THE CUSTOMER CENTRICITY CONUNDRUM

Published by Gbaf News

Posted on June 18, 2014

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 18, 2014

6 min readLast updated: January 22, 2026

It’s all very well trying to entice consumers with attractive new current accounts, but if the service behind them remains below par, it won’t be long before customers move on again, warns Egremont Group’s Natalie McLellan

Steps by the UK’s Financial Conduct Authority (FCA) to make it easier for customers to switch banks have placed the onus on FS providers to prove their worth. Recently a number of players in the UK have responded by introducing new-style current accounts which, at face value, seem quite alluring. But without a stand-out service behind them, their impact may only be short-lived.

So it’s interesting that FS providers are no nearer to improving their customer-friendliness. Mystery Shopper research conducted recently by Egremont Group among leading Retail Banks, found that the vast majority gave a frontline service that was woefully inadequate.

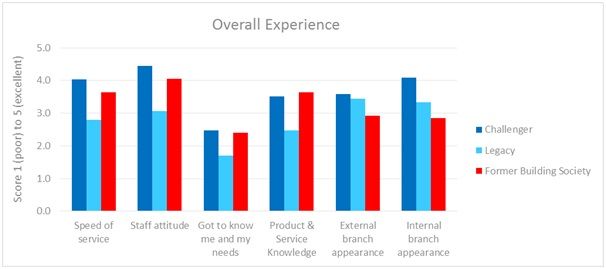

Source: Egremont Group, 2014: Customer Experience Mystery Shopping Review

Source: Egremont Group, 2014: Customer Experience Mystery Shopping Review

The most acute and widespread shortfalls were found to be in providers’ ability to get to know customers as individuals and build up a fuller understanding of their needs. In one of the worst cases, 85% of mystery shoppers approaching a high-street bank found the staff they engaged with made no effort to build up a picture of their personal situation. Although challenger brands were found to provide a higher level of service generally, their depth of product/service knowledge and interest in the customer’s individual circumstances was found to be significantly lacking – 55% of undercover shoppers rating efforts to be poor or extremely poor.

The findings suggest that increasingly stringent controls over sales tactics have rendered customer-facing staff mute – or at least terrified of diverging from the script. FCA compliance has become a box-ticking exercise, so that in the worst instances customer conversations have become a 10-15-minute monologue as the sales person covers all bases.

Another customer phenomenon FS providers have failed to adapt to is the way channel use has changed. Consumers are generally a lot more savvy now, happy to do their own research online, and seeing what others are saying about the brands they’re considering. Once they’ve found an offer they like, they might start and even complete the application process online.

For the FS provider winning the business this is great news, but for the others that would have liked to influence that decision process, an opportunity has been lost; they have not had a chance to start a conversation. This isn’t just happening in retail banking, either. As life and pensions providers adopt direct-to-consumer channels, they too must learn how to engage with a broadening spectrum of digitally-literate customers who aren’t afraid to shop online.

As customers’ routes to financial services change, FS providers need to review what value they are adding through their various channels. If service isn’t consistent across the different customer touch points, the overall customer experience will suffer – and disenchanted customers will take their feedback online, chipping away at public brand perception.

In Egremont’s research, significant diversity was found in perceptions of brands’ channel performance. Metro Bank and M&S scored highly on the branch experience, while First Direct got high marks for its contact centre. But it’s how the various channels diverge and follow the customer journey that dictates a good end-to-end experience. This means each channel needs to play to its strengths.

Natalie Mclellan

So how can FS providers strike the right balance between meeting the fuller needs of the customer, achieving legitimate commercial goals, and delivering for the regulator compliance-wise?

If the bank is focused on the needs of the customer, it is already halfway there to keeping regulators happy – and attracting good levels of profitable business. By developing new models to engage with customers, being proactive in understanding the customer more holistically and listening to the customer instead of talking at them, front-line colleagues will become attuned to additional needs they might have missed otherwise – as they learn about the individual’s stage in their career and family life. So instead of the standard “have you currently got mortgage protection?”, a cross-selling conversation might develop organically as part of a more holistic discussion – a conversation which results in mutually beneficial outcomes for both the customer and the bank.

Encouragingly, it appears that frontline staff may be receptive to new direction. Eighty-eight per cent of Egremont’s Mystery Shoppers rated ‘staff attitude’ to be above average – suggesting there is latent potential to more proactively engage customers, behaviour that could be teased out with the right coaching.

Silos are still typically to blame for poor execution. Vertically, the organisation might have a great vision and strategy but lack the mechanism to get this through to the frontline. Horizontally, there may be too much logistical separation between functions, channels or the organisation and third parties. And, culturally, leadership and performance management structure may not be conducive to doing things differently. As the adage goes, if you keep doing the same things you shouldn’t be surprised if you keep getting the same results. So all of these components need to be looked at.

The vision must begin with the customer. To a large degree, organisations need to go back to basics, using techniques that were built into customer relationship management 10 years ago – involving segmenting and developing a deeper understanding of customers, and more holistically, so that products can be developed that better meet their requirements.

FS providers can learn a lot about what to do by looking at the retail sector, where customer engagement is much more advanced.

A common approach to accelerated change here is to use hot-housing techniques – where a handful of branches/stores are ring-fenced for customer experience improvement initiatives. Such projects, which develop into rapid ‘test and learn’ pilots, look at everything holistically across the operation – at the people, the processes and the supporting systems – but arrive at change quickly and effectively. Crucially, any suggestions for change start with the customer and the staff who serve them every day.

Something else retailers do well is reward loyalty. In the FS industry, this would require matching new-customer incentives with end-to-end service improvements, rather than subsidising attractive front-end offers with higher overdraft charges.

It’s a learning curve of course but, with competition intensifying, time isn’t on providers’ side.

ABOUT THE AUTHOR

Natalie McLellan is the Head of Egremont’s Financial Services practice. She is an experienced customer strategy and business transformation specialist with a proven record of delivery within the financial services industry.

Egremont Group is a management consultancy which specialises in bringing retail best practice to the financial service industry. It has worked with all of the UK’s top 20 retailers and a growing number of high street retail banks, building societies and leading life & pensions providers. www.egremontgroup.com

Explore more articles in the Banking category