What Is The One Secret That Has Allowed FTM to Win The Coveted Global Banking & Finance Review Award for Best Fixed Income Fund Offshore 2012?

Published by Gbaf News

Posted on June 27, 2012

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 27, 2012

5 min readLast updated: January 22, 2026

A fund that in times of extreme economic uncertainty has provided a safe harbor for investors AND great returns…a fund with the most stringent controls designed to provide you with ironclad security.

My name is Endre Dobozy and I am managing director of FTM Ltd, a company dedicated to growing your net worth no matter what the market throws at you. A bold claim, I know, but all backed up by facts and more importantly for you REAL RESULTS!

Most major market indices have, at best, gone sideways for the past decade. In fact since 1998 investors really haven’t stood a chance. There was the Russian bond default in 1998, tech wreck in 1999, at least 2 recessions, subprime mortgage mess in the US and, of course, the Global Financial Crisis, which clearly illustrated that asset classes were far more correlated than most investors had otherwise suspected. In reality, the more uncertain things became the more correlated asset classes became.

After the dramatic falls in global markets, it was clear that traditional asset classes such as equities could not be counted on for diversification simply by means of geographical location. Both developed and emerging markets alike experienced large declines as did commodities and non-treasury bonds.

Strangely, this period also coincided with highs in many markets so, by rights, investors should have made money. Unfortunately, the reality is that burying your money in the back yard, or holding cash in the bank would have out performed most markets and investment strategies.

Even now, 4 years on from the GFC, we have continuing sovereign debt issues in Europe, where they believe that throwing money at a problem, while imposing draconian austerity measures, is somehow going to end well.

The truth is, there has never been a more dangerous time to be an investor and if you rely on a rising market for your financial future then you are in serious trouble.

So what we did was create something that has provided safety AND a remarkable return.

At FTM, we looked at all these uncertain market conditions and created an investment that would have been able to profit in all of these situations and, in fact going back as far as 1997, the investments that underpin FTM never ever had a negative year. Actually, this strategy would have resulted in a gain of over 480% during some of the most uncertain economic times in living memory.

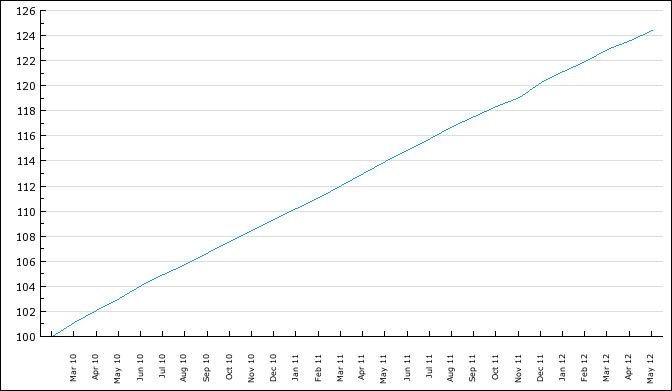

Launched in March 2010 and based on a measurable investment strategy going back to 1997 FTM enables investors to target a return of 12% a year, while keeping 95% of the portfolio secured and keeping risk to a maximum of 1.75% of the overall portfolio.

In fact the graph below is the actual performance of FTM net of fees since opening to the public in March 2010.

The secret to FTM’s success is the use of Medical Accounts receivables, which make up 85% – 90% of the portfolio and are secured at a rate of $3 for every $1 invested.

Basically, the Medical Accounts Receivables company works like an insurance company. For example, if there is a car accident where someone is hurt and either they or the other party has insurance, then (assuming a strict set of guidelines and due diligence has been met) the receivables company funds the operation and any subsequent expenses. They then take a lien against a portion of the payout from the actual insurance policy and are paid out upon settlement of the claim.

The thing to understand is that these operations would have taken place with or without the intervention of the receivables company. It’s just that by providing the funding the operation happens sooner and the injured party can resume a normal life much faster. The hospitals also provide the surgery at a discount, because they get paid sooner instead of having to wait for the settlement of the claim.

However, unlike factoring, where a company buys a pool of debt and simply hopes enough will be good to enable a profit to be made, in our case, the Medical Accounts Receivables Company pick and choose the cases they wish to fund and, on average, 4 out of every 5 cases reviewed are rejected, as investor safety is paramount.

Furthermore, exposure to each individual insurance company is limited to 10% so that in the event of bankruptcy investors remain protected, as over half of the insurance companies could fail and still enable FTM to receive their principal back.

The risks surrounding insurance companies also tend to be misunderstood because in the event of a massive bear market it would ravage the balance sheet of the insurance company, as their liabilities would be unchanged but their assets substantially lower. But in general, insurance companies have liabilities that are years or decades in the future.

The remainder of the portfolio is split with 5% – 10% held in cash and a maximum of 5% in F/X trading, set with a maximum stop loss of 35%. In this way, FTM has created a portfolio that is perfect for retail, institutional investors or pension funds alike, while knowing in advance that the maximum downside is 1.75% of the total portfolio and the upside is far better than the long term average of most markets, with far less volatility.

FTM utilizes an administration company to calculate the NAV values each month, then every quarter these figures are given to an independent accounting firm for verification and, of course, FTM is audited annually and is regulated by the Vanuatu Financial Services Commission.

Endre Dobozy is the Managing Director of FTM, a Licensed Securities Dealer and Master Certified member of the H.S Dent Advisors network. For more information visit www.ftmmutual.com

Explore more articles in the Investing category