Nvidia’s AI chip demand still booming but slowing sales growth worries investors

By Max A. Cherney, Arsheeya Bajwa and Stephen Nellis

By Max A. Cherney, Arsheeya Bajwa and Stephen Nellis

SAN FRANCISCO (Reuters) – Nvidia forecast its slowest revenue growth in seven quarters on Wednesday, with the artificial intelligence chipmaker failing to meet lofty expectations of some investors who have made it the world’s most valuable firm.

Shares of the Santa Clara, California-based company fell 5% after it posted results but quickly pared losses to trade down 2.5% after hours. During the regular session they closed 0.8% lower. In early Frankfurt trade on Thursday they were down 1.9%.

Expectations ran high ahead of the results, with Nvidia shares up more than 20% over the last two months and hitting an intraday record high on Monday. The stock has nearly quadrupled so far this year and is up more than ninefold over the last two years, giving it a market value of $3.6 trillion.

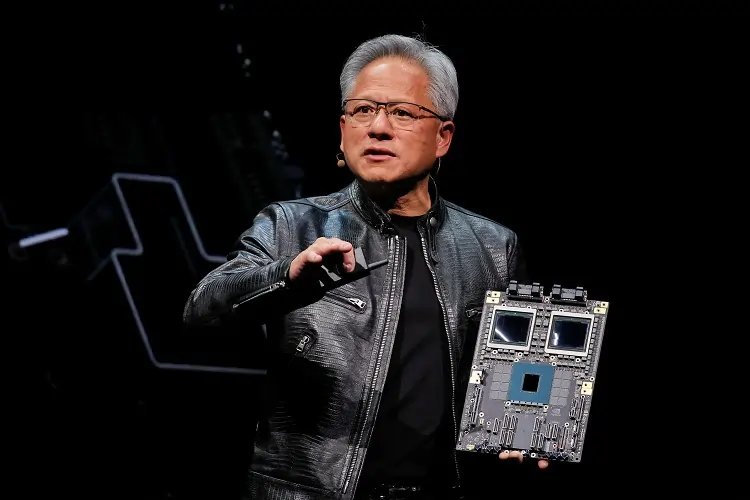

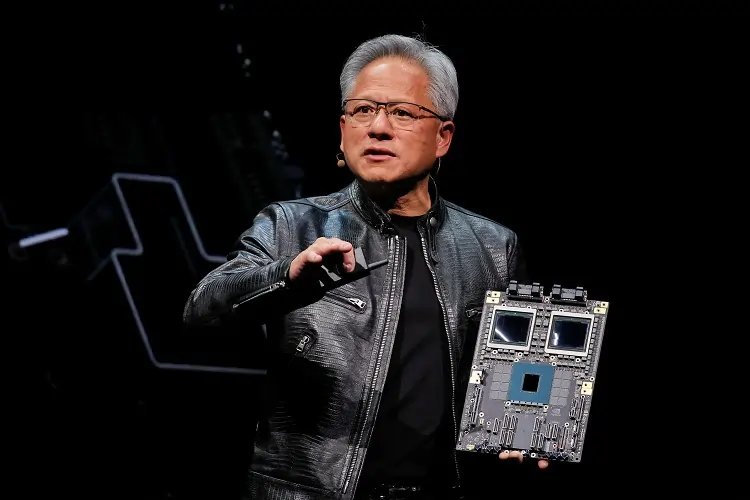

Nvidia is in the middle of launching its powerful Blackwell family of AI chips, which will weigh on the company’s gross margins initially but improve over time.

The new line of processors has been embraced by Nvidia’s customers and the company will exceed its initial projections of several billion dollars in sales of the processors in the fourth quarter, Chief Financial Officer Colette Kress told analysts on a conference call on Wednesday.

Asked about media reports that a flagship liquid-cooled server containing 72 of the new chips was experiencing overheating issues during initial testing, CEO Jensen Huang said there are no issues and customers such as Microsoft, Oracle and CoreWeave are implementing the systems.

“There are no issues with our Grace Blackwell liquid-cooled systems,” Huang told Reuters. “The engineering is not easy at all, because what we’re doing is hard, but we’re in good shape.”

Initially its Blackwell family of chips will carry gross margins in the low 70% range, but will increase to the mid-70% range when production ramps up, Kress said.

The company forecast revenue of $37.5 billion, plus or minus 2% for the fourth quarter, compared with analysts’ average estimate of $37.09 billion according to data compiled by LSEG.

While still a stunning rate of growth thanks to huge demand for the company’s chips that make up the brains of complex generative AI systems, it marks a clear slowdown from previous quarters when Nvidia mostly posted sales that at least doubled.

Nvidia’s fourth-quarter forecast indicated the company’s revenue growth will slow to roughly 69.5% from 94% in the third-quarter.

“Investors have become accustomed to huge beats from this company, but doing that is getting harder and harder,” said Ryan Detrick, chief market strategist at Carson Group. “This was still a very solid report, but the truth is when the bar is this high it makes things just that much tougher.”

The slowdown in revenue growth, however, obfuscates enormous demand for the company’s AI chips, which dominate the market.

Supply chain snags have made it harder for Nvidia to report the big beats on revenue that have helped make it a Wall Street darling. But growth could pick up again if the company’s margins exceed 75%, said IDC analyst Brandon Hoff.

One of the bottlenecks for its chip supply has been the limited capacity for advanced manufacturing techniques at the company’s fabrication partner TSMC.

Huang declined to comment on specific production issues with TSMC but also told Reuters that “as we ramp (Blackwell) up, we’ll keep increasing more production lines, and we’ll keep improving our yield, and we improve our cycle time. All of that would improve our outputs.”

The yield refers to the number of working chips per wafer. The company said it had fixed a design flaw with its Blackwell chips by changing the blueprints used by TSMC to manufacture it.

TSMC shares were down about 1% in early Asian trading on Thursday.

Nvidia recorded third-quarter adjusted earnings of 81 cents per share, compared with estimates of 75 cents per share.

Sales in the data center segment, which accounts for a majority of Nvidia’s revenue, grew 112% to $30.77 billion in the quarter ended Oct. 27. The segment had recorded growth of 154% in the prior quarter.

Nvidia’s sales are boosted by cloud companies’ continued spending on its chips, as they expand data centers capable of handling generative AI’s complex processing needs.

The company said adjusted gross margin shrank to 75%.

(Reporting by Arsheeya Bajwa in Bengaluru and Stephen Nellis and Max A. Cherney in San Francisco; Additional reporting by Noel Randewich in Oakland, California; Editing by Sayantani Ghosh, Matthew Lewis and Jamie Freed)

Revenue growth refers to the increase in a company's sales over a specific period, often expressed as a percentage. It indicates how well a company is performing in generating income.

AI chips are specialized hardware designed to accelerate artificial intelligence tasks, such as machine learning and deep learning. They enhance the performance of AI applications by processing data more efficiently.

Market value is the total worth of a company's outstanding shares of stock, calculated by multiplying the current share price by the total number of shares. It reflects the company's size and investor perception.

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is critical for managing and storing data for businesses.

Explore more articles in the Investing category