European Equity Market Drivers – The Compounding Effect of Currency

Published by Gbaf News

Posted on June 27, 2012

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 27, 2012

6 min readLast updated: January 22, 2026

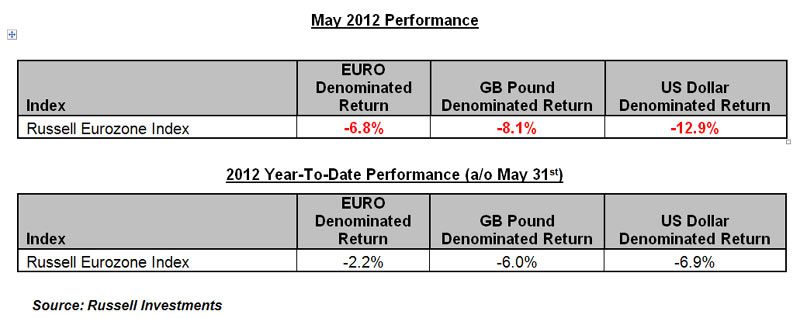

By Tom Goodwin – Senior Research Director, Russell Indexes

How has Turkey managed to outperform all Eurozone markets year-to-date according to Russell Indexes research? The answer can be attributed in part to the strong performance of this country’s growing economy, often earning it the label “New Tiger.” However, the answer can also be attributed to the decline of the euro and the impact it can have on the return experienced by global investors. An examination of the equity market performance of Turkey and other select non-Eurozone countries year-to-date relative to the Eurozone from various aspects helps illustrate the importance of currency in driving market performance, particularly in Europe. Currency’s Impact on Market Performance Unlike all Eurozone countries within the Russell Global Index, Turkey is not tied to the euro currency, which may have actually helped its performance in recent years. During the high-flying years of the Euro, a number of markets such as Turkey may have felt left out of the party, but interestingly not being linked to the euro currency may have actually benefitted some of these economies in the longer term. Turkey was able to fuel its export sectors by keeping the Turkish Lira competitive against the Euro and other developed currencies. It also encouraged direct foreign investment. Consider the performance comparison of Russell Index returns for Eurozone countries relative to Turkey and some other non-Eurozone European nations for 2012. • Among Eurozone countries within the Russell Global Index, for the year-to-date period as of May 31st, Ireland has led all countries with an 8.3% return, followed by Germany (7.2%) and Austria (4.7%). Spain has been the worst performing Eurozone country year-to-date, with a (-26.4%) return, followed by Greece (-17.4%) and Portugal (-13.8%). • Interestingly, within the Russell Global Index, non-Eurozone country Turkey has returned +16.8% for the year-to-date period as of May 31st, outperforming all Eurozone country constituents. • Poland is often mentioned in the same breath as Turkey as another “New Tiger” country which has benefitted from being decoupled from the Euro. Poland also had a positive return year-to-date of 2.0%. 2012 YTD Market Performance (a/o May 31st) Russell Global Index Eurozone Country Returns 2012 YTD Returns (as of May 31, 2012) Ireland 8.3% Germany 7.2% Austria 4.7% France -0.5% Finland -3.6% Netherlands -4.1% Luxembourg -5.8% Italy -11.2% Portugal -13.8% Greece -17.4% Spain -26.4% Russell Global Index Non-Eurozone Country Returns 2012 YTD Returns (as of May 31, 2012) Turkey 16.8% Poland 2.0% Source: Russell Investments. Returns are euro-denominated. Currency’s Impact on Investment Return Beyond playing a role in the economic drivers of market performance, underlying currency can also play a large part in determining the actual experience an investor has when committing investment capital to a certain market. This is illustrated when comparing 2012 Russell Eurozone Index performance when based in U.S. dollars relative to euros, relative to the British pound sterling. Investors in European equities may have a different outlook on these markets in 2012 depending on their location and home currency. Investors have felt the “double whammy’ effect on the markets caused by deterioration of the euro currency in 2012. In particular, in the month of May the Russell Eurozone Index returned -6.8% in euro, -8.1% in British pound sterling and -12.9% in US dollars. The difference is due to the deterioration of the Euro: -1.8% in the EUR/GBP rate and -5.0% in the EUR/USD rate. For the year-to-date, the fall of the Euro has lopped off nearly 4% return when based in British pound sterling and nearly 5% when based in US dollars.  Let’s Not Forget Fundamental Factors While currency is a big part of the investment story, it is just one part of the story and investors should not lose sight of fundamental market characteristics when evaluating a potential country or region in which to invest. Turkey, for example, has benefitted from a number of positive factors in recent years. These include a liberalized and well-regulated banking sector, favorable demographics including an expanding middle class, growing exports and increased foreign investment. In sum, Turkey has an environment that is very conducive to high economic growth and high investment growth, which are important factors for investors to consider when evaluating Turkey as a market. However, just as important, when considering any investment today in Europe or Europe’s neighbors, our research tells us that investors should consider currency and the potential impact of the declining euro on relative market and investment performance. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investments, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Opinions expressed by Mr. Goodwin reflect market performance and observations as of May 31, 2012 and are subject to change at anytime based on market or other conditions without notice. Please remember that past performance does not guarantee future performance. The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the index are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp Please note: Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Russell’s publication of the Indexes or Index constituents in no way suggests or implies a representation or opinion by Russell as to the attractiveness of investing in a particular security. Inclusion of a security in an Index is not a promotion, sponsorship or endorsement of a security by Russell and Russell makes no representation, warranty or guarantee with respect to the performance of any security included in a Russell Index. Russell Investment Group is a Washington, USA corporation, which operates through subsidiaries worldwide, including Russell Investments, and is a subsidiary of The Northwestern Mutual Life Insurance Company.

Let’s Not Forget Fundamental Factors While currency is a big part of the investment story, it is just one part of the story and investors should not lose sight of fundamental market characteristics when evaluating a potential country or region in which to invest. Turkey, for example, has benefitted from a number of positive factors in recent years. These include a liberalized and well-regulated banking sector, favorable demographics including an expanding middle class, growing exports and increased foreign investment. In sum, Turkey has an environment that is very conducive to high economic growth and high investment growth, which are important factors for investors to consider when evaluating Turkey as a market. However, just as important, when considering any investment today in Europe or Europe’s neighbors, our research tells us that investors should consider currency and the potential impact of the declining euro on relative market and investment performance. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investments, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Opinions expressed by Mr. Goodwin reflect market performance and observations as of May 31, 2012 and are subject to change at anytime based on market or other conditions without notice. Please remember that past performance does not guarantee future performance. The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the index are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp Please note: Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Russell’s publication of the Indexes or Index constituents in no way suggests or implies a representation or opinion by Russell as to the attractiveness of investing in a particular security. Inclusion of a security in an Index is not a promotion, sponsorship or endorsement of a security by Russell and Russell makes no representation, warranty or guarantee with respect to the performance of any security included in a Russell Index. Russell Investment Group is a Washington, USA corporation, which operates through subsidiaries worldwide, including Russell Investments, and is a subsidiary of The Northwestern Mutual Life Insurance Company.

Explore more articles in the Trading category