MONETISING BIG DATA IN RETAIL BANKS STARTS WITH A BETTER CUSTOMER EXPERIENCE

Published by Gbaf News

Posted on March 21, 2014

9 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 21, 2014

9 min readLast updated: January 22, 2026

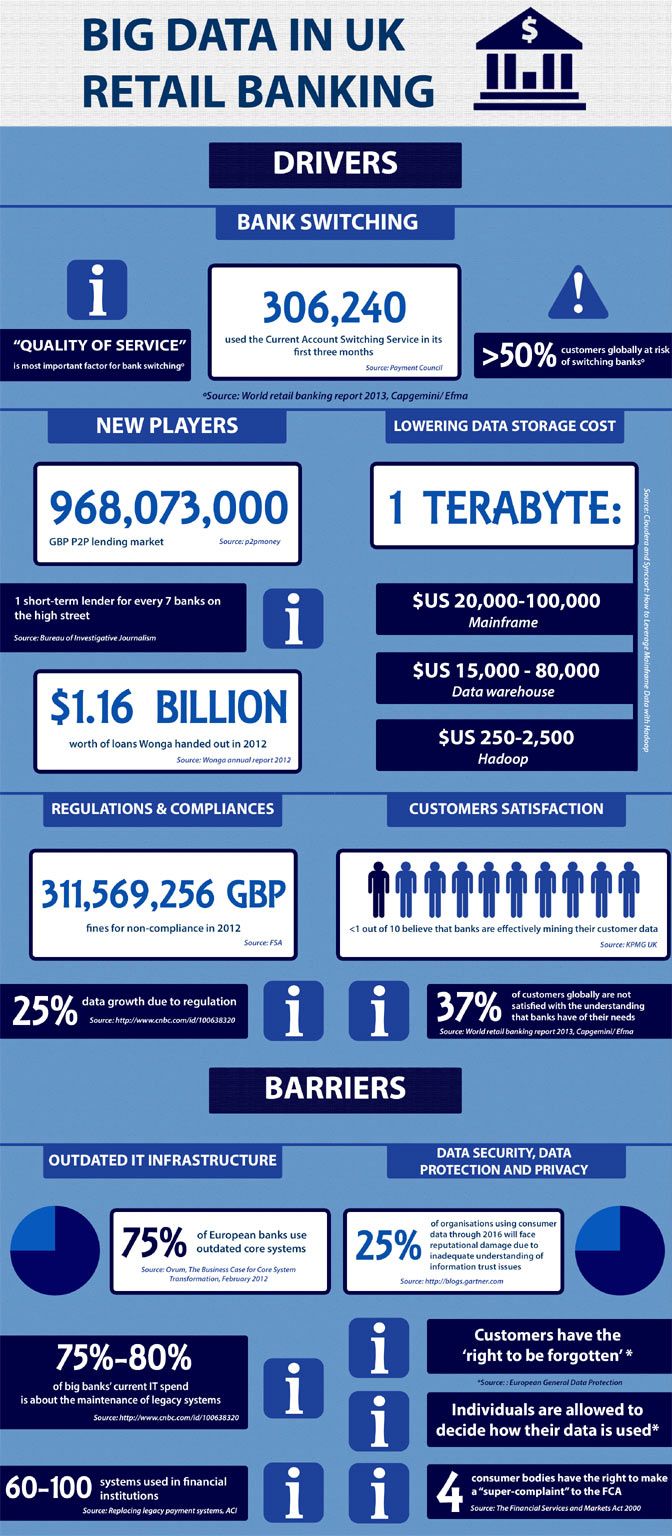

Retail banks are starting to view big data as a promising asset class that can provide new revenue streams. However as the government’s recent pause on the NHS Care.data scheme proves, even when organisations intend to use data to benefit society and it’s anonymised, consumers are still wary. Retail banks, which have been wracked by scandals relating to PPI fraud, LIBOR rigging, unpopular bonus schemes and IT failures, need to think beyond upselling and cross-selling and consider how big data analytics can repair trust and improve the whole customer experience.

