Asia stocks stagger up from lows, mood fragile

Published by maria gbaf

Posted on August 23, 2021

7 min readLast updated: January 21, 2026

Published by maria gbaf

Posted on August 23, 2021

7 min readLast updated: January 21, 2026

By Wayne Cole

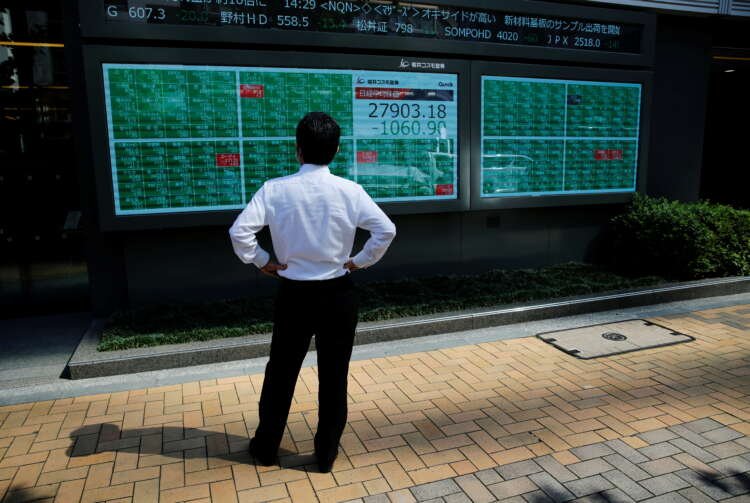

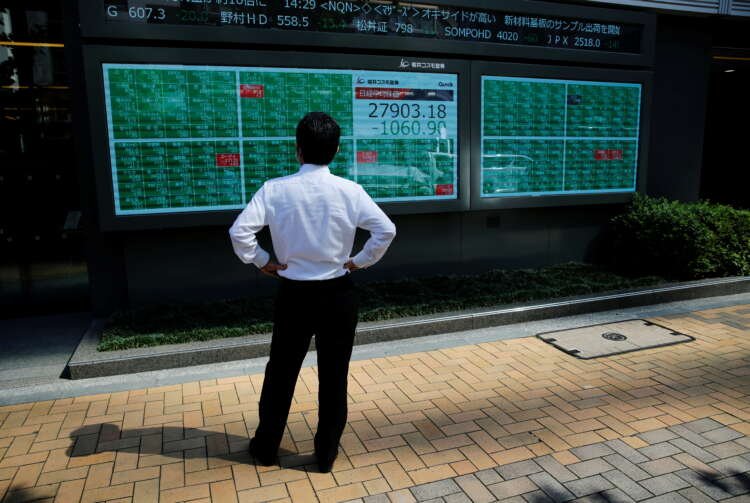

SYDNEY (Reuters) – Asian shares bounced on Monday as a wave of bargain hunting swept beaten-down markets and China reported no new locally acquired COVID-19 cases for the first time since July, though the mood remained brittle overall.

A raft of “flash” manufacturing surveys for August out on Monday will offer an early indication of how global growth is faring in the face of the Delta variant, with analysts expecting some slippage and especially in Asia.

Japan’s factory activity growth slowed in August, while that of the services sector shrank at the fastest pace since May last year, highlighting the toll from COVID-19 measures on the economy.

“Following a strong V-shaped recovery, there are many signs of slower growth,” says BofA’s chief investment strategist Michael Hartnett. “The U.S. yield curve is at a one-year low, emerging markets are negative YTD and both copper and oil are down double digits from recent highs.”

He expects negative returns for stocks and credit in the rest of this year and suggests investors own defensive quality.

Concerns over China’s economy have only intensified in recent weeks, while Beijing’s regulatory crackdown on the tech sector delivered a double blow to markets.

More than $560 billion was wiped from Hong Kong and mainland China exchanges last week as funds fretted on which sectors regulators might target next.

Beijing is considering pressing data-rich companies to hand over management and supervision of their data to third-party firms if they want U.S. stock listings, sources told Reuters.

The impact has been evident in MSCI’s broadest index of Asia-Pacific shares outside Japan which sank 4.8% last week. The sheer speed and scale of the fall left it oversold, helping it rally 1.5% on Monday.

Japan’s Nikkei also bounced 1.7%, but that follows a 3.4% slide last week to its lowest since December. Chinese blue chips firmed 1.2% from a three-week low.

Nasdaq futures and S&P 500 futures rose 0.3%, while EUROSTOXX 50 futures added 0.4% and FTSE futures 0.5%.

TAPERING TIME?

The spread of the Delta variant also has the potential to upset the timing of the U.S. Federal Reserve’s tapering plans.

Dallas Federal Reserve President Robert Kaplan, a well-known hawk, said on Friday he might reconsider the need for an early start to tapering if the virus harms the economy.

That adds an extra frisson of uncertainty to Fed Chair Jerome Powell’s speech at Jackson Hole this week, which has had to be moved online because of pandemic restrictions.

“Our base case is that the FOMC will announce a taper in September if the August non‑farm payrolls is strong,” said Joseph Capurso, head of international economics at CBA.

