WORLD ECONOMICS SALES MANAGERS’ INDEX: CHINA

Published by Gbaf News

Posted on August 1, 2014

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 1, 2014

5 min readLast updated: January 22, 2026

Market and Sales growth Indexes slow in July

• SMI Headline Index falls to 56.1

• Business Confidence drops for second month

• Price pressures abate

Overview

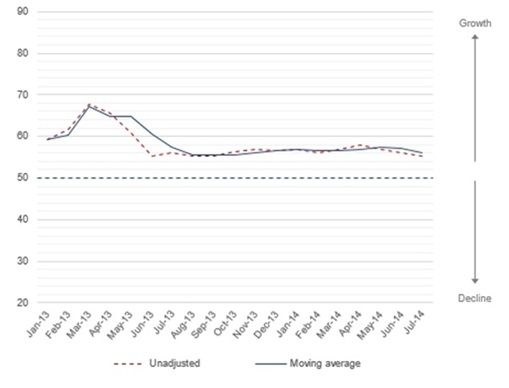

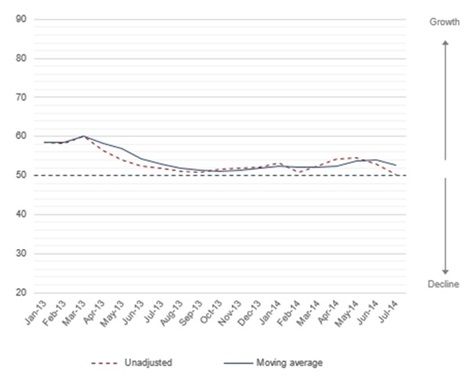

The Headline Index for July was 56.1, down by 0.9 on June, the second consecutive monthly decline.

The China Headline Index is designed to reflect overall economic growth, bringing together the average movement of Confidence, Market Expansion, Product Sales, Prices Charged and the Staffing Indices.

Headline Sales Managers’ Index

Business Confidence

Business Confidence

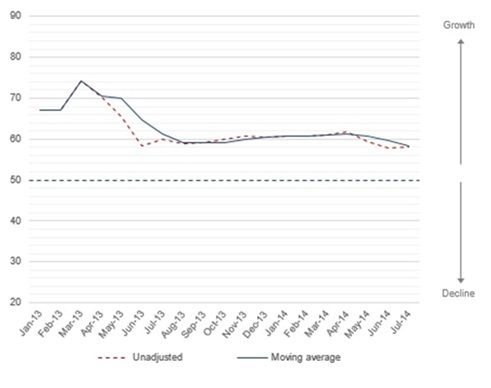

The Business Confidence Index measures how Sales Managers’ expect the economy as a whole to perform over the coming months and provides a valuable sentiment insight as confidence has a knock on effect for jobs and sales growth.

The index value registered for this variable fell by 0.8 in July to an index value of 60.2. This is the second successive monthly fall. Panellists’ confidence remains at a high level and the fall reflects slowing rates of growth in Market and Sales growth. Most of China’s sales managers still anticipate a buoyant economic environment in the coming months.

Business Confidence Index

Market Growth

Market Growth

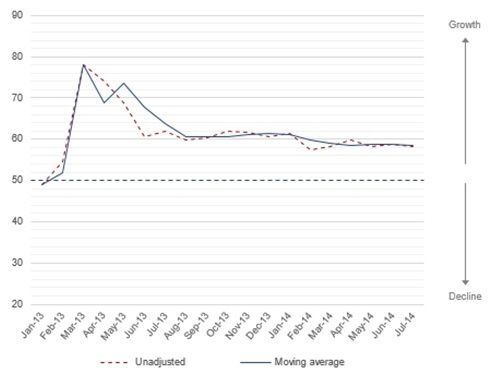

The Index value for Market Growth in July dropped by 1.2 to reach 58.5 the third successive monthly fall. Panellists are experiencing growth in the markets they operate in, but the growth rate is slowing.

The Index value for Market Growth in July dropped by 1.2 to reach 58.5 the third successive monthly fall. Panellists are experiencing growth in the markets they operate in, but the growth rate is slowing.

Market Growth Index

Product Sales

The Product Sales Index represents sales made by panellists’ own companies.

The July Index for Product Sales was 58.4, down by 0.5 on June. This indicates that the deceleration in the rate of growth in the markets in which firms operate is starting to impact on own company sales.

