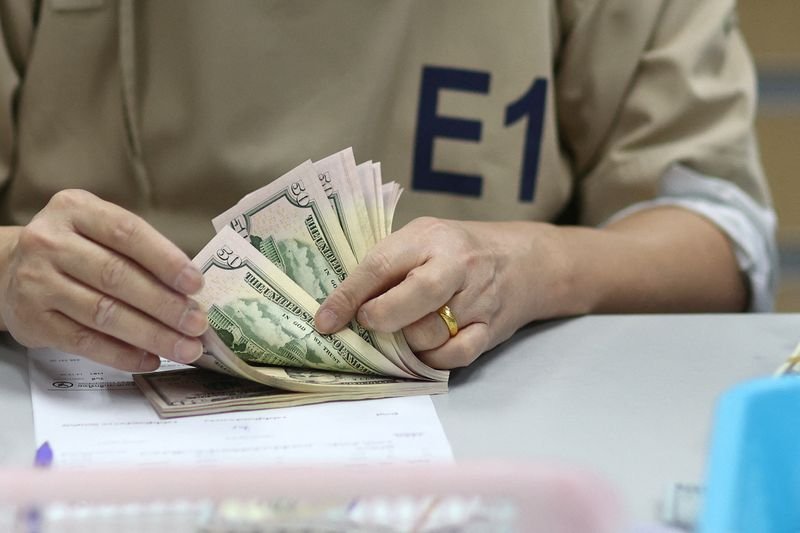

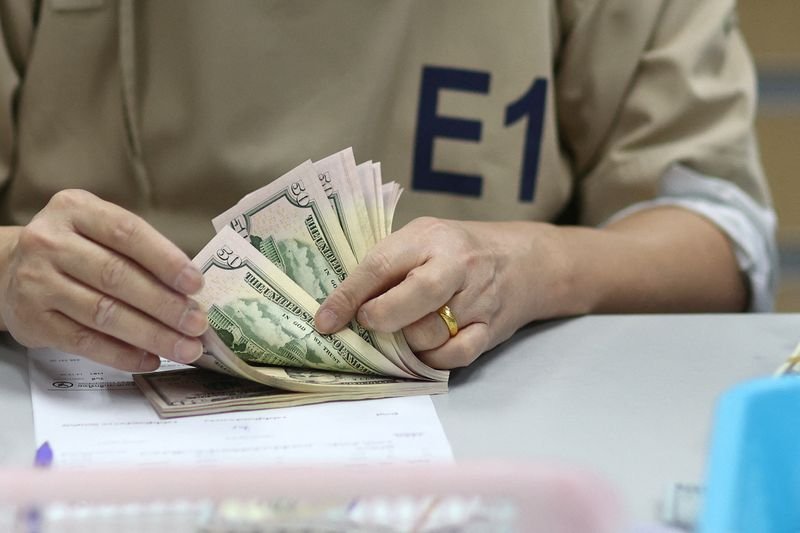

Dollar down in choppy trade on Trump tariff confusion

Published by Global Banking & Finance Review®

Posted on January 24, 2025

4 min readLast updated: January 27, 2026

Published by Global Banking & Finance Review®

Posted on January 24, 2025

4 min readLast updated: January 27, 2026

The US dollar fell in volatile trading due to confusion over Trump's tariff plans, with significant market reactions and currency fluctuations.

By Chuck Mikolajczak

NEW YORK (Reuters) -The U.S. dollar was lower on Monday in choppy trading after conflicting reports about how aggressive President-elect Donald Trump's tariff plans could be when he takes office.

The dollar dropped as much as 1.07% on the session against a basket of major currencies after the Washington Post reported that Trump's aides were exploring plans that would apply tariffs to every country - but only on sectors seen as critical to U.S. national or economic security, easing concerns about harsher and wider levies.

The dollar then sharply pared declines after Trump denied the report in a post on his Truth Social platform.

"The reality here is that Trump's Truth Social views are going to drive FX volatility for a while and (Monday) morning's reaction is indicative of the underlying dynamics," said Karl Schamotta, chief market strategist at Corpay in Toronto.

"The market consensus is that Trump's bark will be worse than his bite, and any news that confirms that concept is fuel for rallying in risk assets and for a decline in the dollar and Treasury yields, but the reality here is that the downside risks remain and there's no clear endpoint for that," Schamotta added.

The dollar index, which measures the greenback against a basket of currencies, fell 0.64% to 108.26, with the euro up 0.76% at $1.0386. The dollar was on pace for its biggest daily percentage drop since Nov. 27 with the euro poised for its biggest daily gain since Aug. 2.

The dollar index had reached a two-year high of 109.54 last week en route to its fifth straight weekly gain, as the resilient economy, the potential for higher inflation from tariffs and a slower pace of rate cuts from the Federal Reserve have buttressed the greenback.

The Chinese yuan strengthened 0.16% against the greenback to 7.348 per dollar. The dollar reached a 26-month high against the currency last week as China is seen as one of Trump's major tariff targets.

Also helping the dollar pare declines were comments from Fed Governor Lisa Cook, who said the Fed can afford to be cautious with any further rate cuts given an economy that is on solid footing and inflation that has been stickier than expected.

Various Fed policymakers are scheduled to speak this week, and are likely to echo recent comments from other Fed officials that there remains a need to combat the stubborn levels of inflation.

The euro, which hit its lowest level since November 2022 last week, strengthened after annual German inflation rose more than forecast in December, according to preliminary data.

"There's a window there for potentially 2%, 3% or 4% correction in the dollar index that could unfold in the next while, but we'd need either a stronger sense that either the European economy's doing a bit better, so we see a further pick up in European interest rates, or some further moderation in expectations regarding tariffs to drive that," said Shaun Osborne, chief FX strategist at Scotiabank in Toronto.

U.S. economic data showed new orders for U.S.-manufactured goods fell in November while business spending on equipment appeared to have slowed in the fourth quarter.

Against the Japanese yen, the dollar firmed 0.17% to 157.53 while sterling strengthened 0.72% to $1.251.

Investors will gauge a string of data on the U.S. labor market this week, culminating in Friday's key government payrolls report.

The Canadian dollar strengthened 0.74% versus the greenback to C$1.43 per dollar after Canadian Prime Minister Justin Trudeau said he would step down as leader of the ruling Liberals in the coming month.

(Reporting by Chuck Mikolajczak, additional reporting by Lisa Pauline Mattackal in Bengaluru; Editing by Bernadette Baum, Will Dunham and Emelia Sithole-Matarise)

The article discusses the US dollar's decline due to confusion over Trump's tariff plans and its impact on global currencies.

Trump's denial of aggressive tariff plans led to market volatility, influencing currency values and investor sentiment.

The euro gained significantly against the dollar, marking its biggest daily gain since August.

Explore more articles in the Finance category