OneFunded: Prop Firm Overview and Program Structure

OneFunded operates as a proprietary trading firm focused on simulated trading evaluations. The firm offers a structured program where participants trade virtual capital in a controlled demo environment and must follow published rules to progress. This model is used by firms that do not take client deposits and do not provide investment services.

The information below outlines how the program works, what the company states about its rules, and the registration details available through public sources.

Sponsored Content - Information only. This article describes a proprietary trading firm offering simulated trading programs. It is not investment, legal, tax or financial advice and does not constitute an offer to invest or trade. Participants trade virtual capital in demo environments; payouts are conditional and not guaranteed.

According to OneFunded, all program specifications and conditions listed above reflect the firm’s current official parameters.

All information reflects publicly available registration data and company statements.

OneFunded uses simulation-based evaluations, allowing participants to trade virtual capital in accounts that mirror real market conditions. Success in the evaluation may grant a simulated funded account eligibility and potential payouts, per the company’s rules. Trading results do not represent real investment risk beyond the evaluation fee.

Participants must adhere to drawdown limits, profit targets, and risk management rules published by the firm. The evaluation programs are structured to give traders time and flexibility, with unlimited trading days in most programs.

According to the OneFunded’s documentation, they have 3 types of Evaluation Programs with such terms and prices:

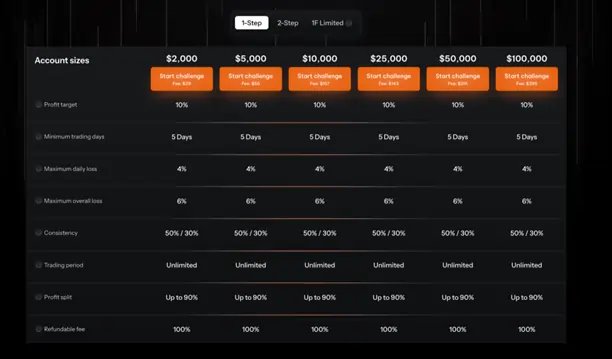

According to OneFunded the One-step Challenge consists of a single phase. Participants in this challenge aim to reach the trading targets outlined below within a specified timeframe. Upon meeting these targets and passing the final Evaluation by the Provider, participants may be offered a simulated OneFunded TRADER account.

| Account | Fee | Target | Daily DD | Max DD | Min Days | Duration |

| $2K | $29 | 10% | 4% | 6% | 5 | Unlimited |

| $5K | $56 | 10% | 4% | 6% | 5 | Unlimited |

| $10K | $107 | 10% | 4% | 6% | 5 | Unlimited |

| $25K | $143 | 10% | 4% | 6% | 5 | Unlimited |

| $50K | $215 | 10% | 4% | 6% | 5 | Unlimited |

| $100K | $395 | 10% | 4% | 6% | 5 | Unlimited |

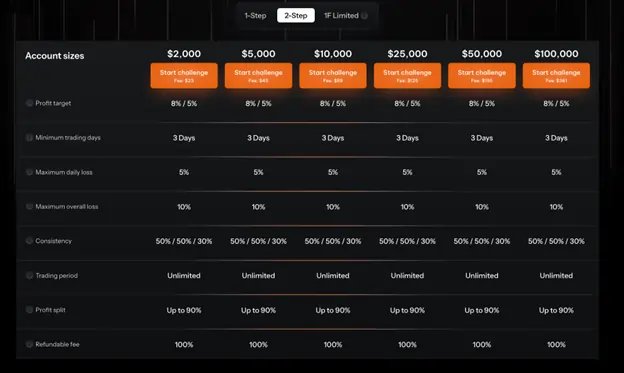

According to OneFunded the Two-step Challenge consists of two distinct phases: Phase 1 and Phase 2.

| Account | Fee | Target (1/2) | Daily DD | Max DD | Min Days | Duration |

| $2K | $23 | 8% / 5% | 5% | 10% | 3 | Unlimited |

| $5K | $45 | 8% / 5% | 5% | 10% | 3 | Unlimited |

| $10K | $89 | 8% / 5% | 5% | 10% | 3 | Unlimited |

| $25K | $125 | 8% / 5% | 5% | 10% | 3 | Unlimited |

| $50K | $295 | 8% / 5% | 5% | 10% | 3 | Unlimited |

| $100K | $361 | 8% / 5% | 5% | 10% | 3 | Unlimited |

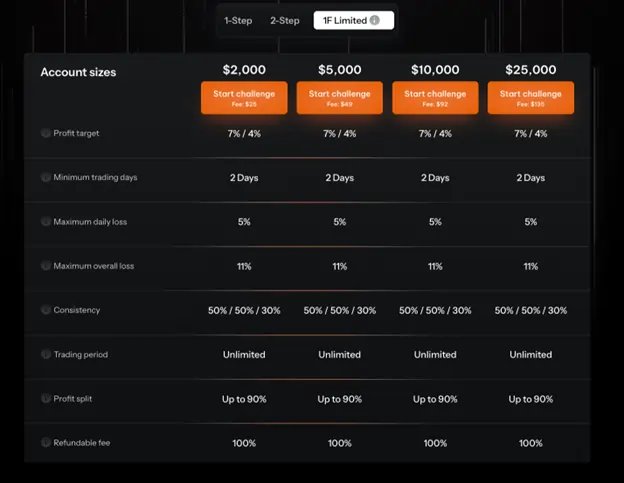

The 1F Limited Challenge is an advanced two-phase evaluation designed to offer simple trading conditions in the market, with enhanced flexibility and risk management for account sizes up to $25,000. Larger account sizes are not offered to prioritize risk management.

| Account | Fee | Target (1/2) | Daily DD | Max DD | Min Days | Duration |

| $2K | $25 | 7% / 4% | 5% | 11% | 2 | Unlimited |

| $5K | $49 | 7% / 4% | 5% | 11% | 2 | Unlimited |

| $10K | $92 | 7% / 4% | 5% | 11% | 2 | Unlimited |

| $25K | $135 | 7% / 4% | 5% | 11% | 2 | Unlimited |

OneFunded provides access to two powerful trading platforms - cTrader and TradeLocker, designed to meet the needs of both beginner and professional traders.

