NZDUSD STRUGGLING POST ANZ BUSINESS CONFIDENCE

Published by Gbaf News

Posted on April 1, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on April 1, 2014

3 min readLast updated: January 22, 2026

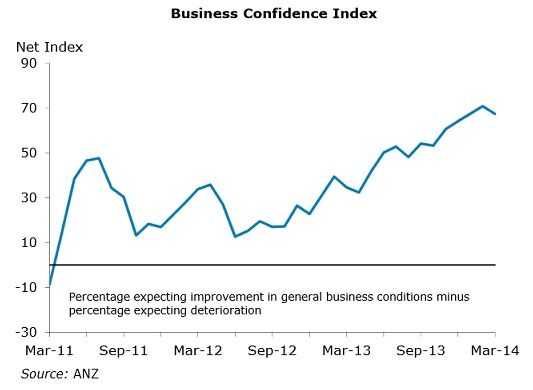

ANZ Business Confidence

In the Asian session, New Zealand’s business confidence was published by ANZ Bank New Zealand Limited. The report highlighted that net 67 percent of firms are optimistic about general prospects, down from last month’s 71 percent. The market was unhappy with the decline, but the fact remains that confidence levels are still elevated. The report mentioned that the “confidence across all the major subsectors is now north of +50 – that’s a sign of a broad-based expansion, as opposed to an upswing dominated by a few pockets of the economy”. NZDUSD pair traded a touch lower after the release, but the impact should be limited in the short term.

Technical Analysis

Technical Analysis

NZDUSD extended the upside movement during last week, and challenged 0.8700 physiological level. There is a channel forming on the 4 hour timeframe with resistance around recent 0.8695 high. As of writing, the pair is flirting with 0.8640 support level, which also represents the March 18, 2014 high. This level can hold the downside in the pair for now. A break and close below the mentioned spike level might open the doors for further downside acceleration towards the channel support zone. 50 simple moving average is also moving along the channel support zone, which signifies the importance of channel.

On the upside, 0.8695 and 0.8700 levels remain key resistance area for the pair. If buyers succeed in pushing the pair higher, then a test of 0.8780 level might be on the cards. There is a divergence noted on the RSI, which is an early-warning sign.

Prepared by Aayush Jindal, Chief Technical Analyst at Capital Trust Markets

To keep yourself updated with the latest financial news, visit the official website of Capital Trust Markets

To keep yourself updated with the latest financial news, visit the official website of Capital Trust Markets

Capital Trust Markets is an online Forex brokerage firm, headquartered in New Zealand. It was established in 2013, with an emphasis on providing the most excellent customer services in the industry. The trading environment offered to investors and traders is unparalleled – devoid of all common mistakes usually prevalent in the financial trading industry. The focused determination to provide the highest quality products, services, and support to clients and customers is what truly sets Capital Trust Markets apart from every other major brokerage firm.

Explore more articles in the Trading category