Dow Jones FXCM Dollar Index

Published by Gbaf News

Posted on June 14, 2011

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 14, 2011

3 min readLast updated: January 22, 2026

THE DOW JONES FXCM DOLLAR INDEX BASKET WAS DEVELOPED BY TRADERS FOR TRADERS ALLOWING YOU TO TAKE ADVANTAGE OF US DOLLAR APPRECIATION OR DEPRECIATION WITH PRECISE TRACKING AND MAXIMUM LIQUIDITY.

THE DOW JONES FXCM DOLLAR INDEX BASKET WAS DEVELOPED BY TRADERS FOR TRADERS ALLOWING YOU TO TAKE ADVANTAGE OF US DOLLAR APPRECIATION OR DEPRECIATION WITH PRECISE TRACKING AND MAXIMUM LIQUIDITY.

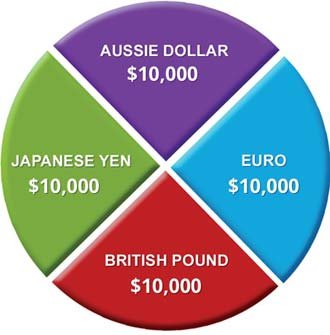

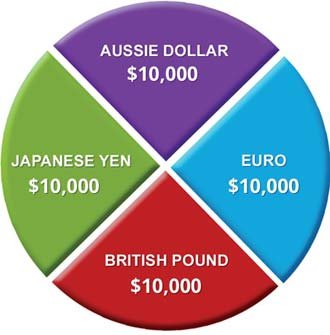

| The US dollar remains the world’s foremost currency and the standard against which other currencies are measured. The Dow Jones FXCM Dollar Index Basket allows the trader to act on their US dollar bias with especially low transaction costs. Easy to Use: Do you believe the US dollar is likely to appreciate? You can buy the DJ FXCM Dollar Index Basket and benefit if it gains against four currencies. Think it will head lower? Selling is just as easy. Low spreads: Strong liquidity across these four currencies leads to low spreads, making this an inexpensive way to trade the US dollar. | CURRENCY SELECTION Euro: The other half of the most heavily traded currency pair in the world and a key measure of the US dollar’s value. British Pound: Highly liquid and popular with forex traders, the pound retains great significance as the UK remains an important global financial hub. Japanese Yen: A mainstay of the forex carry trade, the yen represents the third-largest economy in the world. Australian Dollar: A titan in the fast-growing Asia/Pacific region, the AUD gives our index high yields and a link to commodity markets. |

THE DOW JONES FXCM DOLLAR INDEX BASKET IS INTENDED TO BE MORE

RELEVANT, TRADABLE, AND EASIER TO USE THAN EXISTING DOLLAR INDICES.

The Dow Jones FXCM Dollar Index was designed with the trader in mind.

It avoids outdated currency pair selection and confusing methodology to

produce a more straightforward design and maximize utility for the trader.

The index basket is designed to be as easy to understand as it is to trade. At

inception date, the index reflects an equivalent $10,000 long position against

the euro, British pound, Japanese yen, and Australian dollar. The value of the

index is subsequently the average value of those US Dollar positions.

If the US Dollar rallies 100 pips against the euro, Australian dollar, Japanese yen, and British pound, the index will appreciate by approximately 100 points. It’s that simple.

With liquidity available 24 hours per day and five days per week, the Dow Jones FXCM Dollar Index Basket is an easy-to-use and inexpensive way to trade the US dollar.

“Dow Jones Indexes”, the marketing name of CME Group Index Services LLC (“CME Indexes”), is a trademark of Dow Jones Trademark Holdings LLC. “Dow Jones®”, “Dow Jones Indexes”, “DJ” and “Dow

Jones FXCM Dollar IndexSM” are service marks of Dow Jones Trademark Holdings LLC (“Dow Jones”) or Forex Capital Markets LLC, as the case may be, and have been licensed for use by CME Indexes

and sublicensed by Forex Capital Markets. “CME” is a trademark of Chicago Mercantile Exchange Inc. The Dow Jones FXCM Dollar Index Basket is not sponsored, endorsed, sold, or promoted by Dow Jones,

CME Indexes or their respective affiliates and none of Dow Jones, CME Indexes, or any of their respective affiliates make any representation regarding the advisability of # in such Basket product.

Risk Warning: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors as you could sustain a total loss of your deposited funds. Forex trading products are only suitable for those customers who fully understand the market risk.

Risk Warning: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors as you could sustain a total loss of your deposited funds. Forex trading products are only suitable for those customers who fully understand the market risk.

All references to “FXCM” refer to FXCM, Inc. and its consolidated subsidiaries.

For Further information visit FXCM

Explore more articles in the Trading category