How to get a bank statement

Published by Gbaf News

Posted on October 16, 2019

3 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on October 16, 2019

3 min readLast updated: January 21, 2026

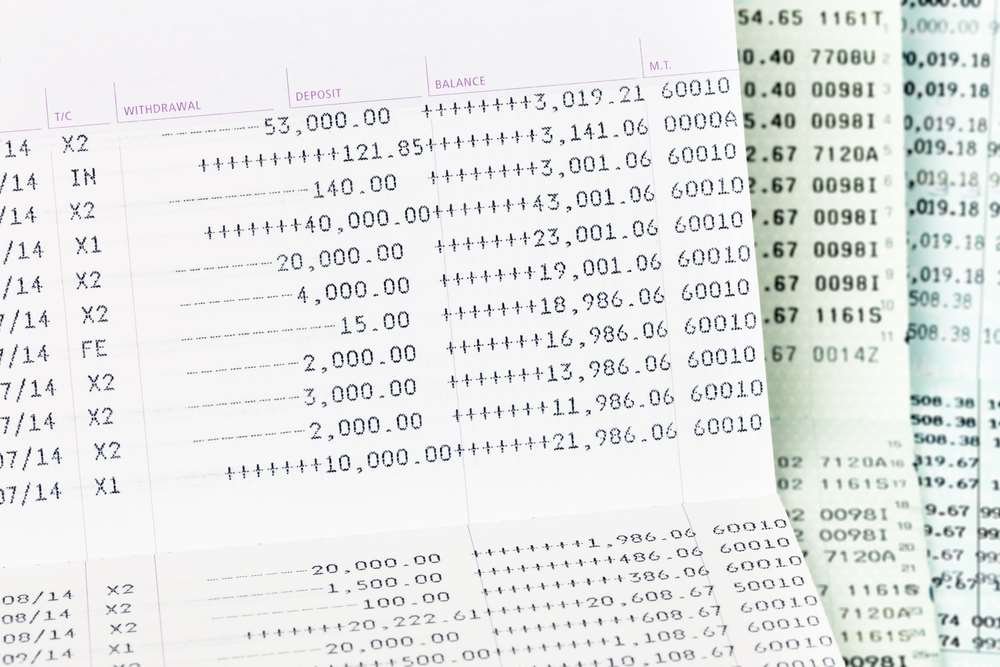

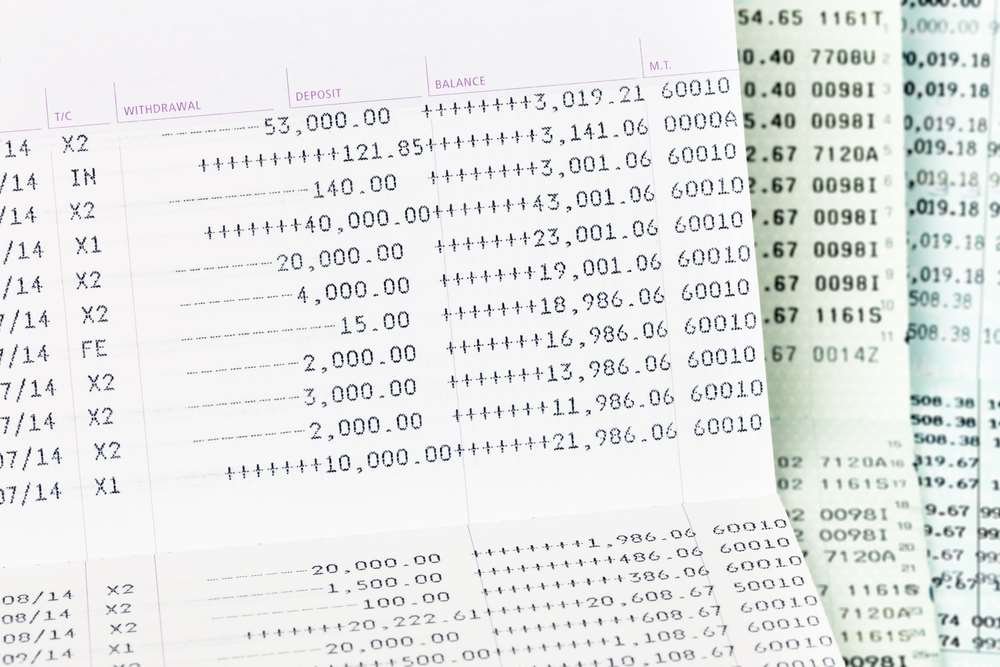

On a monthly basis, all banks prepare a document that accurately charts all the transactions on a customer’s account for them, which is called a bank statement. This then provides users with the opportunity to check the accuracy of all of these transactions and query any that they do not recognise or remember making – which could potentially mean there has been fraudulent activity on an account.

There are a number of ways in which a bank statement can be accessed, in order to provide customers with the all-important convenience they have come to associate with all the services they use in modern times.

Getting a bank statement online

This is one of the most common methods for viewing a statement, because the online portal also allows instant transfers to be made between a users’ accounts and also when there is the need to transfer to someone else’s. There are a number of methods employed by banks for accessing online statements, but one of the most common is to issue a card reader device to each user, which they then use to access a secure code for logging on each time they want to see their statement. Although the period shown is usually the preceding month of transactions, users should always have the option to view and download previous months on PDF copies.

Getting a bank statement through the post

Most bank accounts have users sent their bank statements through the post by default, unless customers specify otherwise. They are sent out on a four-weekly basis, based on the day an account was opened, so do not necessarily run from the 1st or the beginning of the month. The option will always exist to view statements online, in case a paper copy is lost, but this does not mean that customers are automatically registered for online banking. Users may, therefore, need to speak to their bank’s customer service team in order to set up online access to their statements.

How long can you access your bank statement for?

Typically, banks will limit the amount of time statements can be viewed for, and this is usually a period of 7 years. This makes it crucial to keep past copies of bank statements in case users ever need to look back beyond the time which banks keep these documents for, especially where there is a possibility of making a claim against a bank or financial institution, where unfair charges are concerned. This is especially true in light of strict data protection rules – called GDPR – that have recently come into force, which put greater pressure on businesses to keep customer data as secure as possible. This means that it I even more important to keep personal copies of statements that might be needed as there is less of a chance that the bank will have copies if they are having to meet the demands of stricter regulation where the treatment of customer data is concerned.

One of the most popular challenges to banks in recent years has been unwanted PPI charges, which has collectively cost banks billions in pay-outs. Although the deadline for PPI claims has now passed, there are a wealth of other charges that banks levy, that could still be validly claimed as unfair, and subsequently challenged.

When users no longer need their bank statements, it’s advisable to shred them, as they would any document containing private financial information.

Explore more articles in the How To category