Ant International Announces Sustainability Framework, Serving 100 mn Merchants to Advance Inclusive Growth in Re-globalisation

The now-independent company combines techfin and sustainability work in 6T areas: travel, trade, thrive, technology, talent and trust

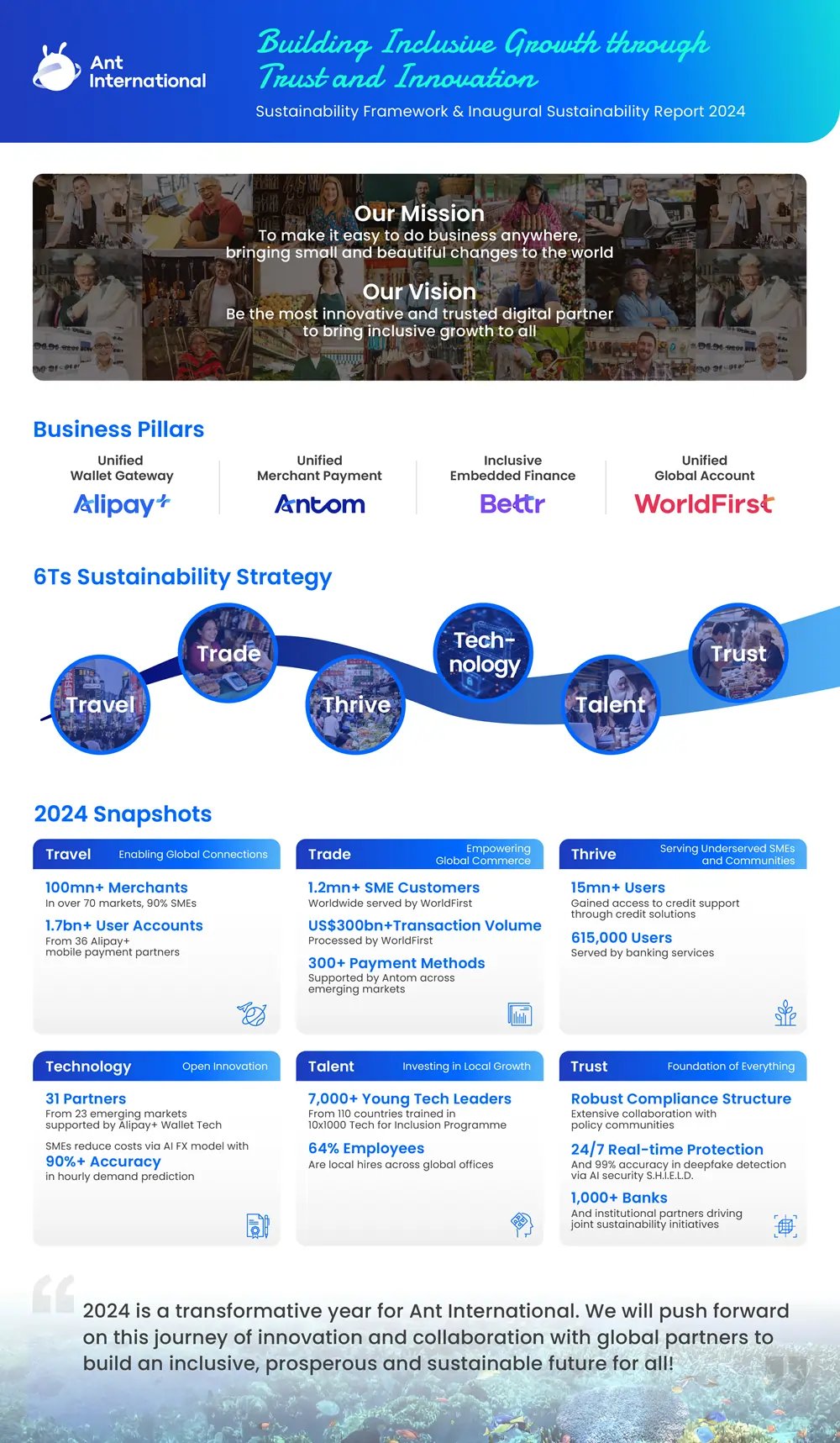

Singapore, 16 June – Ant International, a leading global digital payment, digitisation and financial technology provider, today announced its Sustainability Framework in its first independent Sustainability Report.

