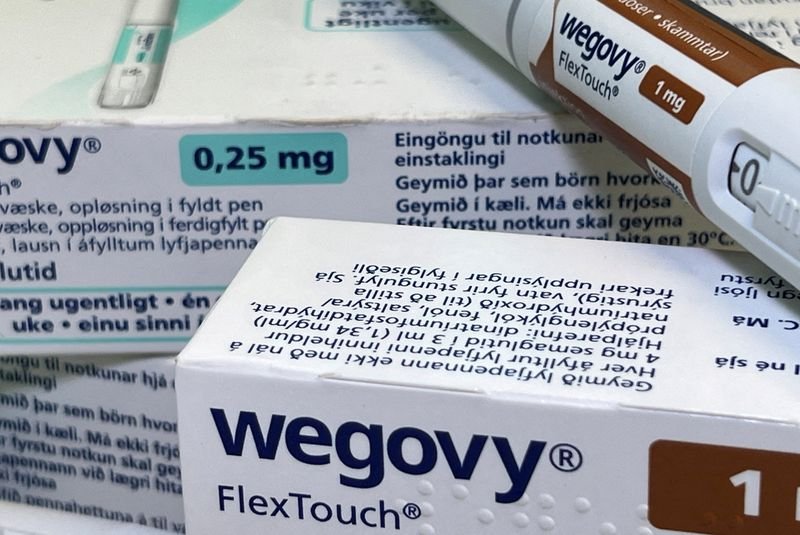

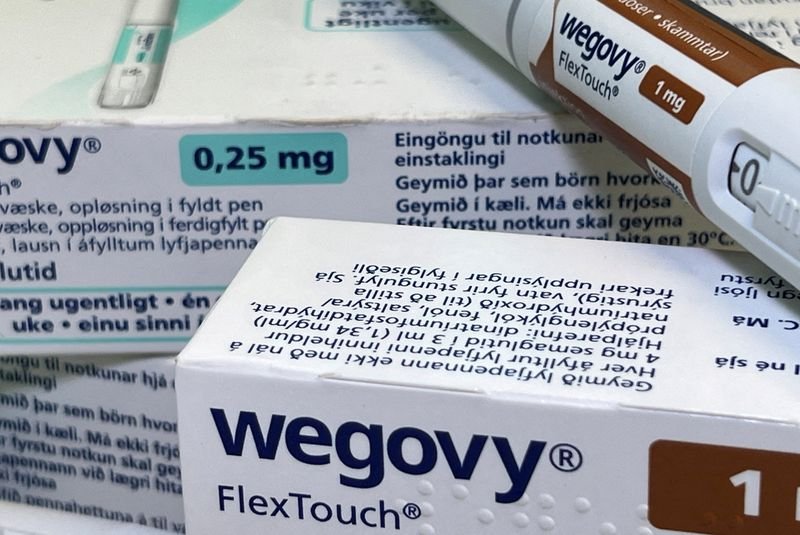

Novo's Wegovy and Ozempic removed from US FDA shortage list, compounders on notice

Published by Global Banking & Finance Review®

Posted on February 21, 2025

3 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on February 21, 2025

3 min readLast updated: January 26, 2026

The FDA has removed Wegovy and Ozempic from its shortage list, impacting compounding pharmacies and market dynamics for obesity and diabetes drugs.

By Patrick Wingrove and Bhanvi Satija

(Reuters) - The U.S. Food and Drug Administration said on Friday there was no longer a shortage of Novo Nordisk's popular weight-loss and diabetes drugs, Wegovy and Ozempic, a declaration that will curtail widespread sales of cheaper copies made by compounding pharmacies.

U.S. regulations allow compounding pharmacies to copy brand-name medicines that are in short supply. Wegovy and Ozempic, both known chemically as semaglutide, were in shortage in the U.S. for much of last year.

The sale of compounded versions of Eli Lilly's rival obesity and diabetes drugs, Zepbound and Mounjaro, was banned in December after the FDA found them to no longer be in short supply.

The FDA said in a statement that compounding pharmacies would be given a grace period of 60 to 90 days, as was the case when Lilly's drugs were declared out of shortage.

Americans who cannot afford Wegovy or have struggled to find it have been turning to often-cheaper versions sold by pharmacies and telehealth providers like Hims & Hers Health and WeightWatchers. Wegovy has been shown to help patients lose as much as 15% of their weight on average.

More than 200,000 prescriptions for semaglutide drugs not manufactured by Novo Nordisk were being filled by U.S. patients each month, an industry group told the FDA in a letter last year, saying it should consider their role in alleviating the obesity drug supply crunch before barring them.

For Hims and other compounders, this development "starts the clock on having unfettered market access (to Novo's drugs)," said Leerink Partners analyst Michael Cherny.

Hims & Hers shares were down 21% at $52.66, while WeightWatchers was up 6.4% at 78 cents in morning trading. Neither company immediately responded to requests for comment.

Novo and Lilly have invested billions to ramp up supply of their treatments, which lagged demand for most of last year.

Novo said in a statement that all doses of Wegovy and Ozempic were being shipped regularly to wholesalers, and the resolution comes after ongoing dialogue with the FDA.

All doses of Ozempic and Wegovy were listed as available on the FDA's website in October, but the treatments had not been taken off the official shortage list at the time.

The agency usually assesses if all back orders have been filled before deciding on whether a shortage has been resolved.

(Reporting by Bhanvi Satija and Puyaan Singh in Bengaluru; Editing by Arun Koyyur)

The FDA's removal of Wegovy and Ozempic from the drug shortage list and its implications on the market.

Wegovy and Ozempic are semaglutide-based drugs used for weight-loss and diabetes treatment.

Compounding pharmacies will face restrictions on producing cheaper copies of these drugs.

Explore more articles in the Finance category