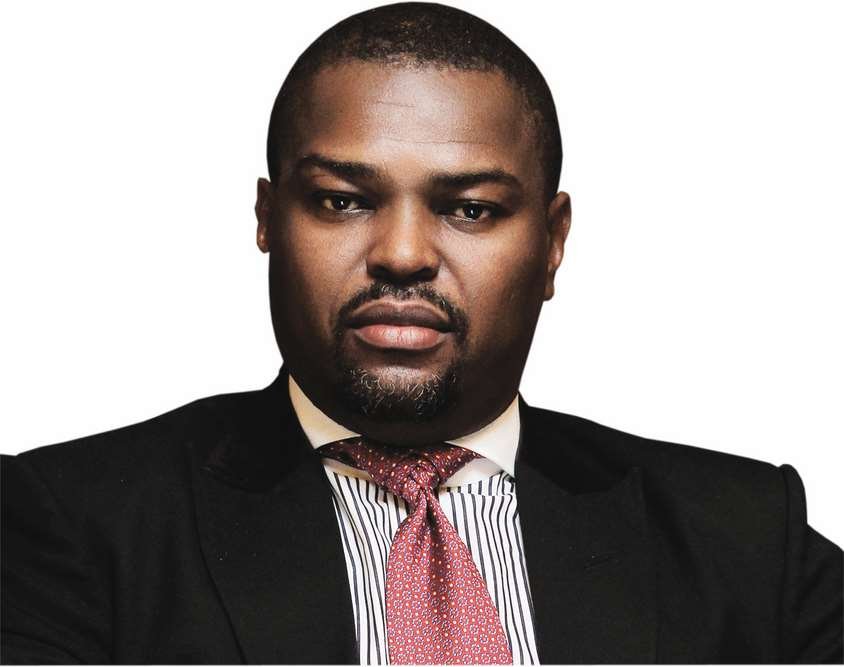

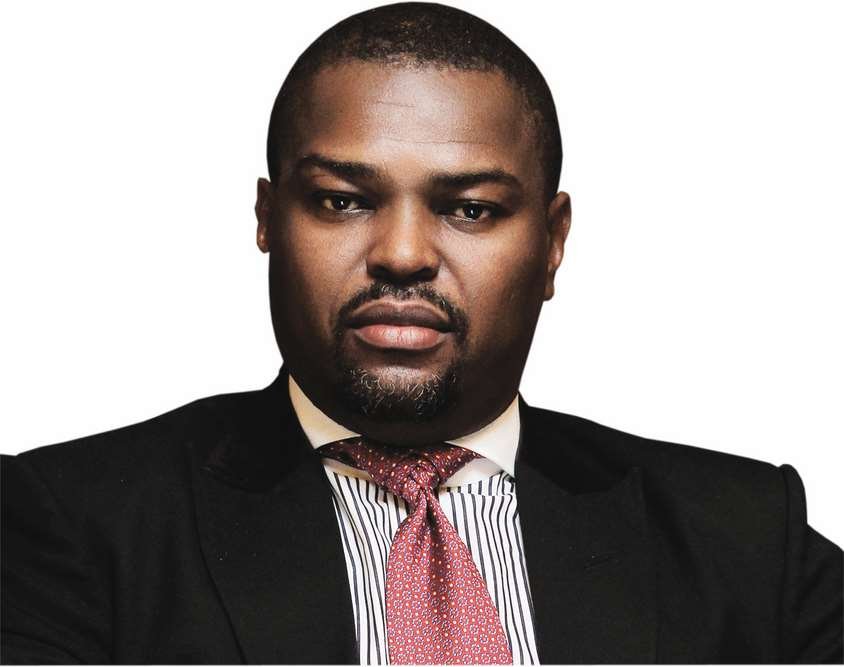

Exclusive interview with Mr Sonnie Ayere, Chairman and CEO of Dunn Loren Merrifield Group

Published by Gbaf News

Posted on January 21, 2019

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on January 21, 2019

4 min readLast updated: January 21, 2026

Global Banking & Finance Awards® 2018 Winner – Dunn Loren Merrifield

Mr Sonnie Ayere, Chairman and CEO of Dunn Loren Merrifield Group

Established in 2009, Dunn Loren Merrifield is a full-service investment house. What initiatives do you feel have led to your growth and success?

DLM’s focus on being client centric – focusing on structuring and marketing those more difficult deals

In your opinion, what are the challenges and opportunities facing the Nigerian financial markets – re NBFIs?

Lots of opportunities abound but, finding and harnessing them is like finding a needle in a haystack – one of the key challenges is lack of regulatory coordination to make the business enabling environment much easier for firms to grow. Another is the funding challenge, the creation of liabilities to fund assets remains a major challenge for NBFIs.

What are the different services available at Dunn Loren Merrifield?

We see ourselves as a key institutional link between key sectors of the Nigerian Economy such as Housing, Micro-Finance, SMEs to the money and capital markets. We do this via funding our clients through Asset Backed Commercial Paper Programs and term securitization programs. Key product offerings are – Conduit Management, Investment banking, Asset Management, Trustees, Securities Dealing, Nominees, Loans.

Over the years you have executed numerous complex transactions. Can talk to us about the MWFL (Mortgage Warehouse Funding Limited) deal and its importance?

MWFL is a an Asset Backed Commercial Paper program set up to assist Nigerian mortgage banks with financing their origination capacity. Where no individual mortgage bank has a rating of above BBB, MWFL is currently rated by Global Credit Ratings – A1 short term and Agusto Ratings – S1 short term (one notch below equivalent AAA). The lower cost and availability of funds significantly improves all member mortgage banks’ ability to operate.

What is your investment strategy?

Risk Averse – but we will take calculated risks from time to time.

How does your team assist clients in achieving their investment objectives?

The role of the firm in any investment or capital raising activity largely depends on the nature and type of investment or capital raise being undertaken by the client. Some investments are executed under strict regulatory guidelines whilst others may be discretionary or non-discretionary in the investment decision making process. Where the investment is discretionary, the firm always employs professionalism and best efforts to ensure that the optimal interest of the client is always served.

How have foreign direct investments impacted the economy? Do you expect an increase in foreign investments?

The monetary policies of the Central Bank of Nigeria in the outgoing year was arguably designed to promote and attract foreign direct investments into the country and we think it would be fair to say that this objective was largely achieved in the short term. This has helped to provide relative stability in the FX market in the course of the year. We think that the CBN would likely sustain this approach in the forthcoming year by largely maintaining the existing monetary policies to create a sense of financial stability and attractive returns indicators to FDIs. However, the 2019 outlook may be adversely influenced by the political atmosphere which may create a level of uncertainty especially in the first half of 2019.

Can you tell us about the Dunn Loren Merrifield Foundation?

DLM foundation is a non-profit entity setup to take charge of the corporate social responsibility functions of the firm amongst other objectives. The activities of this foundation are still at infancy stage. We expect to do more as the firm develops, most especially in the, our 10year anniversary.

What does the year ahead look like? Or What is your current strategy for continued growth and development?

DLM as a Group is an innovative institution engaged in numerous complex transactions designed to provide the lead the pathway in products and services to the sectors we already cover going forward. In the year ahead, we expect to further deepen our relationships and market share.

Explore more articles in the Interviews category