Product Sales Index

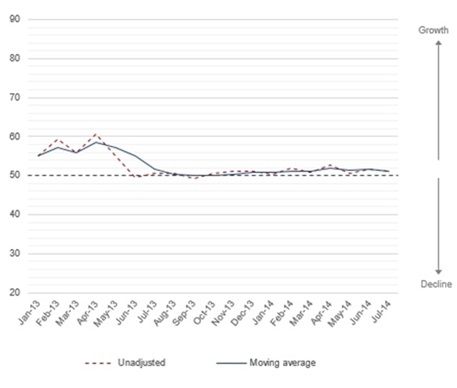

Prices Charged

Prices Charged

The Prices Changed index fell by 0.5 to reach 51.1 in July. Over the first seven months of 2014 this index has averaged 51.3 showing that panellists are experiencing mildly rising prices, but inflationary pressures across markets are weak.

Prices Charged Index

Staffing Levels

Staffing Levels

The Staffing Index reached 52.6 in July, down by 1.3 indicating that panellists are increasing payrolls, but the rate of growth is slowing.

Staffing Levels Index

Yuan Valuation

Yuan Valuation

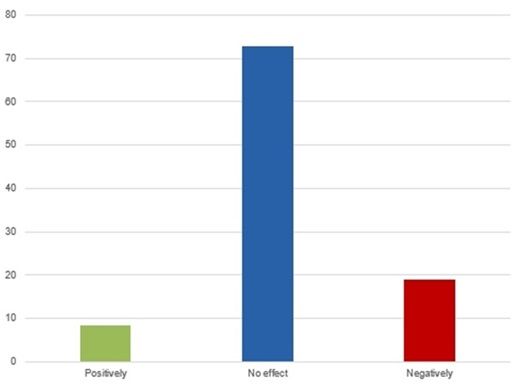

In answer to a special question posed to panellists in July, 19% of Chinese Sales Managers’ now believe the valuation of the Yuan is negatively affecting their business, the same proportion as last month.

How is the Value of the Yuan Affecting Your Business?

Summary

Summary

World Economics Chief Executive Ed Jones commented:

“The Headline Index dropped in July as a result of falls in all recorded variables. Market and Sales growth are both slowing and this is chipping away at confidence. The number of panellists expressing concern that the valuation of the Yuan is having a negative impact on their business is unchanged at 19%.”

Methodology

The Sales Managers’ Index results are calculated by taking the percentage of respondents that report that the activity has risen (“Increasing”) and adding it to one-half of the percentage that report the activity has not changed (“Unchanged”). Using half of the “Unchanged” percentage effectively measures the bias toward a positive (above 50 points) or negative (below 50 points) index. An example of how to calculate a diffusion index: if the response is 40% “Increasing,” 40% “Unchanged,” and 20% “Reducing,” the Diffusion Index would be 60 points (40% + [0.50 x 40%]). A value of 50 indicates “no change” from the previous month.

The more distant the index is from the amount that would indicate “no change” (50 points), the greater the rate of change indicated. Therefore, an index value of 58 indicates a faster rate of increase than an index value of 53, and an index value of 40 indicates a faster rate of decrease than an index value of 45. A value of 100 indicates all respondents are reporting increased activity while 0 indicates that all respondents report decreased activity.

About the Sales Managers’ Indexes

The Sales Managers’ Indexes are a series of new products available for Africa, Asia and the Americas, designed to raise the voice and profile of sales people throughout the world. The Sales Managers’ Indexes provide the earliest indication each and every month of the direction of economic activity, and the speed at which its markets are growing.

Sales Managers are unique as an occupational group in being really at the front line of economic activity. The Sales Manager is ideally placed to feel the first few whispers of caution in the market or to see the new green shoots of economic recovery.

The Sales Managers’ Index brings together the collective wisdom of Sales Managers and consequently produces the best and earliest source of understanding about what’s really happening in the Chinese economy.

The Sales Managers’ Index has been developed by World Economics, a leading edge provider of original economic data. Sister products include the World Economics Journal, the World Price Index, the Global Marketing Index, as well as the China, India and Eurozone Growth Monitors.

About World Economics

World Economics is an organisation dedicated to producing analysis, insight and data relating to questions of importance in understanding the world economy.

Currently our primary research objective is to encourage and assist the development of better and faster measures of economic activity. In cases where we believe we can contribute directly, as opposed to through highlighting the work of others, we are producing our own measures of economic activity.

Our work is mainly of interest to investors, organisations and individuals in the financial sector and to significant corporations with global operations, as well as governments and academic economists.

Explore more articles in the Investing category