A TIME OF PAYMENT MARKET CHANGE DOES NOT AUTOMATICALLY SIGNAL MARKET DECLINE

Published by Gbaf News

Posted on January 28, 2015

7 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on January 28, 2015

7 min readLast updated: January 22, 2026

According to Sopra Banking’s Amanda Hartshorne, a single, open, secure and innovative European market in payment services will have many positive implications for banks – but will also force many of them to adapt or reinvent in order to be sure of a place in the coming new environment

Like many other business sectors, the banking industry is undergoing far-reaching change. And just like so many other transformations, our sector’s also driven by a combination of new technologies, shifts in consumer behaviour, regulatory changes – and the need to never slack for a second when it comes to searching for process efficiencies.

A reminder on the context: by adapting the legal framework governing payments, successive European regulatory provisions (specifically, Payment Services Directives and related regulations) have, without question, had a huge impact on the business models of banks. Despite the fact that payments are critical for both direct and indirect income, banks are seeing margins cut –while the arrival on the market of new specialised entrants from non-banking backgrounds (e-commerce firms especially) is also posing a clear threat.

For example, the latter are challenging the established players in payments of mainstream banks, with a clear agenda of seizing significant market share by taking advantage of those regulatory and technological changes. And as many of these new entrants are able to draw on huge resources, plus can bring into play their expertise acquired in their core business, this is absolutely no time for complacency on the part of anyincumbents in the payment arena.

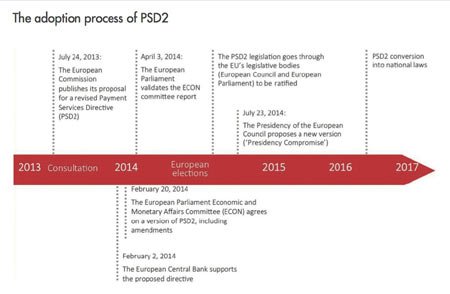

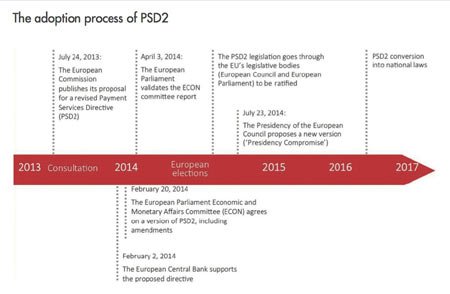

Should banks, though, give up and resign themselves to losing their current payment world ‘pole position’? Or is it, instead, actually an ideal time for banks to respond and adapt/reinvent in order to protect their place? The reality is that new European regulatory provisions, like the new Payment Services Directive (PSD2) (see http://ec.europa.eu/finance/payments/framework/index_en.htm), mean they will soon no longer have any choice – as Third Party Providers (TPP) will soon have access to bank accounts for their payment initiation services.

All in all, new developments on the payment market are disrupting established positions, plus have a clear impact on the income of banks and enlarging their competitive environment by encouraging new non-banking competitors to enter the market with different business models. But such a context is conducive to innovative initiatives and potentially multiple attractive market offerings in terms of content, price or user-friendliness, all vying to become market benchmarks.

However, the proliferation of value propositions is creating some confusion. This gives banks as much of a window of opportunity as TPPs, to be frank – and it’s a window that you should try and make use of, if you are an established player, without a doubt.

An action plan for a time of market disruption

To protect their income and create ever more added value for their customers, banks must look at devising new offerings and new services for their customers and partners by positioning themselves in a support role throughout the purchase journey.

They should also be looking to build a proposition around their own payment information services to their customers, almost certainly through collaborative, community initiatives between banks in order to create innovative payment frameworks (which they can then market to Third Party Providers, incidentally).

This will be achieved only when banks enter a new era – one of opening up their systems to external players, not just tolerating but actively tolerating ‘co-opetition’ between participants and putting in place viable business ecosystems that are end-customer-oriented. Such a living ‘environment,’ open to the outside world and constantly evolving, will enable banks to interact with the various stakeholders to create the conditions to boost agility and creativity.

Banks will also have to devise ways of cooperating with non-banking players in order to ensure equitable value sharing, plus look to make progress while learning from their experiences and piping front-line feedback with regard to technical feasibility and customer adoption in order to maximise their chances of success.

The following aphorism sums up this new style well: “We cannot afford to wait to know the truth before committing ourselves.” However, it is never easy to break with old (proven) models. However, even when faced with all the new entrants to the payments market, banks will be able to rely on their many advantages in the area of payments: strong market share, legitimacy, expertise in the area, a high level of trust, and so on.

However, to compete more effectively, they must also learn from the methods used by the latter: understanding what drives customers and makes them happy so as to anticipate their future needs; constant adaptation to remain in step (hopefully, even one step ahead) of market expectations, stimulating creativity and innovation, developing agility and reactivity and always 100% focusing on superior customer experience.

We contend that instead of acting in isolation or in a scattershot manner in reaction to this period of dynamic payments market changes, the implementation of that co-opetition culture I just spoke about enables banks to better confront the challenges that lie ahead by:

They must be part of genuine innovation networks, possibly composed of very diverse participants:other banks facing the same challenges with a view to building critical mass more rapidly; new hungry start-ups, contributing not only their dynamism in the innovation process but also highly relevant responses to the challenges banks face; players from other industries, too, who can bring both a fresh perspective and successful innovations in their core business. Reassuringly, both the recent and more distant past is full of examples that illustrate the benefits of co-opetition in the area of payments with other players, as well the diverse forms that it can take; examples range from the development of the bank card or services such as Sepamail or wallets such as Paylib in France, as well as Paym in the United Kingdom or the pan-European MyBank initiative.

They must be part of genuine innovation networks, possibly composed of very diverse participants:other banks facing the same challenges with a view to building critical mass more rapidly; new hungry start-ups, contributing not only their dynamism in the innovation process but also highly relevant responses to the challenges banks face; players from other industries, too, who can bring both a fresh perspective and successful innovations in their core business. Reassuringly, both the recent and more distant past is full of examples that illustrate the benefits of co-opetition in the area of payments with other players, as well the diverse forms that it can take; examples range from the development of the bank card or services such as Sepamail or wallets such as Paylib in France, as well as Paym in the United Kingdom or the pan-European MyBank initiative.

Clearly, the agility and reactivity these new partners can contribute are key to developing creativity and accelerating time-to-market. Some banks have chosen to welcome them into their ecosystem, sometimes by financing them (acquiring a stake or providing them with resources), sometimes by integrating their offerings via white-labelling.

However you choose to do it, embrace external expertise and perspective – as open, collaborative and participatory innovation is what will make it possible to progress more quickly and cost-effectively than you might have done otherwise.

Open and collaborative is the way ahead here

We are convinced banks are equipped to meet the payment revolution challenges. They may well have to adapt their offering to find growth drivers in this world, for example by relying on digital wallets and new services, as well as inaugurating a major mind-shift change by opening up their systems to external players, fostering new styles of relationship with other participants in the payment services sector and putting in place genuine customer-focused ways of working.

We believe that banks will seize all opportunities in this market to reinvent their model and create ever more added value.

The author is Principal Business Consultant, Compliance, at Sopra Banking Software (http://www.soprabanking.com)

Explore more articles in the Business category