Trading on Your Assets

Published by Gbaf News

Posted on May 1, 2013

7 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 1, 2013

7 min readLast updated: January 22, 2026

By Jackie Maguire, CEO, Coller IP

Interest in securing value from intangible assets through strategic management of intellectual property has grown considerably in recent years. This is partly because of the growing awareness that typically,up to 80% of most companies’ value* now evolves directly from intangible assets, including intellectual property (IP) – and also because of the rapidly increasing threat from counterfeiting.

The threat to the financial services industry – as well as businesses more generally – from continuing economic uncertainty and increased regulation makes consideration of the strategic use of intangible assets imperative. Some firms are starting to realise that IP is a way to differentiate themselves in this sector and that intangible assets can play a major role in raising funds and finance.

The number of patent application filings in the financial services sector in the US from fiscal years 2002 to 2010 increased from 7,400 in 2002 to 17,231 in 2010 while the number of insurance patents has increased by over twenty times from a rate of around 15 in 2002 to 332 in 2012.**

However, because it can be challenging to manage intangible assets effectively in a business, including determining who is responsible for them, intangible assets are often misunderstood and therefore undervalued on the balance sheet.

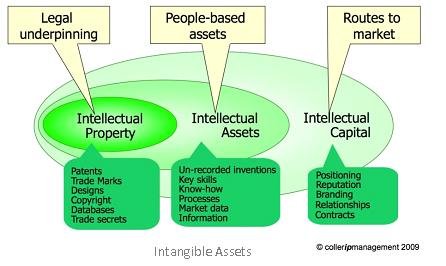

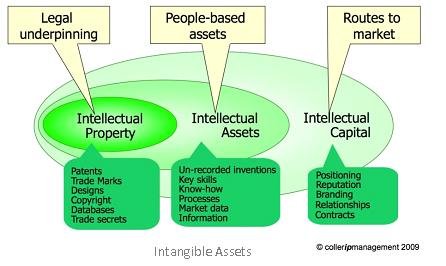

Intangible assets can be considered in three main groups.Intellectual Property means protection of your products, services and brand by patents, trademarks, copyright, designs and trade secrets. Intellectual Assets (IA) relate to the people-based assets of a company, including key skills, know-how and processes; the way your people do business. And finally, Intellectual Capital (IC) encompasses the other intangible assets of a company, including relationships, branding, reputation and contracts which provide the route to market (see diagram).

As with other assets, IP can be valued, bought, sold or leased. Many companies have significant intangible assets not currently recorded on their balance sheets. These can include trade marks, domain names, websites, order books, customer lists, copyright in training materials, software, and patents. In many cases these are tradable commodities with an associated cash value. In addition, intangible assets can allow (in certain circumstances) for the trustees of a pension fund to purchase and lease back an asset from the company releasing cash to the company and providing a return for the pension fund. It is possibly a strategy, too, for retirement, since patents can (in certain circumstances) continue to provide licensing revenue.

Many organisations are struggling to secure capital to invest in the growth of the business and many pension funds are struggling to make good returns on their investments so using IP can be a good solution. This option is still not widely realised.

As Clifton Asset Management says,

“Around 40 per cent of the UK’s SME owners have funds in pension schemes which could be immediately deployed through IP and pension-led funding. This would create an estimated cash injection of £100 billion into the UK’s SME economy.”

Some companies may use IP-based pension-led funding as their only source of business finance while others find that it works well alongside traditional lending options. Organisations such as Clifton Asset Management work closely with bank advisors to encourage them to add pension-led funding to their portfolio. Such companies can help organisations comply with HMRC rules on utilising an independent IP valuation in order to arrange a lease with a pension fund.

To quote Clifton Asset Management’s sister company, Morgan Lloyd, “Investment in Intellectual Property can create an alternative type of business funding whilst creating a safe haven for tax efficient growth. By transferring Intellectual Property into a SIPP, it is protected from creditors and competitors and the client’s pension fund also receives a substantial investment return for the usage of the Intellectual Property.”

In order to use IP assets as collateral to obtain finance, organisations need to be able to prove they have a cash value which is lasting and with a realisable market value. All this depends on a properly established valuation. While it may seem obvious that organisations selling or acquiring a company or portfolio, or those wanting to use IP as part of a pension fund should establish what intangible assets exist, whether they are live and valid, their value, and whether they are fully protected in all jurisdictions, unfortunately this does not always happen as well as it could.

Even if the assets have been included on a balance sheet, IP is often not valued accurately enough, in part because it is not always straightforward to do so. Identifying the intangible assets usually involves carrying out an audit to identify them and working out which of them are of significant value. A number of different approaches are used to measure value. Examples include the cost approach, the market approach, the income approach, or a combination of each.

Following an audit, IP specialists will undertake a landscaping exercise in order to understand the intangible assets that are of value. This includes assessing the company’s position vis a vis existing or potential competitors, as well as identifying possible opportunities for further exploiting any IP.

Not all IP assets are appropriate for raising funds, and a valuation and assessment process may reveal that it would be better to use IP assets deemed as not core to the business to raise cash, for example by selling them.

The monetary value of the assets will depend on how securely the assets have been protected. It is important therefore that protection is as robust as possible.

Business Action To Stop Counterfeiting and Piracy (BASCAP)***claims that the total global economic value of counterfeit and pirated products is as much as $650 billion every year, with international trade accounting for more than half of counterfeiting and piracy estimated at $285 billion to $360 billion.

Research from The Intellectual Property Crime Group (IPCG) has revealed that 40% of businesses surveyed took no practical action such as trade mark registration or employee training to ensure their IP and that of others is protected.

**** It is important to consider the protection of all relevant trade marks, which can of course include words, logos, sounds, colours, gestures, brand names and slogans—in fact, any distinctive feature which can be represented on paper and which can distinguish the goods or services of one business from those of another. They can even consist of 3D shapes.

Patents that protect the functionality of new inventions – including processes or devices – can add real value.

In addition, copyright, registered designs, database rights, and trade secrets can also play an important role in protecting intangible assets.

Intellectual Property is a powerful, flexible and effective business asset, and like other assets it needs to be understood, protected, and reviewed regularly. It needs to be used judiciously – using it as a financial vehicle for example may not be right for all organisations depending on their circumstances. But applied appropriately, the outcome can be highly beneficial to all parties.

*Figure quoted in ‘Making the Intangible Tangible’, a report prepared by PWC for the Australian Copyright Council

**Source: United States Patent and Trademark Office

*** Source: Estimating the Global Economic and Social impacts of Counterfeiting and

Piracy – A Report commissioned by Business Action to Stop Counterfeiting and Piracy (BASCAP) February 2011

****Source: IP Crime Group 2008/9 Crime Report -http://www.ipo.gov.uk/ipcreport08.pdf

Coller IP – www.collerip.com – specialises in helping organisations protect, understand, value and commercialise all aspects of intellectual property/intellectual capital. The CEO, Jackie Maguire, has extensive experience in IP and is a founder of Coller IP. In 2009 she was listed by Intellectual Asset Management magazine as one of the top 300 IP strategists worldwide – and in the top ten in the UK and each year since she has been voted once again into the top 300. Her founding partner, Jim Asher leads Coller IP’s valuation practice.

.

Explore more articles in the Investing category