Integreon Survey Report Shows Corporates are Still Grappling with Regulatory Change

Banks and financial institutions in the US and UK can never rest when it comes to regulatory compliance. Regulatory changes are still debuting and morphing at a steady clip with more coming. The onslaught is relentless and the complexity is increasing. The just-released 2021 Integreon Regulatory Readiness Report shows that financial organisations and their law firms are still facing a deluge of regulatory change with varying degrees of success. According to this second annual survey (the inaugural report was released in 2020), organisations are continually striving, and sometimes struggling, to comply with the regulatory influx.

Featuring research conducted by Pensar Media from April-June 2021, the Integreon Report surveyed 200 compliance and legal professionals in the US and the UK. More than half of the respondents were in banking, financial services and asset management. The survey benchmarked corporates’ level of compliance with existing and upcoming regulations. Also, organisations responded about the impact regulatory change has had on their business.

Most Corporates Lack Adequate Resources

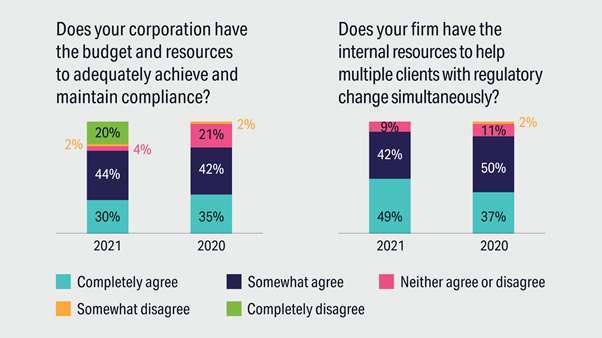

Only 30% of corporate respondents completely agreed that they had the resources and budget to adequately achieve and maintain regulatory compliance, five percentage points down from 35% in 2020. Flipping this statistic, a substantial 70% of corporate organisations do not currently have the resources and budget to adequately achieve and maintain regulatory compliance. Considering how much risk non-compliance holds for these companies, it’s striking that so many of them are lacking tools to meet this burden.

Only 30% of corporates completely agreed they had the budget and resources for compliance needs. Less than half (49%) of law firms said they completely agreed they had the internal resources to help multiple clients with regulatory change at the same time.

Regulatory change undoubtedly has negative impact on many businesses, and the 2021 Integreon survey results underscored that. Some 29% of corporates completely agreed that responding to regulatory change creates operational pressure for their business. Another 21% of corporate respondents completely agreed that regulatory change increased their business’s risk profile, and 22% completely agreed that increased regulation was having a negative impact on their company’s profitability and growth.

Why are regulatory changes potentially damaging to businesses? First, companies must invest considerable time and money for resources, processes and systems required to comply with regulations. These initiatives can include hiring new talent and/or retaining external help, repapering obsolete contract language, devising and enacting policies, reengineering workflow and deploying technology automation solutions. Personnel bandwidth is a trouble spot – 26% of corporations said their biggest challenge when responding to regulatory change was not having enough internal staff to help support, followed by not having enough internal expertise (18%) and disruption to business as usual activities (15%).

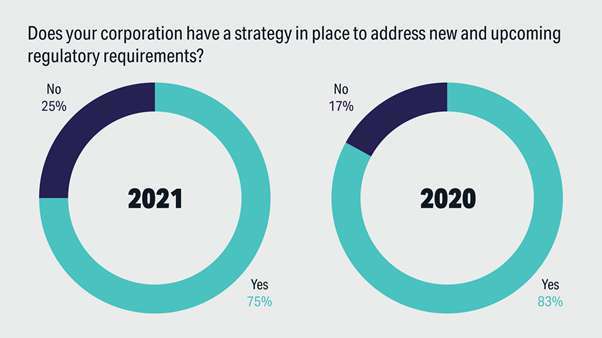

Fewer corporates (75%) said they had a regulatory strategy in place in 2021 as opposed to 83% in the 2020 Integreon Survey.

Law Firms and ALSPs Provide Assistance

When corporates lack internal resources for addressing regulatory change, many turn to external resources for help. A flourishing set of outside counsel law firms and alternative legal services providers (ALSPs) like Integreon have leapt into the breach to help corporates with regulatory compliance.

The 2021 survey found that 49% of law firm professionals completely agreed that their firms had the internal resources to help multiple clients with regulatory change simultaneously, up from 37% in 2020. However, 62% of law firms reported they were under client cost pressures when delivering legal solutions in support of regulatory change, so the workload comes with strings attached. Seeking optimal efficiency to remain profitable, 42% of surveyed law firms responded to client cost pressures by either using ALSPs or relying on their own lower cost captive operations.

