HIGH PRESSURES FOR CFOS – DOES YOUR COMPANY NEED A TEMPERATURE CHECK?

Published by Gbaf News

Posted on July 11, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 11, 2014

4 min readLast updated: January 22, 2026

By Myriam Radi, a Sage Finance Expert.

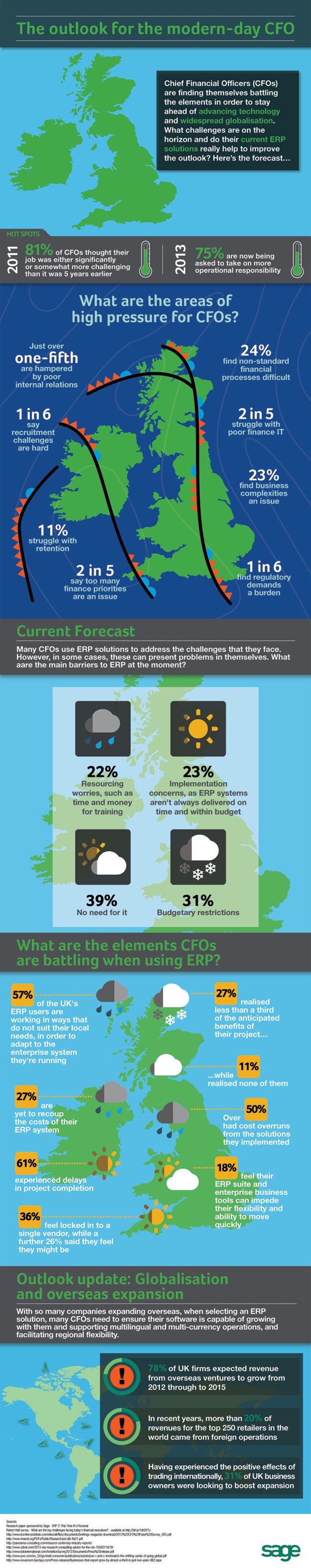

As a chief financial officer of a company, you need to be in the know when it comes to your business processes. Many organisations look to enterprise resource planning (ERP) software to gain insight and control over critical business operations, however some companies remain reluctant to invest in an ERP solution.

According to a research study by Korn/Ferry Institute, 75per cent of CFOs are being asked to take on more responsibility. The finance department has become the interface to all business units within a company and so with increasing pressures on the CFO, implementing a solution that centralises and streamlines processes across the organisation is now not just desirable but a necessity to maintain a competitive edge in the market.

But what are the benefits of an ERP system and how does it impact and support the CFO in daily challenges?

Greater control

Myriam Radi

One of the CFO’s key tasks is to control both the financial process and the figures. An ERP solution offers the necessary tools to control and manage risks for the company – so there are no unwanted surprises. Equipped with personalised dashboards, KPIs, alerts and updates, CFOs will be able to track the business’ every move and find that data is to hand when needed.

Because an ERP system covers most of the common functional areas of any business (from purchasing to production and sales), the organisation should see savings by having one unique system for all business units. Compared to a plethora of independent IT systems with differing support and maintenance requirements, along with different interfaces and technical requirements.

In addition to the financial accounting aspects including general ledger, fixed assets, account payables, account receivables and financial consolidation, CFOs need an ERP solution able to feature modules that manage cash (budgeting, forecasting, bank fees management and reconciliation) as well.

Time efficiency

Making quick evaluations in order to calculate past and future time periods and projections is crucial for a CFO. With the right ERP solution, reliable financial data can be extracted on the spot at a rapid speed. While your business managers will be using modules like cost and development, inventory management, and product planning; financial information is also available for the CFO’s needs on top of this. This allows the CFO to keep an eye on the whole business, giving them full awareness of the company’s financial health in real time – rather than after the reports have come in.

Flexibility

An ERP solution not only economises your IT budget but it provides the freedom to react quickly in situations such as changing market conditions and the expansion to other regions or international markets.

The right ERP solution for your company should be modular and adaptable to your changing business needs, as well as have the capability to be rolled-out quickly and seamlessly across the different locations and business units. An ERP solution that can unite national and international companies and sites within one system and one database, sharing the same business processes, managing different legislations, currencies and languages will make it far easier for you to become international. This is without having to forego the ability to analyse and control the financial health of every part of your business.

Cost Effectiveness

ERP solutions are a long term investment. As a result, CFOs will want to justify the investment by regularly measuring the system’s performance and impact on business operations. Your ERP solution should be highly scalable, meaning that it should be able to be moulded to fit right ‘out of the box’ or tailored to the specific business requirements of your company, depending on your needs, from a few users up to hundreds. Additionally, an ERP should grow with your business, allowing you to add new sites and locations without fresh investments or onerous customisation.

Organisations purchase an ERP system to win back simplicity and control. Centralising data gives the business one authoritative voice that the executive board can draw upon when making strategic and far-reaching decisions.

Overall an ERP solution aims to make running a business easier. With increasing pressures on the CFO it is time companies assess how software can help address challenges across the business.

Explore more articles in the Business category