covid-19 restrictions: Spain would register 5,110 and 5,740 insolvencies in 2021 and 2022, respectively, compared to 4,162 in 2019. In Italy, insolvencies would reach 10,500 cases in 2021 and 12,000 cases in 2022, compared to 10,542 in 2019.

(ii) Those that will see a noticeable rebound in insolvencies in 2022, but not yet return to pre-Covid-19 levels: Switzerland (5,600 cases in 2022), Sweden (7,200), Portugal (2,510), Luxembourg (1,450) and to a lesser extent Denmark (2,400) and the UK (20,540).

(iii) Those with a delayed return to pre-crisis levels, due most often to large packages of support and/or the extension of their support measures: France (37,000 cases in 2022), Germany (16,300), Belgium (8,150) and the Netherlands (2,400).

Figure 8: Business insolvencies in the US, by types of proceeding, number of cases

Sources: US Courts, Euler Hermes, Allianz Research

In this context, the key exception would be the US, with a prolonged low number of insolvencies likely both in 2021 (16,800 cases) and 2022 (17,600). This is the result of the massive support and the strong economic rebound. Indeed, the three rounds of the Paycheck Protection Program (PPP) may still be having a lingering effect. They provided ~35% of annual payroll for all small businesses in 2020, keeping untold numbers out of insolvency all the way into this year, as seen by the number of Chapter 7 filings, the liquidation proceeding most often used by SMEs (see Figure 8). US companies should still benefit from a strong economy via the support from consumer spending (and the USD2.4trn in excess savings left over) after the strongest recovery over three decades likely in 2021. Yet, several factors could put an end to the downside trend in insolvencies, notably (i) the expected tightening of monetary policy, with the reduction of purchases of Treasury and mortgage-backed securities by the Federal Reserve that will slow the flow of credit available in the financial system and (ii) the highly elevated amount of debt in all sectors.

What will shape the path ahead?

We expect the withdrawal of pandemic-related support measures to kick start a return to the normal level of insolvencies, but the trajectory will be both asymmetric — due to the multi-speed economic recovery — and gradual — due to the delicate but pragmatic phasing-out process.

Figure 9: Q3 2021 status of key support measures to companies, by region, in number of countries (*)

Sources: Euler Hermes, Allianz Research

Figure 10: Phasing- out of support measures, timeline of Q3 2021

Sources: Euler Hermes, Allianz Research

In practice, the phasing-out process has already begun (see Figures 9 and 10), especially in countries where an improving sanitary situation has allowed for a faster recovery (eg. in Asia and North America). It is also visible in countries where authorities have decided not to further extend some measures (i.e. the insolvency moratorium in France) or to switch to more targeted measures, for instance by excluding sectors not sensitive to Covid-19 restrictions or specific companies, the non-viable ones, for some (or all) of the renewed support measures. However, the expiration of support measures remains uncertain since the exact modalities of their ending have not always been defined and since they sometimes come with new measures to address specific situations to avoid a cliff-edge effect. This is notably the case in countries with more willingness and/or room for fiscal maneuvering to pursue further specific support measures or large ‘whatever it takes’ policies, such as Germany and France. As of Q3 2021, Europe is now the unique region where the key types of support to companies remain at play in most countries, notably furlough schemes/partial unemployment, public guarantees, tax deferrals and cash transfers.

We expect most governments, in particular in Europe, to continue fine-tuning their step-by-step withdrawal of support in line with improving macroeconomic situations and the impact of future lockdowns and other containment measures. In other words, having successfully helped companies to absorb the Covid-19 shock, we expect most government to now prioritize the management of cash depletion, especially for the most fragile companies. This remains a delicate phase, as evidenced by the uneven tempo of cash-burning among European countries (see Figure 11), with a significantly stronger dynamic in Spain and Italy, two countries where insolvencies are on the upside.

Figure 11: Cash-burning index (*), selected countries

(*) The cash-burning index, calculated at country level, is the ratio between the increase in activity (using nominal GDP as a proxy) and the change in net cash position (the latter being measured by the difference between NFC deposits and NFC new loans (up to EUR1mn))

Sources: Eurostat, ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB, Euler Hermes, Allianz Research

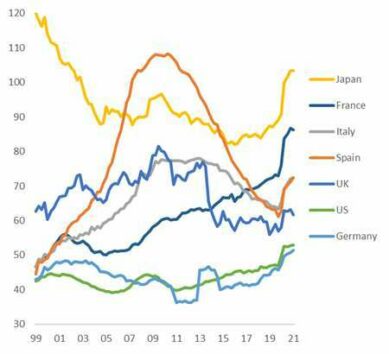

Continuing to manage the pressure on companies’ liquidity and solvability will be key to avoid a sudden bottleneck of the insolvency system that could come from two concerns. First is the high number of companies still at risk of default, a combination of pre-crisis ‘zombies’ and the companies made fragile by the crisis. The former are companies that were no longer viable before the crisis but were kept afloat by emergency measures and remain at risk of insolvencies in case of too weak a recovery, notably in the hardest-hit sectors. The latter are companies facing major turbulence in their business models because of Covid-19-induced changes in supply or demand, and notably those weakened by an extra amount of indebtedness resulting from the crisis (see Figure 12). This matters since the repayment of some state loans has begun in 2021 and the deterioration of companies’ financials is adding to debt sustainability issues. This is also evidenced by the overall situation of SMEs in Europe: Our research shows that 7% of SMEs in Germany, 13% in France and 15% in the UK are still at risk of insolvency in the next four years.

