THE FOUR KEYS TO LONGEVITY

Published by Gbaf News

Posted on August 1, 2014

20 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 1, 2014

20 min readLast updated: January 22, 2026

U.S.EDITION July 2014

Famous comedian George Burns was once quoted as saying, “If you live to be one hundred, you’ve got it made. Very few people die past that age”. By 2050, it is estimated that there will be more than one million centenarians living in the U.S.1 For most people, planning for retirement or their later years is focused mostly on finances and how they will spend their time. However, ensuring they spend those years in good health is something that many overlook. The times are certainly changing, with medical advances and technological breakthroughs, planning for retirement and living longer needs to be more holistic.

In 1970, average life expectancy at birth in the United States was 71 years. In 2014, it is 79 years; and by 2050, the U.S. Census Bureau projects that average life expectancy will be 84 years.2 Today, according to the National Institute on Aging, there are over 40 million people in the United States aged 65 or older, accounting for about 13 percent of the totalpopulation. In 1900, there were just 3.1 million older Americans,or about 4.1% of the population.3

The vast majority of babyboomers—those born between1946 and 1964—are on aquest to improve their oddsof living longer than previousgenerations. They not only wantto live longer, they want to livehealthily, happily and more financially secure than everbefore. Although there is no magic potion to ensure a long and healthy life, there are some notable accounts of individuals,families, and even whole communities that have defied the aging odds.

The holy grail of longevity

In one such amazing story, Stamatis Moraitis, a Greek veteran of World War II, narrates how he was diagnosed with lung cancer in the 1960s while living in the United States.4 He decided to forgo chemotherapy, and instead returned to his birthplace, Ikaria, the island where “people forget to die”. Moraitis abandoned his western diet and lifestyle and embraced the traditional island culture. His American doctors had told Moraitis he had only nine months to live, yet after moving to Ikaria he was still living— cancer free—45 years after his original diagnosis.

According to the story, he never had chemotherapy, took drugs or sought therapy of any sort. All he did was move home to Ikaria and embrace the local lifestyle. He claimed he even outlived his U.S. physicians who, decades earlier, had predicted his imminent death as the only plausible outcome of his devastating diagnosis.

Moraitis is not alone when it comes to longevity on the island of Ikaria. In fact, University of Athens researchers have concluded that people on Ikaria are reaching the age of 90 at two-and-a-half times the rate of their American counterparts.5

Stark differences in their lifestyle are apparent, even to a casual observer. Stress factors such as daily schedules don’t exist on Ikaria. Although the average Ikarian regularly performs vigorous activities, it’s never considered exercise. The island has a symbiotic attitude characterized by equal acceptance and accountability for everyone. Keeping up with the neighbors on the island of Ikaria translates into good health, happiness and wellbeing for all.

Many traditional cultures with a strong ethnic heritage like Ikaria embrace the simplicities of life. The Ikarian diet is also a factor. It features fresh vegetables, fruits, herbs, spices and local honey, which are all products of weekly harvests that every citizen contributes to and benefits from, thereby maintaining a social structure that literally nurtures the entire community. The legacy of an Ikarian lifestyle may be the closest we have come to discovering the holy grail of longevity.

Obviously, the fast-paced culture and appointment-driven lifestyles of most Americans isn’t conducive to tending toabundant gardens or taking daily naps, both of which provide health benefits and are common practices in Ikaria. However, by recognizing what works in other cultures, it may be possible to find an acceptable middle ground to tip the scales in favor of a long and healthy life—no matter where you live.

Unlocking the door to longevity

To try to further understand the keys to longevity, a survey was conducted by Pollara on behalf of the BMO Wealth Institute to record and analyze the views of 1,000 Americans on various aspects of aging.6

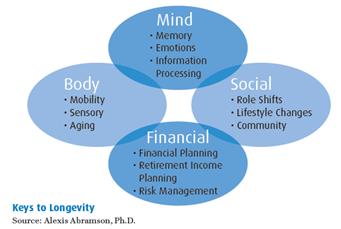

The wide-ranging survey questions were focused around four aspects of life that many experts in the field of aging consider to be the keys to unlocking the mysterious door to longevity.

The four keys: body, mind, social and financial

Normal aging involvesan ongoing physiologicaltransformation. As your body and mind evolve and adapt,it’s helpful to re-evaluate bothyour physical and your mentalstatus, and to determine what

changes in your diet, exerciseregime and general lifestyle arerequired to promote ‘healthy’longevity. In addition, by putting the necessary tools in place as soon as you can to ensure that you have a strong retirement and financial plan and a solid social structure, you are more likely to seamlessly adjust to your senior years.

