UK WORKERS LOSE £2.1 BILLION EACH YEAR THROUGH UNPAID BUSINESS EXPENSES

Published by Gbaf News

Posted on April 10, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on April 10, 2014

2 min readLast updated: January 22, 2026

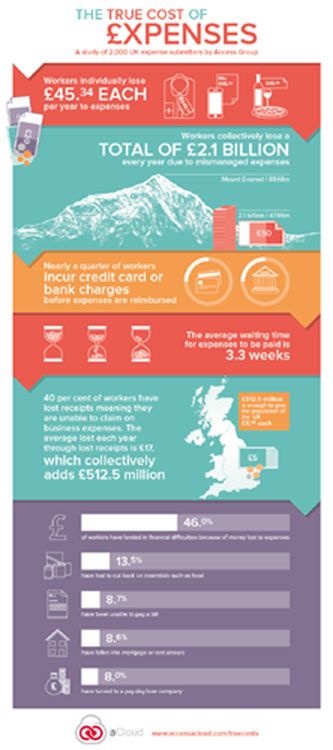

The process of claiming expenses is costing employees £45 a year owing to interest charges while waiting to be reimbursed by their employer. With 46 million people employed in the UK, a collective £2.1 billion is lost by workers every year.

The study of 2,000 expense submitters by Access Group also revealed almost half of UK workers (46 per cent) have landed in financial dire straits because of money lost to expenses. 13.5 per cent have had to cut back on essentials such as food, 8.7 per cent have been unable to pay a bill, 8.6 per cent have fallen into mortgage or rent arrears, while 8 per cent have turned to a pay day loan company to tide them over until their employer reimbursed them.

The average waiting time for expenses to be paid in the UK is 3.3 weeks; while over 20 per cent of people spend a total 6.3 weeks chasing their employer before they are paid what is owed.

The average waiting time for expenses to be paid in the UK is 3.3 weeks; while over 20 per cent of people spend a total 6.3 weeks chasing their employer before they are paid what is owed.

40 per cent of UK workers also admit to having lost receipts meaning they are unable to claim on business expenses. Employers on average lose £17 each year through lost receipts, adding a further £512.5 million to the money collectively lost by UK workers each year.

Jon Jorgensen, group director at Access Group, says, “Paying for goods or services up-front out of their own pocket only to be reimbursed later by their employer is a reality for the majority of workers in the UK. Now it transpires millions of hard working people are being left out of pocket by delays in payment.

“Incurring expenses is accepted as part and parcel of a job, but that should never lead to a person turning to shocking measures such as pay day loan companies which charge huge interest rates.

“Many businesses are quite simply working inefficiently and this is not only costing businesses through wasted time, resource and therefore money, but also employees. At a time when so many are already struggling financially British businesses should not be adding to those pressures simply because of a lack of efficiency over a routine business process.”

The full details of the research can be found in the whitepaper ‘Poor expenses processes hit more than employees’ pockets’, which has been launched today by Access Group. The whitepaper can be downloaded at www.accessacloud.com/truecosts.

Explore more articles in the Top Stories category