Figure 12: Non-financial corporations (NFC) debt ratio, in % of GDP, selected countries

Sources: Banque de France, Euler Hermes, Allianz Research

The second concern is the risk of insolvencies associated with both the pre-Covid upside trend and the quick recovery of business creation (see Figure 13 for Europe). The increasing number of businesses is mechanically increasing the base for potential insolvencies, in particular in sectors where business creation is highly related to meeting new needs arising from the pandemic (i.e. home delivery) but with uncertain viability.

Figure 13: Registrations of businesses, EU, seasonally adjusted figures, quarterly, index 2015=100

Sources: Eurostat, Euler Hermes, Allianz Research

At the same time, the global picture will also be determined by two factors at play in lowering the number of insolvencies: First, the macroeconomic momentum, since most countries are expected to maintain a strong recovery pace in 2022. Most countries, notably advanced economies, are to record GDP growth that used to be sufficient to observe a decline in insolvencies. In Europe, for instance, GDP is to increase by more than +5% in 2021 and +4% in 2022, while the long-term average minimum growth required to stabilize insolvencies (see Figure 14) was +1.7% prior to the pandemic, with slightly different elasticities by country. Second is a long-term trend that did not stop with the crisis: the growing number and higher usage of (amicable/preventive) out-of-court procedures across countries. These are by nature not taken into account in official insolvency statistics, which are massively based upon court publications. In addition, the extension of restructuring frameworks, notably within Europe since the EU Directive 2019/1023, is not always included in the official statistics, lowering the number of liquidations.

Figure 14: Minimum growth required to stabilize insolvencies

Sources: Euler Hermes, Allianz Research

STATISTICAL APPENDIX

Table 1: Business insolvencies level

(*) The Euler Hermes Global (or regional) Insolvency Index is the weighted sum of national indices, each country being weighted by the share of its GDP within the countries used in the sample (44 countries representing 86% of global GDP in 2020). National indices are based upon national sources or Euler Hermes internal data on insolvencies, using a base of 100 in year 2000. Forecasts are reviewed each quarter, with the agreement of EH business units.

(**) GDP 2020 weighing at current exchange rates

Sources: National sources, Euler Hermes, Allianz Research (e: estimate; f: forecast) – Data are available on the webapp MindYourReceivables

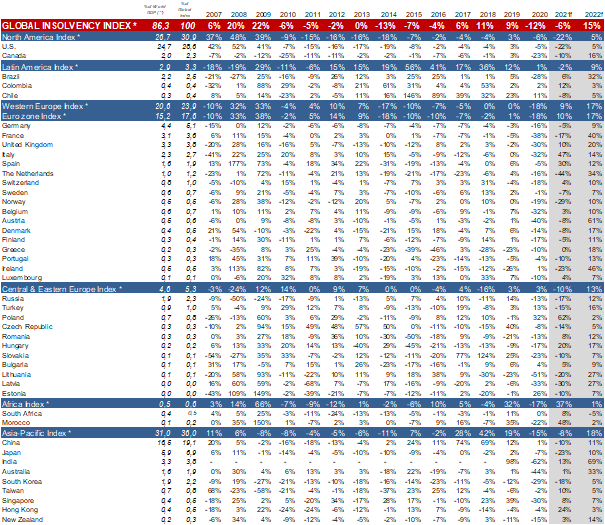

Table 2: Business insolvencies growth

(*) The Euler Hermes Global (or regional) Insolvency Index is the weighted sum of national indices, each country being weighted by the share of its GDP within the countries used in the sample (44 countries representing 86% of global GDP in 2020). National indices are based upon national sources or Euler Hermes internal data on insolvencies, using a base of 100 in year 2000. Forecasts are reviewed each quarter, with the agreement of EH business units.

(**) GDP 2020 weighing at current exchange rates

Sources: National sources, Euler Hermes, Allianz Research (e: estimate; f: forecast) – Data are available on the webapp MindYourReceivables

The article discusses the expected rebound in business insolvencies in 2022 as state support measures are withdrawn.

Insolvencies are expected to increase by 15% globally, with variations across different regions.

Western Europe and emerging markets may see significant changes, while the US and Asia may experience fewer insolvencies.

Explore more articles in the Business category