“We anticipate the taper will be implemented in October or November, though the recent increase in Covid infections and deaths in parts of the U.S. may give Powell pause.”

That is in marked contrast to the European Central Bank which is under pressure to add more stimulus, giving the dollar a leg up on the euro.

“Unlike the Fed, we do not expect the ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB to shift away from its ultra‑dovish monetary policy stance,” said Capurso. “We expect EUR to decline to a low of $1.12 in Q1 2022, before gradually appreciating.”

The single currency was trading at $1.1714, after losing 0.8% last week to touch 10-month lows at $1.1662. The dollar index was trading at 93.323 having hit a 10-month peak of 93.734 last week.

The dollar also made large gains on commodity and emerging market currencies, and turned higher on the Chinese yuan.

It has been more restrained against the Japanese yen at 109.84, which is benefiting from safe haven flows.

Global growth jitters took a heavy toll on commodities last week, with base metals, bulk resources and oil all falling.

Gold was steadier at $1,785, following a one-day plunge earlier in August.

Oil pared some losses on Monday, after suffering its worst week in more than nine months as investors anticipated weakened fuel demand worldwide due to a surge in COVID-19 cases. [O/R]

Brent edged up 70 cents to $65.88 a barrel, while U.S. crude added 57 cents to $62.71.

(Editing by Shri Navaratnam and Jacqueline Wong)

By Wayne Cole

SYDNEY (Reuters) – Asian shares bounced on Monday as a wave of bargain hunting swept beaten-down markets and China reported no new locally acquired COVID-19 cases for the first time since July, though the mood remained brittle overall.

A raft of “flash” manufacturing surveys for August out on Monday will offer an early indication of how global growth is faring in the face of the Delta variant, with analysts expecting some slippage and especially in Asia.

Japan’s factory activity growth slowed in August, while that of the services sector shrank at the fastest pace since May last year, highlighting the toll from COVID-19 measures on the economy.

“Following a strong V-shaped recovery, there are many signs of slower growth,” says BofA’s chief investment strategist Michael Hartnett. “The U.S. yield curve is at a one-year low, emerging markets are negative YTD and both copper and oil are down double digits from recent highs.”

He expects negative returns for stocks and credit in the rest of this year and suggests investors own defensive quality.

Concerns over China’s economy have only intensified in recent weeks, while Beijing’s regulatory crackdown on the tech sector delivered a double blow to markets.

More than $560 billion was wiped from Hong Kong and mainland China exchanges last week as funds fretted on which sectors regulators might target next.

Beijing is considering pressing data-rich companies to hand over management and supervision of their data to third-party firms if they want U.S. stock listings, sources told Reuters.

The impact has been evident in MSCI’s broadest index of Asia-Pacific shares outside Japan which sank 4.8% last week. The sheer speed and scale of the fall left it oversold, helping it rally 1.5% on Monday.

Japan’s Nikkei also bounced 1.7%, but that follows a 3.4% slide last week to its lowest since December. Chinese blue chips firmed 1.2% from a three-week low.

Nasdaq futures and S&P 500 futures rose 0.3%, while EUROSTOXX 50 futures added 0.4% and FTSE futures 0.5%.

TAPERING TIME?

The spread of the Delta variant also has the potential to upset the timing of the U.S. Federal Reserve’s tapering plans.

Dallas Federal Reserve President Robert Kaplan, a well-known hawk, said on Friday he might reconsider the need for an early start to tapering if the virus harms the economy.

That adds an extra frisson of uncertainty to Fed Chair Jerome Powell’s speech at Jackson Hole this week, which has had to be moved online because of pandemic restrictions.

“Our base case is that the FOMC will announce a taper in September if the August non‑farm payrolls is strong,” said Joseph Capurso, head of international economics at CBA.

“We anticipate the taper will be implemented in October or November, though the recent increase in Covid infections and deaths in parts of the U.S. may give Powell pause.”

That is in marked contrast to the European Central Bank which is under pressure to add more stimulus, giving the dollar a leg up on the euro.

“Unlike the Fed, we do not expect the ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB to shift away from its ultra‑dovish monetary policy stance,” said Capurso. “We expect EUR to decline to a low of $1.12 in Q1 2022, before gradually appreciating.”

The single currency was trading at $1.1714, after losing 0.8% last week to touch 10-month lows at $1.1662. The dollar index was trading at 93.323 having hit a 10-month peak of 93.734 last week.

The dollar also made large gains on commodity and emerging market currencies, and turned higher on the Chinese yuan.

It has been more restrained against the Japanese yen at 109.84, which is benefiting from safe haven flows.

Global growth jitters took a heavy toll on commodities last week, with base metals, bulk resources and oil all falling.

Gold was steadier at $1,785, following a one-day plunge earlier in August.

Oil pared some losses on Monday, after suffering its worst week in more than nine months as investors anticipated weakened fuel demand worldwide due to a surge in COVID-19 cases. [O/R]

Brent edged up 70 cents to $65.88 a barrel, while U.S. crude added 57 cents to $62.71.

(Editing by Shri Navaratnam and Jacqueline Wong)

Explore more articles in the Investing category