2019 Valentine’s Day: Losing the Retail Love?

Published by Gbaf News

Posted on February 12, 2019

3 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on February 12, 2019

3 min readLast updated: January 21, 2026

Year-on-year sales decline on 14 February strengthens the need to save the high-street

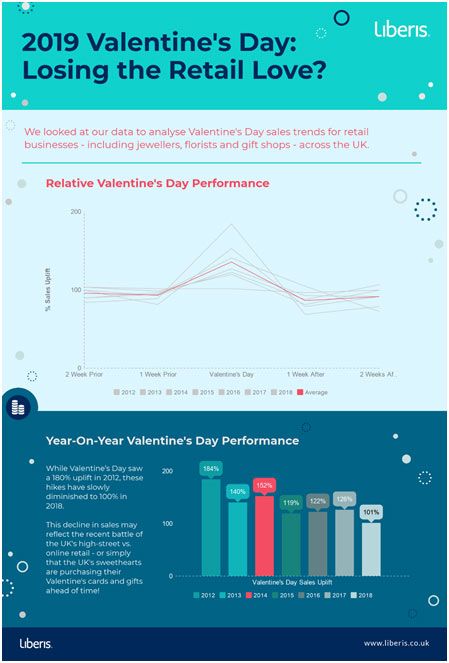

With Valentine’s Day looming, businesses including retail stores, jewellers and florists are getting ready for one of their busiest periods. However, according to Liberis, a leading alternative finance provider for SMEs, 2019 may not be as rosy as before. Although UK retailers are set to experience up to a 35% sales hike in the Valentine’s Day week in comparison with sales during January and March, the overall YOY sales figures show a surprising decline.

The last few years have seen these YOY sales gradually decline. While Valentine’s Day saw a 180% uplift in 2012, these hikes have slowly diminished to 100% in 2018. This may be due to consumers being more prepared for the holiday and either buying gifts ahead of time, or online as opposed to in store. But ultimately, the decline in sales may reinforce the recent battle of the UK’s high-street and sufferings of both big and small brands alike; highlighting an even greater need for business support and smart tools to save it. With retail performance on the day of love dwindling, small businesses need to adapt quickly.

Helping small and medium size businesses scale up and grow, Liberis has been working with SMEs since 2007 and has funded over 10,000 businesses to date[i]. Focusing on providing small businesses with financing they need to thrive, Rob Straathof, CEO, Liberis, states, “While the losses of big brands have been a major discussion point in the conversation of saving the high street, we emphasise the need to better support the smaller scale and independent high-street brands too. The UK’s 2.4 million SMEs make up 99% of its employers and employ almost 40% of UK workers. Since SMEs have accounted for 90% of the UK’s net employment growth since 2008, their success is overtly critical to the country’s economic and social performance[ii].”

In order to retain customers’ attention and strengthen loyalty, Liberis recommends small businesses to focus on creating bespoke customer experiences this Valentine’s Day. Tailoring customer experience by understanding their preference is always a good place to start, and the special tokens people buy for their loved ones can be enhanced by combining it with a social experience.

With the concept of sustainability increasing beyond the food market, eco-friendly consumers may also be interested in contributing to the environment while they celebrate love – or at least being aware of the impact made by the businesses they’re shopping with.

[i]As of February 2019, figure

[ii]Pg 5 – Value of Liberis, 2018 report available on site.

Explore more articles in the Business category