Both platforms offer fast order execution, high stability, and accessibility across desktop, web, and mobile devices, allowing traders to stay in control wherever they are.

OneFunded traders gain access to a broad range of global markets, enabling flexible strategies and portfolio diversification.

Platforms: cTrader, TradeLocker.

Markets & Instruments: Forex, Cryptocurrencies, Global indices, Metals, Stocks (US and EU)

Demo Access: Traders can explore the platform and view instruments/spreads with demo credentials before committing

According to OneFunded all payouts are subject to the firm’s rules and verification process.

Profit Split: up to 90% to the trader, 10% to OneFunded (80% base; 90% with add-on).

First Payout: Available after 14 days from opening the first position and with a minimum $100 profit (with the Weekly Payout Add-on, you can request payouts every 7 days).

Recurring Payouts: Every 14 days thereafter (with the Weekly Payout Add-on, you can request payouts every 7 days).

Minimum Payout Amount: $100.

Methods: Crypto (USDT TRC20): For payouts under $1,000 (faster and lower fees) and Bank Transfer: For payouts above $1,000.

Paid at the start of a Challenge.

Refundable once the trader passes the Challenge and becomes a OneFunded Trader.

Reimbursed with the first payout.

Non-refundable if the trader fails or violates rules.

Multiple Accounts: Unlimited number of live accounts allowed.

Maximum Balance: $200,000 across all active accounts (e.g., two $100,000 accounts).

OneFunded offers a flexible environment for a variety of trading approaches, accommodating different styles and preferences.

Traders can participate in news-related events at all stages of the evaluation. Trades placed within five minutes before or after major economic announcements are monitored for unusual activity, such as order spamming or latency arbitrage. Trading within reasonable and logical parameters is fully allowed.

Expert Advisors (EAs) are permitted on supported platforms, allowing for automated or semi-automated trading. cTrader and TradeLocker provide reliable execution and precision for these strategies.

Holding trades overnight or over weekends is allowed under normal swap or rollover conditions. This supports swing and position trading strategies without impacting compliance with the evaluation rules.

Based on company publications:

Unlimited trading period - trading at the user's own pace without time pressure during evaluations.

Affordable challenge fees - starting from just $23 for smaller accounts, making it accessible for beginners.

100% refundable fees - the user’s initial fee is fully refunded with the first payout.

Up to 90% profit split - available through an optional add-on.

Multiple trading platforms - cTrader and TradeLocker are available now, with MT5 integration coming soon.

Weekly payout option - accessible through an add-on for faster profit withdrawals.

Maximum funding - at $100,000 per account and $200,000 total per trader.

No scaling plan -currently, there’s no option to grow account size beyond the maximum cap.

No account merge feature yet -combining multiple accounts isn’t supported, though it’s planned for future updates.

The OneFunded Rewards Center is a loyalty program that lets traders earn extra value for using the platform. By completing simple tasks and challenges, users collect Reward Points that can be redeemed for discounts or even free evaluation challenges. This system helps lower costs, unlock benefits, and keep traders motivated.

All progress is tracked in real time directly inside the user's personal dashboard. Exact tasks and rewards may vary and be updated over time.

Save money – Use points for discounts or free challenges.

Flexibility – Choose how to redeem points based on your goals.

Motivation – Earned rewards encourage continuous engagement.

Transparency – All points earned and rewards redeemed are clearly visible in your account.

According to public program information OneFunded also offers an affiliate program that allows individuals and businesses to earn commissions by referring clients. Affiliates can earn up to 30% on the first purchase and recurring commissions of 12–22% on subsequent purchases.

Anyone aged 18 or older can join. No prior experience is required, and there are no fees to participate.

OneFunded clearly states that it provides educational and simulated trading programs only — not investment or asset management services. Traders do not deposit funds for investment, and all activity takes place in a virtual trading environment using simulated capital. This means participants face no direct financial risk beyond the evaluation fee.

For those considering joining, the platform offers a low entry cost, a transparent rulebook, and a refund option with the first payout.

As with any prop firm, traders should always:

Risk Warning: Simulated trading involves risk. Fees paid for evaluation programs may not be refunded unless stated in the firm’s terms. Performance in simulations does not predict real-world results.

Regulatory Notice (UAE/Dubai): OneFunded and its parent Brynex Tech Limited are not licensed or authorised by the Dubai Virtual Assets Regulatory Authority (VAR A) or any UAE financial regulator. UAE residents should ensure that any participation complies with local laws and VARA Marketing Regulations.

OneFunded account sizes range from $2,000 to $100,000. That said, $100k is the max allocation.

Yes, OneFunded lets traders hold or enter positions around major news events. But there’s a catch, if you repeatedly try to exploit quick spikes in the first five minutes after releases, compliance may flag it as “gaming the system.”

The firm supports a decent mix of instruments, including: Forex (majors, minors, and exotics) Cryptocurrencies Indices Metals (gold, silver, etc.) Stocks

Currently, no. The maximum allocation is capped at $100,000, and traders can’t scale up further.

OneFunded payouts happen every 14 days by default or weekly if you purchase the add-on. Minimum withdrawal is $100 and you can withdraw via crypto or bank transfer

Explore more articles in the Trading category