Although it’s never too late to make positive changes, keeping clear goals in sight is easier when good habits are formed and incorporated over a lifetime, rather than adopted as an afterthought. It’s critical that you devise a strategy that will help you remain vigilant about all aspects of your health, well being, personal life and financial assets. By consciously nurturing these four components, you can unlock your potential to achieve a long and rewarding life.

Key 1: The body: The master key that unlocks every other door

Good health is one of the basic elements required to achieve long life; without it, everything else is diminished. Now is the time to initiate the changes necessary to maximize your current and future health status.

Research conducted by Dr.Dean Ornish and his team at the University of California,San Francisco concluded that following a program of “healthy eating, exercise and stress reduction an not only reverse some diseases—it may actually slow down the aging process at the genetic level.”7

In fact, longevity odds are greatly influenced by your personal lifestyle choices. Other aspects of good health should include:

The BMO Wealth Institute survey noted that there is always room for improvement as we strive to increase our lifespan.

The most common initiatives are eating healthily (53%), exercising (49%) and visiting their doctor regularly (47%). Young people reported that they were less likely to visit their doctor regularly (33%).

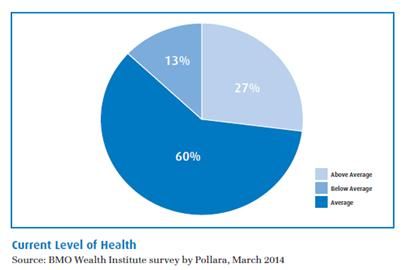

When asked how they would rate their level of health based on their age, the majority of survey respondents considered themselves to be of average health for their age (60%), with approximately one-quarter saying their current level of health was above average (27%). Approximately one in ten (13%) considered their health was below the average for their age. Men, and those in the 18–29 age category, were most likely to consider their current level of health to be above average.

Key 2: The mind: The fundamental key

Living your best life depends on a healthy brain. A recent article explores the best ways to improve your brain power for life.8 This article reveals that functioning to our fullest capacity is directly linked to the health of our brains. The article suggests that you incorporate these four fundamental lifestyle changes to boost your brain power.

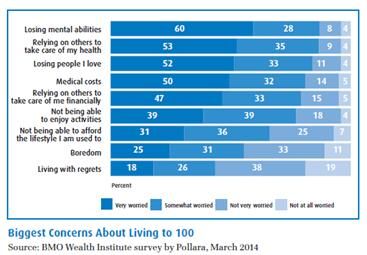

The survey results revealed that loss of mental ability was the biggest concern that respondents had about living to 100 and beyond. Below is a complete list of the feedback received when respondents were asked for their biggest concern about living to 100.

It’s a common myth that anolder brain is not as sharp asa young one. The good newsis that research tells us thatcomparisons between thehuman brain and computerssuggest otherwise. We must take into consideration that an older mind has stored and processed much more information over the course of a lifetime than someone in, for instance, their 20’s. Although the information is still accessible, at some point it begins to take longer to process, much like a well-used computer’s hard drive.

The brain, just like the musclesof the body, requires regularexercise to keep the mindsharp. Mature adults are rising to the challenge by adapting to the technology wave and incorporating activities that challenge the thinking process, including surfing the web, online gaming, and using an electronic reader to catch up on the latest book. There is no doubt that all of these activities sharpen your cognitive skills – the key to optimal mental health.

Key 3: Social: The key to enjoying life

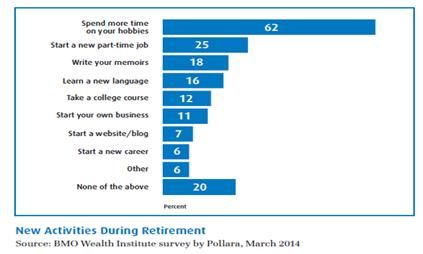

The popularity of personal bucket lists has ignited a passion in seniors to take up new hobbies, write their life stories, or develop new careers. Senior wanderlust knows no bounds when it comes to fulfilling dreams after raising a family and retiring from a dedicated career. Survey results suggest there are a plethora of new activities respondents are interested in incorporating into their daily lives after retirement.