Davy Nys, Vice President Of EMEA & APAC, Pentaho

Retail banks are indeed under more pressure than ever to use their valuable data to come up with more competitive customer offerings. With UK household disposable incomes at their lowest point since 1987 (ONS figures as of Q1 2013) more consumers are using resources like switching websites and tuning into programmes like Moneybox to take a more active role in managing their finances. Although consumers are still slow to change their current accounts, when it comes to other financial products and loans, this is changing thanks to initiatives like The Payment Council’s recently launched Current Account Switch Service. Some are evaluating new players like peer-to-peer lending services Zopa and RateSetter and using personal finance management software like Intuit’s Mint.

So with competition and awareness heating up, how can retail banks monetise their customer data to gain marketshare without jeopardising already fragile customer trust? The best way to start is to use data to give customers something they genuinely want! Fortunately there’s one glaring thing that falls into that category: integrating financial product and service portfolios into a ‘360 degree view’ so that they are easier for customers to manage. Every banking customer has a story about when they called their online bank manager to enquire about, say, their buildings and contents insurance, and was swiftly transferred to another department (or automated voicemail system). This, despite having been sold on the promise that they would get a seamless, integrated customer experience.

To varying degrees, banks have started to integrate their core retail products like current, savings and mortgage accounts into single views. However customers increasingly expect to be able to see, for example, insurance policy details and renewal dates so they have the visibility to compare products, negotiate fees and read the latest terms and conditions. Some banks already fearing for their reputations, have been afraid to carry out further integration for fear that data will leak out of legacy IT silos and threaten data privacy and security. Other banks feel threatened by greater transparency and the giving customers more information to help them ‘shop around’.

These are valid fears, however given all the high-profile security failures and breaches that have happened recently, these no longer support inaction. The reality is that many banks run on ancient IT infrastructures riddled with risks and costs, both of which get passed on to customers. Furthermore, as it dawns on customers that their financial products aren’t truly integrated but merely ‘white-labelled,’ they no longer see the point in paying any kind of premium to buy services from a single provider and are much more likely to shop around.

A bigger picture

I want to be very clear that monetising big data is not just about making it easier to upsell insurance to a mortgage customer. It’s about offering the kind of exceptional personal service and experience that ultimately leads to the ‘Valhalla’ of customer value pricing (CVP), or maximising the total value of a customer to a bank throughout all interactions and transactions.

CVP is a relatively simple idea and will be familiar to most readers: by working out what different customers need and integrating that knowledge throughout all its interactions, a bank should be able to improve customer service and loyalty as well as increase its own profitability by optimising pricing for customer value. Simple though it may sound, this has eluded retail banks for years because they have set pricing using assumptions that are too generic and crucially, focused more on growing revenue than adding customer value. Big data analytics offers an important technological solution to help resolve this dilemma.

How big data integration and analytics supports CVP

Unlike other industries that offer multiple services to customers such as broadband providers, retail banks uniquely possess very concrete data about exactly what their customers have purchased, when and how often. This means retail banks are have the best data available for building detailed customer profiles and tailoring product and service offerings accordingly. So how do modern big data integration and analytics tools support this? Here are just a few ways:

Supporting a two-way, 360-view

The most fundamental service that benefits the retail bank and its customers is the ability to offer that integrated 360-degree view of each customer’s entire portfolio I described earlier. This view also needs to run both ways! Yes, banks should have that holistic view of its customers, but similarly customers increasingly expect that same visibility of their products and services. This includes being able to use a single password to sign in and view everything through a clear and simple dashboard. Customers who prefer to deal in person or over the phone should get a similarly integrated experience and not have to be transferred to people in other departments using completely non-integrated IT systems. This 360-view is the prerequisite to being able to monetise data more profitably in the future.

