Lehman Brothers 10 years on – Investment opportunities that have weathered the storm

Published by Gbaf News

Posted on September 22, 2018

6 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 22, 2018

6 min readLast updated: January 21, 2026

The biggest crashes, from the tech bubble burst in 2000 to the credit crunch in 2008, linger in the collective memory as historic economic catastrophes

But to focus solely on the negative is to overlook the investment opportunities contained within every stock market fall. Investec Click & Invest has selected and analysed those investments that have weathered the storm post crash to look ahead and identify investment opportunities, which could deliver returns in the future.

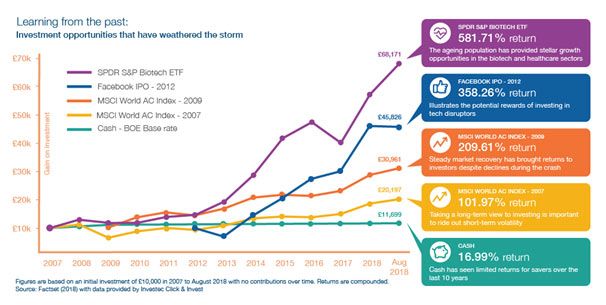

The returns achieved from the MSCI AC World Index in the last decade as well as other significant investment opportunities over this period show that stock market investments have fared well against cash savings, even in the toughest of environments.

Figures come from Factset and calculations of returns were based on an original £10,000 investment with no withdrawals made during that time on a rolling basis. It is also worth remembering your capital is at risk with investing and past performance is not an indicator of future performance

In the year following the Lehman Brother’s collapse, those who invested £10,000 in the MSCI AC World Index at the beginning of 2009 would now be sitting on a portfolio of £30,961. In 2012, those early adopters who invested in Facebook ahead of its IPO have achieved high returns of 258.26% in comparison to just 16.99% for those playing it safe with cash.

Alex Neilson, Investment Manager at Investec Click & Invest, gives ten tips to make the most of today’s opportunities to achieve positive returns on your investments:

If someone had invested £10,000 in the MSCI World Index at the start of 2007 before the crash they would now have over £20,000. Had they kept the same amount of money in a bank account as cash paying the Bank of England base rate, this would be worth just under £11,700. If planning on saving for the long term it doesn’t matter when you start, as the last ten years have shown opportunities can exist in all market conditions[i].

Don’t get caught short on buy-to-let mortgage payments. Investors in property often do not consider that they are taking on debt to pay for it, both the stock market and property market look like they may be nearing a top, therefore limiting potential returns. A portfolio of stocks and bonds is not only more liquid than property but, if managed well during market falls, should leave investors with some downside protection.

With Brexit around the corner it is worth looking at where UK equity exposure is invested. With 75% of FTSE 100 company profits coming from overseas earnings, they provide insulation to some extent, should the pound fall. On the other hand, FTSE All Share companies are much more UK focussed and will be negatively impacted to a greater extent by a no deal.

In the event of a hard Brexit we are anticipating a 10-15% fall in the pound; however, due to currency translation in the FTSE 100 we anticipate the index may be flat or marginally positive as Brexit nears. Therefore, the currency you invest in can make as much impact on returns as the companies.

ETFs have had a great run over the last decade with rising markets, but with the return of volatility such as in February this year, it’s a stark reminder that active management is the best bet should markets look wobbly. Investors should keep a close eye on their holdings. Given the current market highs, it may be time to start partially transitioning to a cautious actively managed fund. Costs will likely increase, but active management has shown time and again that high volatility creates opportunities.

Value funds are looking increasingly cheap as interest rates stay lower for longer. Now may be the right stage of the economic cycle to switch exposure away from growth and into value as US rates start to rise. Historically, these have been and continue to be very cheap, but be cautious and make sure to avoid ‘value traps’.

Tech disruptors are not only investment opportunities but also a warning to stay away from companies that are not innovating. Disruptors can provide goods and services at a lower cost and more conveniently for consumers, which is hurting established businesses. Netflix Vs traditional cable companies like Time Warner and Sky are the perfect example, traditional cable and satellite is a high technology cost overhead business – while Netflix can focus budgets on content creation for their subscribers.

Many baby boomers are now approaching retirement and transitioning from full time workers to affluent individuals with more free time. To take advantage of this, it might be time to start looking at leisure and travel companies as investment opportunities. Cruise companies such as Carnival should be well placed to attract new retirees – they have made solid investments in new cruise liners and own well-known brands such as P&O Cruises.

The government is making it increasingly hard for people to ignore retirement saving. Therefore, in the coming years people should expect growing incentives for saving for their own retirement and a shake-up of the lifetime ISA. If interest rates don’t get back to previous levels, we might not see annuities come back to a level where individuals get a decent income. Therefore, investors may want to look at other options to access income such as buy-to-let or SIPPs.

DIY investors may not be aware that regulation in relation to management fees has changed significantly over the last 5 years in fund management. One upside is that there may now be much cheaper (in management fee terms) share classes available for funds they have already invested in. These investors may want to dig out their statements and make sure they are getting the lowest management fee available.

[i]Source: Factset (2018), data provided by Investec Click & Invest

Explore more articles in the Investing category