Spending more time on hobbies and starting part-time jobs were both shown to be highly desirable new activities on the list for many survey respondents and this is widely seen as a positive outcome. Researchers at the Institute of Economic Affairs in the U.K. recently identified a range of substantially negative effects on health after retirement. Their study found retirement to be associated with a significant increase in clinical depression and a decline in self-assessed health. These effects were shown to grow as the number of years people spent in retirement increased.10

The encouraging link between continuing to work and longevity is exemplified in the Chianti region of Italy, located in Tuscany between the cities of Florence and Siena. In this famous wine region, the family-owned vineyards are often passed on from generation to generation. While the elders may leave the more taxing jobs to the youngsters, they never fully retire. The older members of the family continue to walk the rows of vines to make sure the grapes are in good condition and participate in tastings to ensure the quality of the wine, and they remain involved in important business decisions. Many locals claim it’s their ongoing daily involvement that is responsible for their exceptionally long and healthy lives.

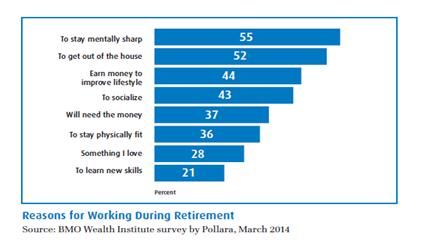

If you’re looking to boost your level of social interaction, to supplement your income, or are seeking a productive way to fill your time, you may want to consider taking on a part-time job. The survey results revealed additional motives respondents suggested would influence their desire to work part-time after retirement.

We are all social creatures at heart. The simple act of a good conversation with a close friend or family member can provide acceptance, understanding, compassion and even an occasional wake-up call when necessary.

John Cacioppo, a University of Chicago social psychologist and neuroscientist who studies the biological effects of social isolation, has found that a lack of social connectedness leads to loneliness and can be linked to dramatic increases in stress, hardening of the arteries and inflammation in the body. Cacioppo and his research team also found that social isolation can diminish the brain’s executive function, learning and memory. There is no doubt that we all require ongoing social connectivity to maintain optimal health and longevity.

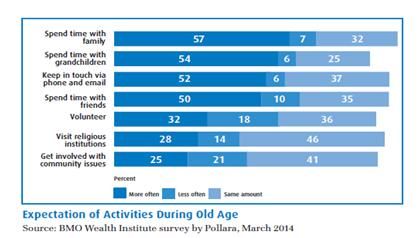

When contemplating expectations of increased involvement in current activities during old age, survey respondents cited social connectivity with family as their primary desire. In their golden years, those surveyed expected they will spend more time with family (57%), grandchildren (54%) and friends (50%), as well as keeping in close touch via phone or email (52%). A number of them (30%) also indicated that they would participate in volunteer activities in some capacity.

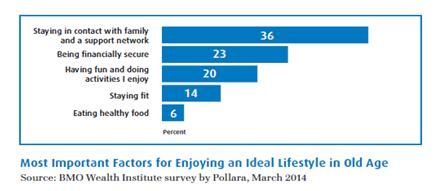

When asked what the most important factor was when it comes to enjoying an ideal lifestyle in old age more than one-third (36%) of respondents stated it was staying in contact with family and having a strong social support network. While financial security came in second, it was cited by 23% of the survey respondents as being the most important characteristic associated with an ideal lifestyle in old age— just above “having fun and doing activities I enjoy” (20%). Interestingly, financial security proved to be more important to women (27%) than men (19%), perhaps because women tend to live longer than men.

Key 4: Financial: The key to success

Americans clearly understand that an important component of successful longevity is having a sense of financial security.Although financial security was cited as a lower priority than maintaining a social network of family and friends for the majority of Americans surveyed, financial security gains importance with age and as personal assets increase over a lifetime. The survey results showed that those with the highest income levels expressed the greatest concern over their finances after retirement. The wealthiest plan to preserve their financial security above enjoying personal pursuits,

socializing, exercising and maintaining a healthy lifestyle.

Future health-care costs

While those surveyedacknowledged the potentialimpact of future health-care costs, few seemed to appreciatethe extent of the health-careexpenses that they will incur. Respondents also did not appearto fully understand that thereare proactive measures thatcan be taken to help minimizespiraling medical expenditures.Long-term care insurance is one such measure that may be part of the strategy to help curtail these expenses in the future. It may seem like peace of mind at a price, but not when you consider that currently there is a 70% chance of a retiree needing some type of long- term or in-home care as they age.11 The costs may vary a great deal by state; such that annual nursing-home care costs can range from $36,000 for a shared room to $72,000 for a single room.12

If you’re still in the active workforce and meet qualifying conditions, you may opt to open a health savings account (HSA) to help meet your future health-care expenses. These plans provide the opportunity to deposit funds and grow them on a tax-favored basis. However,the annual contribution limits of approximately $3,300 fora single individual or about$6,550 for a family reduces the account’s overall effectiveness in covering the potentially high health-care costs in retirement.13

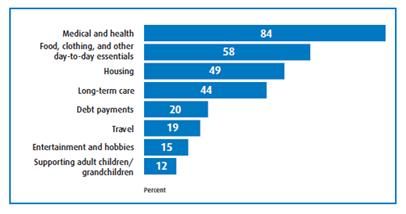

Below is a list of the expenses survey participants felt would most impact their senior years.

