Factbox: How silver is traded, from stocks and shares to coins and bars

Published by linker 5

Posted on February 3, 2021

3 min readLast updated: January 21, 2026

Published by linker 5

Posted on February 3, 2021

3 min readLast updated: January 21, 2026

LONDON (Reuters) – Silver prices rocketed to their highest since 2013 on Monday after small investors responded to calls on Reddit and other social media to pile into the market and push prices up.

The move into silver came after the Reddit message board r/WallStreetBets marshalled a surge of buying of companies including GameStop, forcing their shares up by hundreds of percent.

Silver has moved less dramatically – rising around 20% before falling back – in part because it is a larger and more complex market.

So how does silver trade?

OVER THE COUNTER

The biggest marketplace for physical silver (and gold) is London, where banks and brokers handle buy and sell orders from clients across the world.

Trading is done bilaterally over the counter (OTC) between financial institutions, and an investor must have a relationship with one of these to access the market.

The market is underpinned by bars of bullion which sit in the vaults of large banks such as JPMorgan and HSBC.

Around 660 million ounces of silver worth some $18 billion traded on average each day in the London market last week, according to the London Bullion Market Association.

FUTURES

Silver also trades on futures exchanges. The largest are the Shanghai Futures Exchange in China and CME Group’s. Comex in New York, each of which host trading of around half a billion ounces of silver a day.

Futures are contracts in which the seller pledges to deliver silver to the buyer on a later date. They are typically traded through a broker.

Most futures are not held until delivery but swapped for later-dated ones. This allows both buyer and seller to speculate on the silver price without the trouble of moving and storing metal.

Another advantage of futures is that the holder need not pay the full amount for silver, but instead pays a fraction of its value, known as a margin.

EXCHANGE TRADED FUNDS (ETFs)

ETFs trade on stock exchanges such as the NYSE and LSE alongside shares in publicly traded companies.

They store silver for their investors, with each share in the fund representing an amount of silver stored in a vault.

Small investors can trade shares in ETFs easily via apps such as Robinhood.

If demand for the ETF is strong enough to push the price above that of the underlying metal, more silver is moved into the vault to allow new shares to be created, moving the prices back into line.

The largest is the iShares Silver Trust, run by investment manager Blackrock, which contains around 620 million ounces of silver worth some $17 billion at current prices.

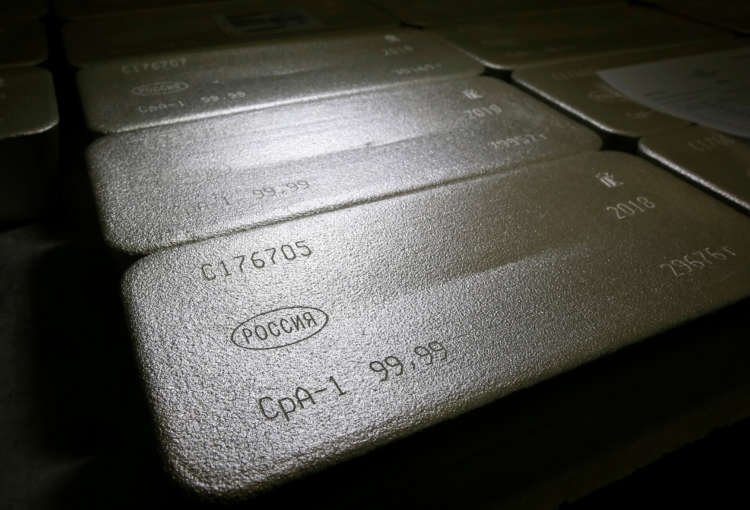

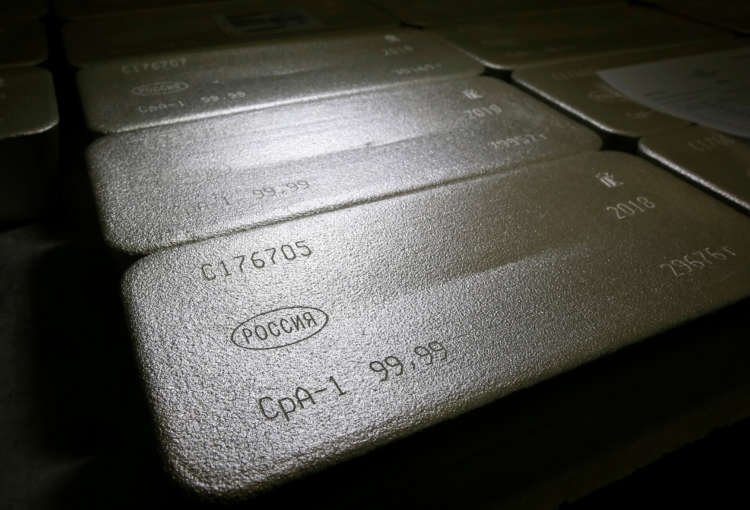

BARS AND COINS

Smaller investors can also buy silver bars and coins from retailers around the world.

Investors buy roughly 200 million ounces of silver bars and coins each year, accounting for about one fifth of total annual supply of silver, according to analysts Refinitiv Metals.

SILVER MINERS

Investors can also buy shares in companies that mine silver. Like ETFs, these are easy to trade on platforms like Robinhood.

Shares in these companies tend to rise and fall with silver prices, but many other factors such as the company’s management, debt or performance also affect their value.

(Reporting by Peter Hobson; Editing by Jan Harvey)

Explore more articles in the Trading category