As mentioned before, many banks still fear that data will leak out of their ‘secure’ silos if they attempt to integrate it into new applications that improve the experience for customers or their bank managers. However sophisticated new data integration tools make it possible for banks to blend data ‘at the source’ without having to first move it into a different ‘staging area’. These same tools also make it possible for banks to set up smart rules to ensure that data is handled according to local and European data governance rules, virtually eliminating the risk of compliance and security breaches.

Lower costs

Retail banks are harshly criticised for passing on high operating costs to customers by stealth, whether it be through hidden transaction fees or selling products customers don’t need. New players in the market can offer customers better value, in part because they use modern, cost-effective IT infrastructures. Data storage is one of the most expensive and escalating components of IT spend so consider this: according to a report (October 2013) by Cloudera and Syncsort, to store one Terabyte of data in a mainframe costs anywhere from $20,000-100,000. That same data costs roughly $15,000-80,000 to store in a data warehouse. However, it only costs $250-$2500 to store it in a Hadoop cluster. That’s anywhere from six to 400 times cheaper than the alternatives! Big data infrastructure and tools, which are based on open standards, generally cost much less than their legacy, proprietary alternatives.

Smarter offers

To demonstrate how far banks are from being able to make smart offers today, in a recent US Gallup poll of 9000 people, it transpired that customers were being so poorly targeted that 53 percent of those surveyed reported already owning the products that were being marketed to them! Clearly, with all the data banks have available, they can do much better. For instance if a bank can see from a credit card statement that one of its customers has just purchased an expensive bicycle or rare painting, that customer’s manager could recommend a more comprehensive buildings and insurance policy to make sure those items were covered. Similarly if a credit card statement indicated that a customer regularly goes snowboarding in the Alps, the customer’s manager could suggest a travel insurance policy that covers winter sports. Even if banks aren’t ready to switch to modern IT architectures today or prefer to migrate over time, new tools are available that enable safe, cost-effective and easy data blending, without needing to move data out their existing systems.

Customer-friendly fraud detection

For the past five years I have been travelling to Orlando in February for our company’s kick-off meeting and every year, without fail, my credit card provider flags my card as potentially being used for fraudulent transactions. Surely, it can see a pattern here by now! Getting smarter about using data for fraud detection is a simple way banks can improve the customer experience by giving the impression that they care just as much about the customer experience as they do its own risk.

Measuring customer sentiment

According to a recent survey by Bain and Company, the rewards of securing greater customer loyalty can be substantial, around $10,000 more in net present value over the lifetime of an affluent ‘promoter’ customer versus one that is a ‘detractor’ (note: US data). But most banks go about measuring customer satisfaction in a haphazard, outdated way. Retail banks are crazy for surveys, with some banks’ customers being invited to complete a survey after every transaction. I personally find these annoying and either ignore them or complete them so quickly that they are probably not very useful. A much more revealing and less intrusive way to establish customer sentiment is to combine less frequent, more detailed surveys with social and online content that customers voluntarily publish. Big data analytics tools can help mash up these different data sources to help banks continually design better services.

Beyond Valhalla

Retail banks have considerable work to do to build the infrastructures and transform their cultures so that they can deliver the integrated, 360 customer views that will serve as the foundation for the ‘Valhalla’ that is CVP. I firmly believe it’s worth the effort because beyond that the rewards are even greater. For example, when customers trust their banks enough to allow them to share data with their favourite retailers, data could have a very high monetary value indeed. Furthermore as the trend in omni-channel banking grows to include things like ‘smart ATMs,’ touch screen walls, mobile applications and kiosks the opportunity to create sophisticated service experiences driven by high quality, integrated data are practically limitless.

But remember, majestic structures like Valhalla can only be built upon strong foundations. Retail banks need to figure out how to monetise their own data, before they can even think about commercialising it externally. Fortunately the right tools are available in the market today to embark on this journey.

big data in retail banking

Explore more articles in the Top Stories category