The state of health care and its associated costs are constantly evolving in the United States. Here are some steps you can take to keep pace with insurance industry and Medicare changes.

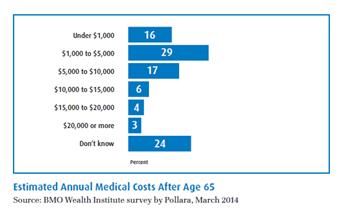

Overall, the majority of survey respondents anticipate the financial impact of health-care expenses to be significant as they age. In fact, Americans surveyed expected to spend an average of $5,822 a year on out-of-pocket medical costs after the age of 65.

This number appears to be quite accurate according to recent research conducted by the Employee Benefit Research Institute (EBRI).14 The EBRI found that Medicare generally covers only about 60 percent of the cost of health-care services (not including long-term care) for Medicare beneficiaries aged 65 and older, while out-of-pocket spending accounts for 13 percent of health-care expenditures (private insurance is an additional 14%). With that in mind, the EBRI estimates that a 65-year-old couple, both with median drug expenses, would need approximately $283,000 in today’s dollars to have a high probability of covering 25 years of future health-care expenses (excluding long-term care) in retirement.

Fail to plan — plan to fail

One of the easiest ways to increase confidence in your financial security is to work with a financial advisor to develop a retirement plan. Yet, those who have taken this important step are still in the minority. According to the Society of Actuaries, as of 2012, only one-third of pre-retirees have a retirement plan, and less than two-thirds (57%) of retirees have a plan.15

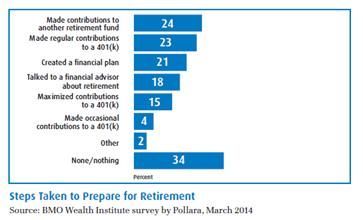

The survey results reflect this relatively low level of planning among pre-retirees, and at the same time demonstrate the comparative confidence that comes with a financial plan. Of those surveyed who stated they were confident that they will be financially secure in their retirement, 27% have a financial plan, and 23% have discussed their situation with a financial advisor. For those that are not confident about a financially secure retirement, only 8% have a financial plan, and only 7% have consulted with a financial advisor. The survey appears to show that working with a financial advisor may increase your confidence in your ability to meet your financial goals in retirement.

The majority of respondents have made contributions to a retirement fund or 401(k) plan, often through employer-sponsoredplans. However, over one-third of Americans (34%)have not yet taken any steps to prepare for their retirement.

The following table shows steps that respondents to the survey have taken towards preparing for their retirement.

The need for financial security becomes more apparent as we age. When regular employment income is no longer part of the equation, the wealth accumulated during working years may help to fill the gaps. Uncertainty about the future of Medicare and Social Security has forced us to become more resourceful and to seek out other long-term solutions.

An important first step is to talk with a financial advisor who will work with you to develop a financial plan that, among other things, looks at your retirement income needs and ways to meet these financial goals that are in line with your tolerance for risk. By working together with your BMO financial professional, you can discover new doorways to financial security that may help to sustain you in your golden years.

A final thought

The compelling findings of the BMO Wealth Institute survey speak to the need for all of us to have a better overall plan when it comes to the four key components of longevity; body, mind, social and financial. Many challenges that may arise in our later years can be both anticipated, and properly planned for, by making smart decisions focused on the ultimate goal of successful longevity.

Certainly, there are lessons to learn from the resiliency found in the people of Ikaria. With little else to sustain their culture, value is placed on the most simple, yet endearing aspects of living a satisfying life—like interacting with neighbors and enjoying a good meal with friends and family. If attitude and fortitude were the most-valued assets, Ikarians might possibly be the richest people on the planet.

Footnotes

1 Living to 100? Giddan J, Cole E. The Huffington Post Blog, May 27, 2014.

http://www.huffingtonpost.com/jane-giddan-and-ellen-cole/living-to-100_b_5384496.html (accessed June 2014).

2 Life Expectancy–United States. Data 360. http://www.data360.org/dsg.aspx?Data_Set_Group_Id=195 (accessed June 4, 2014).

3 Older Americans 2012: Key Indicators of Well-Being (Table 1a). National Institute on Aging, August 2012.

http://www.agingstats.gov/agingstatsdotnet/main_site/default.aspx (accessed June 2014).

