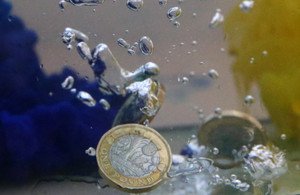

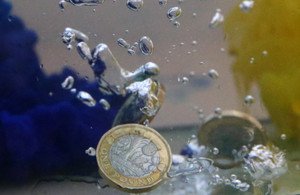

Trader confidence in sterling takes a dive on bond market turmoil

Published by Global Banking & Finance Review®

Posted on January 10, 2025

3 min readLast updated: January 27, 2026

Published by Global Banking & Finance Review®

Posted on January 10, 2025

3 min readLast updated: January 27, 2026

Sterling confidence declines as UK bond yields hit 16-year highs, impacting the pound. Traders show increased bearish sentiment amid economic uncertainty.

By Amanda Cooper

LONDON (Reuters) - Traders' confidence in the pound has taken its biggest dive this week since the 2022 UK budget crisis, according to the options market, as a global bond selloff added to growing unease over Britain's finances and sent bond yields to 16-year highs.

The options market shows traders are positioned more bearishly against the pound than at any time since early 2023, as the market was emerging from the wild swings unleashed by then-Prime Minister Liz Truss' mini-budget in September 2022.

This week, 10-year gilt yields have risen by a quarter point to a high of 4.925%, the most since 2008, echoing a sell-off in U.S. Treasuries that has rippled through global bond markets, punishing UK debt harder than most.

The pound is set for a weekly drop of nearly 1%, having hit a 14-month low of $1.2239.

Rising yields mean British finance minister Rachel Reeves is under pressure to find ways to meet the government's fiscal rules, which could complicate the Bank of England's task to manage monetary policy.

The Treasury's assurance that it has an "iron grip" on the country's finances has returned some stability to UK assets.

But the options market suggested traders were cautious.

Three-month risk reversals, a play that reflects how much more traders are willing to pay to own options to buy the pound versus the cost of owning options to sell it, have fallen to -1.935, their lowest since January 2023.

A negative number indicates the cost of owning an option to buy the pound is below that to sell it and points to trader bearishness towards sterling versus the dollar.

"We are in the process of repricing sterling and UK assets for worse growth, a worse budget and a less stable political outlook than we had hoped for, say, in the middle of last year," Rabobank chief strategist Jane Foley said.

"We'd seen this pressure building and when we had the headlines about the 30-year high since 1998, I think it just gave it more momentum, this adjustment," she said.

STERLING BEARS

Indicating bearishness towards sterling, risk reversals have fallen by the most in a week since September 2022 when they tumbled 2 full points to -4.625.

"There is a huge amount of uncertainty about what the Bank of England could or should react to. And I think from that point of view, it's not that surprising that the options market is reflecting that uncertainty," Rabobank's Foley said.

Deutsche Bank on Friday recommended selling the pound on a broad, trade-weighted basis.

Traders are also paying more to hedge against big swings in the pound than at any time since the March 2023 banking crisis. One-month options volatility, a measure of demand for protection, hit a high of 10.9% on Thursday.

By Friday, this had retreated to 9.7% and the sense among currency watchers is there might be enough of a sense of calm to offer sterling some respite for now.

ING strategist Francesco Pesole said sterling could see buyers come in around $1.225-1.230, as long as gilts remained calm.

(Additional reporting by Alun John; Editing by Dhara Ranasinghe and Toby Chopra)

The article discusses the decline in trader confidence in sterling due to turmoil in the UK bond market.

The global bond selloff has led to UK bond yields reaching 16-year highs, causing the pound to hit a 14-month low.

The Bank of England faces challenges in managing monetary policy amid rising bond yields and economic uncertainty.

Explore more articles in the Finance category