Companies fear economic risks and business interruption

Published by Gbaf News

Posted on January 27, 2012

9 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on January 27, 2012

9 min readLast updated: January 22, 2026

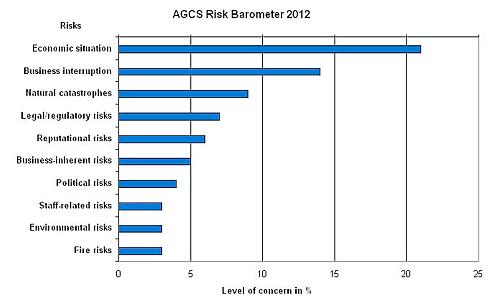

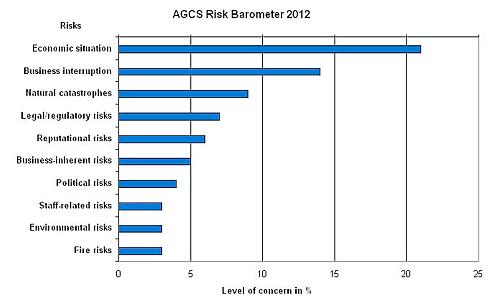

Which risks do businesses fear the most in 2012? Economic risks, business interruption and destructive natural catastrophes are the most pressing business risks for many companies. Cyber risks, in turn, remain widely underestimated. These are some of the results of a study conducted by Allianz Global Corporate & Specialty (AGCS).

Allianz Global Corporate & Specialty

AGCS, the global corporate and specialty insurer in the Allianz Group, carried out a survey among its risk consultants in the second half of 2011 to identify the risks they expect to trouble companies most during the coming year. The most frequently mentioned type of risk was economic risk (21 percent of respondents). Specifically, companies are concerned about a looming recession and the sovereign debt crisis as well as about rising commodity prices and foreign currency fluctuations.

Business interruption ranks second (14 percent of respondents). Centralized procurement, global purchasing, increasing outsourcing to suppliers and just-in-time production reduce costs, but also render companies more vulnerable to process interruptions. According to the AGCS survey, natural catastrophes are ranked third among the greatest business risks for 2012. From floods and torrential rains to hurricanes, typhoons or earthquakes – economic development and technological progress multiply the cost of natural catastrophes. In fact, insured claims related to weather-related natural catastrophes have increased from 5 billion US dollars to more than 40 billion US dollars over the last 30 years.

Closely interconnected risks produce chain reactions

Each individual risk poses a threat to business success. However, the AGCS study also shows that risks increasingly cannot be seen in isolation. “In today’s interconnected and globalized world, risks are closely interrelated and create knock-on effects,’ explains AGCS risk engineer Michael Bruch. For many companies, he says, the year of 2011 represented a “perfect storm’ as different risks occurred together. For example, natural catastrophes caused immense physical damage and widespread business interruption in the Asia-Pacific region. But production lines in Europe also temporarily came to a halt when supplies from Asia failed to arrive on time. At the same time, the sovereign debt crisis has caused the economic environment in many developed economies to deteriorate – along with the sales outlook in many sectors.

AGCS Risk Barometer: Top five risiks for companies by region and country

Regional differences: Asia fears natcats, while UK is worried about over-regulation

Regional differences: Asia fears natcats, while UK is worried about over-regulation

The global survey of AGCS risk engineers also highlighted regional differences in risk assessments. The risk of natural catastrophes is most feared by companies in Asia-Pacific – a fear sadly justified by the earthquake and tsunami in Japan or the recent flooding in Thailand. Businesses in these countries are also concerned about political risks, including protectionism and state intervention. In Germany, complexity risks feature prominently: In complex industrial projects, defective product designs and inadequate internal control systems may lead to compromised effectiveness or a series of losses. In the UK, companies are more worried about regulatory issues.

Around the world, companies show relatively little concern about IT risks (only one percent of the surveyed AGCS experts rate this as a key client concern). In fact, however, IT failures – resulting from hacker attacks or deficient internal processes – can quickly entail follow-on costs and revenue losses in the millions.

Disclaimer

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertain-ties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may”, “will”, “should”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” and similar expressions identify forward-looking statements.