4 The Greek island of old age. Bomford, Andrew. BBC News, Last updated January 6, 2013. http://www.bbc.com/news/magazine-20898379

(accessed June 2014).

5 Sociodemographic and lifestyle statistics of oldest old people (>80 years) living in Ikaria Island: The Ikaria Study. Panagiotakos DB, Chrysohoou C,

Siasos G, Zisimos K, Skoumas J. Pitsavos C. Stefanadis C. Cardiology Research and Practice, February 2011.

http://www.ncbi.nlm.nih.gov/pubmed/21403883?dopt=Abstract (accessed June 2014).

6 Survey conducted by Pollara for the BMO Wealth Institute between February 27, 2014 and March 3, 2014 with an online sample size of 1,000

Americans. Overall probability results for a sample of this size would be accurate to within 3.1%, 19 times out of 20.

7 Can lifestyle changes reverse coronary heart disease? Ornish D, Brown SE, Billings, JG, Scherwitz LW, Armstrong WT, Ports TA, McLanahan SM,

Kirkeeide RL, Gould KL, Brand RJ. The Lancet, July 21, 1990.

http://www.thelancet.com/journals/lancet/article/PII0140-6736(90)91656-U/abstract (accessed June 2014).

8 What Is the Best Way To Improve Your Brain Power For Life? Bergland, Christoper. Psychology Today, January 21, 2014.

http://www.psychologytoday.com/blog/the-athletes-way/201401/what-is-the-best-way-improve-your-brain-power-life (accessed June 2014).

9 Forget about forgetting: Elderly know more, use it better. Ramscar M. Universitaet Tubingen, January 20, 2014.

http://www.sciencedaily.com/releases/2014/01/140120090415.htm (accessed June 2014).

10 Work longer, live healthier. Sahlgren GH. Institute of Economic Affairs, May 2013.

http://www.iea.org.uk/sites/default/files/publications/files/Work%20Longer,%20Live_Healthier.pdf (accessed June 2014).

11 Long-term care insurance: Peace of mind at a price. Waggoner J. USA Today, December 2, 2013.

http://www.usatoday.com/story/money/columnist/waggoner/2013/12/02/long-term-care-insurance/3807147/ (accessed June 2014).

12 Genworth 2012 Cost of Care Survey, 2012. http://www.skillednursingfacilities.org/articles/nursing-home-costs.php (accessed June 2014).

13 Resource Center: Health Savings Accounts (HSAs). U.S. Department of the Treasury, last updated October 18, 2013.

http://www.treasury.gov/resource-center/faqs/taxes/pages/health-savings-accounts.aspx (accessed June 2014).

14 Savings Needed for Health Expenses for People Eligible for Medicare: Some Rare Good News. Fronstin P, Salisbury D, VanDerhei J. Employee Benefit

Research Institute, October 2012. http://www.ebri.org/pdf/notespdf/EBRI_Notes_10_Oct-12.HlthSvg-only.pdf (accessed June 2014).

15 Retirement Planning in the Age of Longevity – Conference Proceedings. Stanford Center on Longevity, May 2012.

http://longevity3.stanford.edu/wp-content/uploads/2012/12/Retirement-in-the-Age-of-Longevity-Conference-Proceedings11.pdf

(accessed June 2014).

Securities, investment advisory services and insurance products are offered through BMO Harris Financial Advisors, Inc. Member FINRA/SIPC. SEC registered investment adviser.

BMO Harris Financial Advisors, Inc. and BMO Harris Bank N.A. are affiliated companies. Securities and insurance products offered are: NOT A DEPOSIT – NOT INSURED BY THE FDIC

OR ANY FEDERAL GOVERNMENT AGENCY – NOT GUARANTEED BY ANY BANK – MAY LOSE VALUE.

BMO Harris Financial Advisors does not offer tax advice. Contact your tax advisor.

United States Department of Treasury Regulation Circular 230 requires that we notify you that this information is not intended to be tax or legal advice. This information cannot

be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on the taxpayer. This information is being used to support the promotion or marketing

of the planning strategies discussed herein. BMO Financial Group and its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances

with your independent legal and tax advisors.

Estate planning requires legal assistance which BMO Financial Group and its affiliates do not provide.

BMO and BMO Financial Group are trade names used by Bank of Montreal.

About the BMO Wealth Institute BMO Wealth Institute, a unit of BMO Financial Group provides this commentary to clients for informational purposes only. The comments

included in this document are general in nature and should not be construed as legal, tax or financial advice to any party. Particular investments or financial plans should be

evaluated relative to each individual, and professional advice should be obtained with respect to any circumstance.

Explore more articles in the Top Stories category