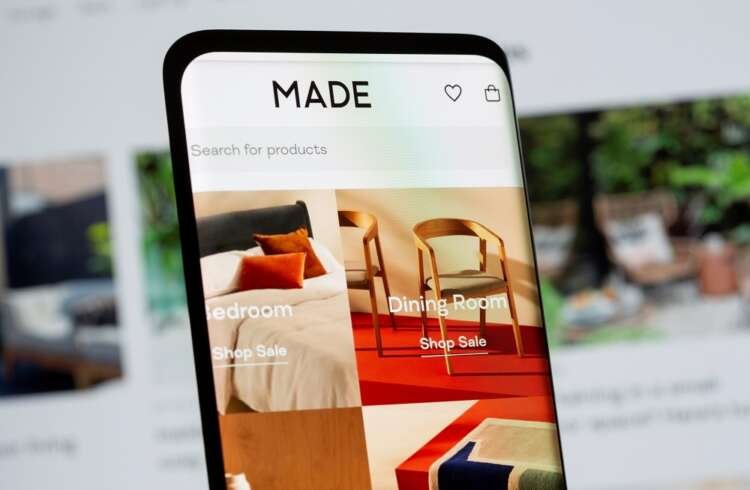

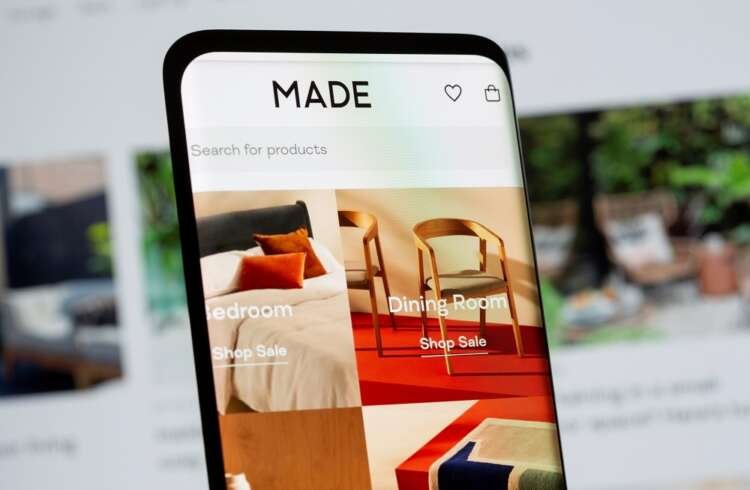

Made.com becomes casualty of Britain’s consumer squeeze

Published by Jessica Weisman-Pitts

Posted on November 1, 2022

2 min readLast updated: February 3, 2026

Published by Jessica Weisman-Pitts

Posted on November 1, 2022

2 min readLast updated: February 3, 2026

By Sarah Young and Pushkala Aripaka

LONDON (Reuters) -Online furniture retailer Made.com is to appoint administrators after running out of cash, becoming one of the most high profile British retailers to fail this year partly as a result of a squeeze on household budgets.

Made.com, which floated in June 2021 with a valuation of 775 million pounds ($894 million), has struggled with supply chain problems and consumers cutting back on discretionary spending in the face of rising mortgage rates and higher food and energy bills.

Its board said on Tuesday it would appoint administrators from PricewaterhouseCoopers and they would handle any sale of its brand or assets. Last week, the group stopped taking customer orders and said an attempt to find a buyer had failed.

Made.com grew rapidly during the pandemic when shoppers, stuck at home in lockdowns, spent freely on sofas, coffee tables and lamps.

But Britain’s economy has slowed this year, and retailers across the board are now bracing for a difficult period.

Even e-commerce group Amazon.com warned of a slowdown in sales growth in Europe this Christmas, highlighting the challenge for smaller operators. Half of Britons plan to spend less on Christmas this year, market researcher Kantar has said.

Other online retailers, which benefited from higher spending during pandemic lockdowns, have also been hit, such as fashion-focused ASOS.

Made.com had highlighted earlier this year the impact of supply chain problems, higher costs, reducing demand and high stock levels. Its shares have lost 99.6% of their value since January.

“They (Made.com) were looking to quickly scale and expand into a homewares platform, but ultimately did not have the reserves or margin to withstand any kind of consumer downturn or drop off in demand,” said Peel Hunt analyst John Stevenson, adding that the brand would be attractive to a number of listed and unlisted trade buyers.

($1 = 0.8666 pounds)

(Reporting by Sarah Young in London and Pushkala Aripaka in Bengaluru; Editing by Rashmi Aich and Jane Merriman)

Discretionary spending refers to non-essential expenses that consumers can choose to spend or not spend, such as dining out, entertainment, and luxury items.

A financial crisis is a situation in which the value of financial institutions or assets drops rapidly, leading to widespread economic instability and loss of confidence in the financial system.

Consumer perception is how customers view and interpret a brand or product based on their experiences, beliefs, and feelings, which can significantly influence their purchasing decisions.

Supply chain problems occur when there are disruptions in the production and distribution processes, leading to delays, increased costs, and shortages of goods.

A mortgage rate is the interest rate charged on a mortgage loan, which can affect the monthly payments and overall cost of borrowing for homebuyers.

Explore more articles in the Business category