GDPR is Still #1 Concern in UK and US

The 2021 Report showed that persistent regulatory compliance issues such as GDPR (General Data Protection Regulation), LIBOR (London Interbank Offered Rate), Initial Margin Phase 5 (IM5) and Brexit are still demanding substantial resources from corporations.

GDPR still reigns as #1 for both UK and US companies because, even though the law has been in place since 2018, GDPR non-compliance has sharp teeth and can result in stiff financial penalties. Almost €300 million ($350+ million US Dollars) of fines have befallen corporates since GDPR rules went live, according to Privacy Affairs’ GDPR Fines Tracker. Neither UK nor US firms want to become cautionary tales.

Looking at the UK and US combined, the 2021 survey showed that compliance and legal professionals ranked GDPR as the most important regulatory event they currently had to focus on, followed by the LIBOR transition second and then Brexit third. In 2020, respondents had listed GDPR, Brexit and IM5 as the top 3 most important regulatory events. IM5 fell off the top 3 list in 2021 and LIBOR ascended, underscoring the greater focus on LIBOR now given its looming deadline at the end of 2021.

Parsing the UK and US corporate responses to the 2021 survey, it’s clear that geography plays a role in how compliance regulations are prioritised and addressed. The California Consumer Privacy Act (CCPA) made the top 3 list of priorities for US-based corporates, which is obviously more relevant for American companies than British ones due to its California-specific scope. The number of US corporations that said they are fully compliant with GDPR and CCPA in 2021 rose to 69% and 60% respectively, up from 62% and 55% in 2020. US-based respondents ranked GDPR first, LIBOR second and CCPA third. Corporates in the UK also rated GDPR #1, but ranked Brexit second and LIBOR third with no mention of CCPA.

LIBOR Deadline is Upon Us

LIBOR is now taking center-stage since its upcoming exit at the end of 2021 warrants attention – it’s now or never. The number of corporations that said they are well prepared for the LIBOR transition in 2021 edged up to 58% from 53% in 2020. Law firms also expressed increased confidence about how well prepared their corporate clients are for LIBOR’s end—just 38% said their clients were well prepared in 2020 compared to 52% this year. Lawyers responding to the survey noted that, while most of their clients’ LIBOR-related work is on track, a stubborn set of “tough legacy” contracts have yet to be amended with valid language.

Brexit Nail-biting Escalates

Brexit remains a real concern for corporates. Only 51% of corporate respondents to the 2021 survey said they feel well-prepared for the UK’s exit from the EU (an event that has already happened). This response is five percentage points down from 56% in 2020. Brexit promises to persist as a vexing issue and 20% of survey respondents expect it to remain one of the biggest issues in 2022—higher than any other response for that question.

While the UK has now officially left the EU, the future relationship between the two regarding financial services remains unclear. The EU is still refusing to grant equivalence and the UK has yet to finalise its own rules. This limbo scenario is understandably nerve-wracking for financial organisations and the law firms which represent them. Hopefully Brexit directives will become clearer so organisations can finalise their compliance plans.

More to Come, So Make a Plan

Looking forward, corporates and their law firms will still have to contend with current regulatory changes while also addressing new entrants. As Brexit comes into clearer focus, so will its respective compliance requirements for companies doing business in the UK and EU. The LIBOR deadline will end on December 31, 2021 but questions regarding tough legacy contracts will remain open. Other American states are now beginning to pass their own CCPA equivalent data privacy laws, and each of those new laws will present a new workload, on a state-by-state basis. Corporate respondents also expressed concerns about changing tax laws in the US and potential Covid-19 regulations.

Companies like Integreon, an ALSP and managed services provider, are actively assisting corporates and law firms in tackling these regulatory compliance issues. With a solid transition plan, readiness strategy, skilled people and carefully chosen technology automation solutions, financial organisations and their outside counsel firms can successfully achieve regulatory compliance and be ready for what the future brings.

The 2021 Integreon Regulatory Readiness Report can be downloaded here: https://www.integreon.com/regulatory-readiness-report-2021/.

For more information on how Integreon can assist your organisation with regulatory change, contracts and compliance, visit https://www.integreon.com/what-we-do/risk-regulatory-services/regulatory-events-support/ or email info@integreon.com.

The 2021 Integreon Regulatory Readiness Report captured the Top 5 Biggest Challenges that US and UK corporates faced. #1 was “not enough internal support”.

This is a Sponsored Feature.

Explore more articles in the Business category