‘Get-Paid-As-You-Go’ Wagestream service raises £4.5m to end ‘payday poverty’ cycle

Published by Gbaf News

Posted on October 1, 2018

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on October 1, 2018

4 min readLast updated: January 21, 2026

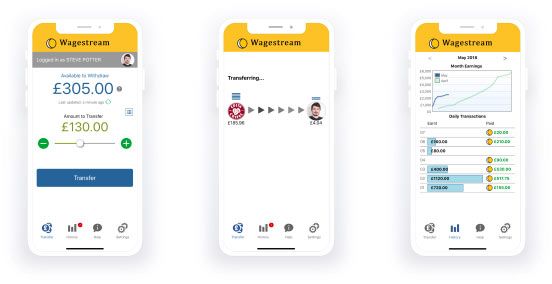

Fintech startup Wagestream, whose ‘Get-Paid-As-You-Go’ service allows workers to access their monthly wages in real-time, has raised £4.5m in funding from a group of the world’s leading technology and social impact investors.

Backers include QED Investors, Village Global (a global VC backed by leading entrepreneurs, including Bill Gates and Jeff Bezos), as well as the London Mayor’s Co-Investment Fund and the Fair by Design fund, whose social impact charities include Big Society Capital, Nominet Trust and the Joseph Rowntree Foundation.

Co-Founded by Portman Wills and Peter Briffett, former COO of YPlan and CEO of LivingSocial UK, Wagestream aims to end the ‘payday poverty cycle’, and last-resort measures like payday loans along with it.

Research shows that over half of families cannot afford a £250 unplanned expense – around the same amount as the average payday loan in the UK. Most UK employees are paid monthly (around 85%), meaning that employee financial stress is uniquely higher in Europe because of the monthly pay cycle. Wagestream removes the problem, allowing workers to access their ‘earned income’ at any time during the monthly pay cycle. The service can be implemented by companies without impacting cash-flow, payroll or timekeeping processes, and provides instant financial security to UK workers.

As the first Get-Paid-As-You-Go provider to be accredited by the FCA, the company expects its approach will become the ‘new normal’ and displace the current payday cycle – particularly for employers which operate large numbers of shift and temporary workers, in sectors such as hospitality, security, retail and manufacturing.

Over 20 employers and partners are now piloting the Wagestream platform including Key Security, and Fourth, who provide cloud-based hospitality solutions for a large proportion of the hospitality industry. The early results are so promising Wagestream now guarantees a 10% increase in staff retention, 20% improvement in workforce productivity and a 100% increase in job applicants when a company is Wagestream accredited.

David Reed, Ops Director, Key Security, said:

“Partnering with Wagestream has not only provided our staff with better flexible and financial security, but has also had a positive impact on our service delivery with staff volunteering for extra shifts.”

wagestream

The launch follows news earlier this month that leading payday lender Wonga went into administration on Thursday, 30th August. In an effort to support workers affected by payday loans – a negative impact of the payday poverty cycle – Wagestream will be donating all of it’s August revenue to Step Change Debt Charity, which helps people with debt problems take back control of their financial lives.

Peter Briffett, CEO and Co-Founder of Wagestream, explained:

“As we mark the death of one of the payday loan giants, we’re pleased to finally present a viable solution to help give the UK’s workforce the financial freedom they deserve.

While the wider and long outdated issue of monthly pay cycles is in desperate need of modernisation, for far too long legal loan sharks have been exploiting the most disadvantaged consumers with crippling high-cost loans. By giving workers access to their earnings, they can prevent themselves from going into overdraft, credit card debt or the worst case, applying for a payday loan.

The poverty premium is real. Lower income workers can often pay more than everyone else, despite struggling to make ends meet. At Wagestream we give people access to their earned income when they need it, without the need for employers to alter their usual payroll frequency.

Ben Hood, CEO at Fourth, added:

“For too long payday loan companies have preyed on people when they are most in need, in doing so generating significant stress, financial and mental health issues – this simply has to stop. Wagestream’s platform brings much needed evolution, providing workers with autonomy to access their hard-earned cash when they need it, without having to pay through the teeth.”

At our very core we are champions of the hospitality industry who thrive on pushing the boundaries of innovation. Our partnership with Wagestream will not only revolutionise the way people are paid in the hospitality industry, but trail blaze a path for the payment of the future.”

Wagestreamlead a ‘funeral procession’ in London on 2nd September in remembrance of the Payday Loan.

Explore more articles in the Top Stories category