Actual results, performance or events may differ materially from those in such statements due to, without limitation, (i) general economic conditions, including in particular economic conditions in the Allianz Groups core business and core markets, (ii) performance of financial markets, including emerging markets, and including market volatility, liquidity and credit events (iii) the frequency and severity of insured loss events, including from natural catastrophes and including the development of loss expenses, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) the extent of credit defaults, (vii) interest rate levels, (viii) currency exchange rates including the Euro/U.S. Dollar exchange rate, (ix) changing levels of competition, (x) changes in laws and regulations, including monetary convergence and the European Monetary Union, (xi) changes in the policies of central banks and/or foreign governments, (xii) the impact of acquisitions, including related integration issues, (xiii) reorganization measures, and (xiv) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences. The company assumes no obligation to update any forward-looking statement.

No duty to update

The company assumes no obligation to update any information contained herein.

Source :www.allianz.com

Which risks do businesses fear the most in 2012? Economic risks, business interruption and destructive natural catastrophes are the most pressing business risks for many companies. Cyber risks, in turn, remain widely underestimated. These are some of the results of a study conducted by Allianz Global Corporate & Specialty (AGCS).

Allianz Global Corporate & Specialty

AGCS, the global corporate and specialty insurer in the Allianz Group, carried out a survey among its risk consultants in the second half of 2011 to identify the risks they expect to trouble companies most during the coming year. The most frequently mentioned type of risk was economic risk (21 percent of respondents). Specifically, companies are concerned about a looming recession and the sovereign debt crisis as well as about rising commodity prices and foreign currency fluctuations.

Business interruption ranks second (14 percent of respondents). Centralized procurement, global purchasing, increasing outsourcing to suppliers and just-in-time production reduce costs, but also render companies more vulnerable to process interruptions. According to the AGCS survey, natural catastrophes are ranked third among the greatest business risks for 2012. From floods and torrential rains to hurricanes, typhoons or earthquakes – economic development and technological progress multiply the cost of natural catastrophes. In fact, insured claims related to weather-related natural catastrophes have increased from 5 billion US dollars to more than 40 billion US dollars over the last 30 years.

Closely interconnected risks produce chain reactions

Each individual risk poses a threat to business success. However, the AGCS study also shows that risks increasingly cannot be seen in isolation. “In today’s interconnected and globalized world, risks are closely interrelated and create knock-on effects,’ explains AGCS risk engineer Michael Bruch. For many companies, he says, the year of 2011 represented a “perfect storm’ as different risks occurred together. For example, natural catastrophes caused immense physical damage and widespread business interruption in the Asia-Pacific region. But production lines in Europe also temporarily came to a halt when supplies from Asia failed to arrive on time. At the same time, the sovereign debt crisis has caused the economic environment in many developed economies to deteriorate – along with the sales outlook in many sectors.

AGCS Risk Barometer: Top five risiks for companies by region and country

Regional differences: Asia fears natcats, while UK is worried about over-regulation

Regional differences: Asia fears natcats, while UK is worried about over-regulation

The global survey of AGCS risk engineers also highlighted regional differences in risk assessments. The risk of natural catastrophes is most feared by companies in Asia-Pacific – a fear sadly justified by the earthquake and tsunami in Japan or the recent flooding in Thailand. Businesses in these countries are also concerned about political risks, including protectionism and state intervention. In Germany, complexity risks feature prominently: In complex industrial projects, defective product designs and inadequate internal control systems may lead to compromised effectiveness or a series of losses. In the UK, companies are more worried about regulatory issues.

Around the world, companies show relatively little concern about IT risks (only one percent of the surveyed AGCS experts rate this as a key client concern). In fact, however, IT failures – resulting from hacker attacks or deficient internal processes – can quickly entail follow-on costs and revenue losses in the millions.

Disclaimer

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertain-ties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may”, “will”, “should”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue” and similar expressions identify forward-looking statements.

Actual results, performance or events may differ materially from those in such statements due to, without limitation, (i) general economic conditions, including in particular economic conditions in the Allianz Groups core business and core markets, (ii) performance of financial markets, including emerging markets, and including market volatility, liquidity and credit events (iii) the frequency and severity of insured loss events, including from natural catastrophes and including the development of loss expenses, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) the extent of credit defaults, (vii) interest rate levels, (viii) currency exchange rates including the Euro/U.S. Dollar exchange rate, (ix) changing levels of competition, (x) changes in laws and regulations, including monetary convergence and the European Monetary Union, (xi) changes in the policies of central banks and/or foreign governments, (xii) the impact of acquisitions, including related integration issues, (xiii) reorganization measures, and (xiv) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences. The company assumes no obligation to update any forward-looking statement.

No duty to update

The company assumes no obligation to update any information contained herein.

Source :www.allianz.com

Explore more articles in the Business category