A New Chapter of Growth with New Mission and Vision at a Critical Moment

2024 is a transformative year for Ant International, which became independent after a reorganisation of Ant Group. With headquarters in Singapore and over 30 offices around the world, Ant International provides cross-border digital payment, commerce and finance solutions to merchants and financial institutions, connecting 100 million+ merchants to global consumers across its 4 business units:

In its new corporate identity, Ant International's mission is to make it easy to do business anywhere, bringing small and beautiful changes to the world. Its vision is be the most innovative and trusted digital partner to bring inclusive growth to all.

The management reiterated that in the face of global economic turbulence, de-globalisation threats, and new risks of digital divide, tech companies need to enhance, not weaken their social commitments with concrete action. “The call for action on the digital tech community has never been so urgent: we need to take action to ensure innovation works for the many, not the few, so we can build a truly inclusive and sustainable global economy for the next generation,” said Eric Jing, Chairman of Ant International, in his opening message.

Yang Peng, Chief Executive Officer, and Douglas Feagin, President of Ant International, said, “We firmly believe that through our sustainability and business efforts, coupled with practical technological innovation, we can actively practice and promote a new, more inclusive, and broader ‘re-globalisation’.”

6T Principle Focuses on SMEs for Inclusive Growth and Re-globalising Commerce

The Sustainability Framework is anchored on an integration of social value and business value creation across its 6T Sustainability Areas. The Report shared highlights as of 2024 in these areas:

Payment: Promoting Global Connectivity with Travel and Trade

Beyond Payment: Democratising Technology for SMEs to Thrive

In the fast-growing Embedded Finance unit,

Collaboration on Trust and Talent to Drive Sustainable Growth

Ant International works to build a trust-based and future-ready digital ecosystem in collaboration with regulators, international organisations and over 1,000 financial institutions. The company invests in 2 pillars of Trust: a comprehensive, robust compliance structure, and AI-security capabilities and solutions. The company has started to share its trusted AI capabilities, such as anti-deepfake expertise, with the broader community.

Such collaboration expands to other community and global initiatives, ranging from MSME sustainability credentials and financing innovations, to joint research efforts on advancing privacy-enhancing technology to strengthen digital trust. The 10x1000 Tech for Inclusion Programme, now in its 7th year, has provided training on fintech and digital innovation to 7,157 talents across 110 countries and regions.

Earlier at the Point Zero Forum in Zurich in May 2025, global leaders and policymakers joined the soft launch event of Ant International’s inaugural Sustainability Report. Mr. Sing Chiong Leong, Deputy Managing Director of the Monetary Authority of Singapore (MAS), was the guest of honour and delivered opening remarks at the event.

Ms. Nan Li Collins, Chair of the United Nations Sustainable Stock Exchange Initiative, who joined the event as a keynote speaker, resonated with Ant International’s commitment to bring equal access and growth opportunities for SMEs through trade. “While the digital economy is booming, developing countries still face a critical gap in essential infrastructure investment - a challenge we must address to ensure no one is left behind in the global transition to sustainable growth.”

Chen Leiming, Chief Sustainability Officer of Ant International, also commented, “Sustainability must be inclusive to be effective. At Ant International, by integrating sustainability into how we innovate, operate and grow, we ensure that every business outcome is also a step towards long-term societal progress.”

About Ant International

With headquarters in Singapore and main operations across Asia, Europe, the Middle East and Latin America, Ant International is a leading global digital payment, digitisation and financial technology provider. Through collaboration across the private and public sectors, our unified techfin platform supports financial institutions and merchants of all sizes to achieve inclusive growth through a comprehensive range of cutting-edge digital payment and financial services solutions. To learn more, please visit https://www.ant-intl.com/

Embedded finance refers to the integration of financial services into non-financial platforms, allowing businesses to offer financial products directly within their services.

Sustainability in business involves operating in a manner that meets current needs without compromising the ability of future generations to meet their own needs, often focusing on environmental and social responsibility.

SMEs, or small and medium-sized enterprises, are businesses whose personnel numbers fall below certain limits, often playing a crucial role in economic growth and job creation.

A cross-border payment is a transaction where the payer and the recipient are located in different countries, often involving currency conversion and international banking regulations.

Explore more articles in the Business category