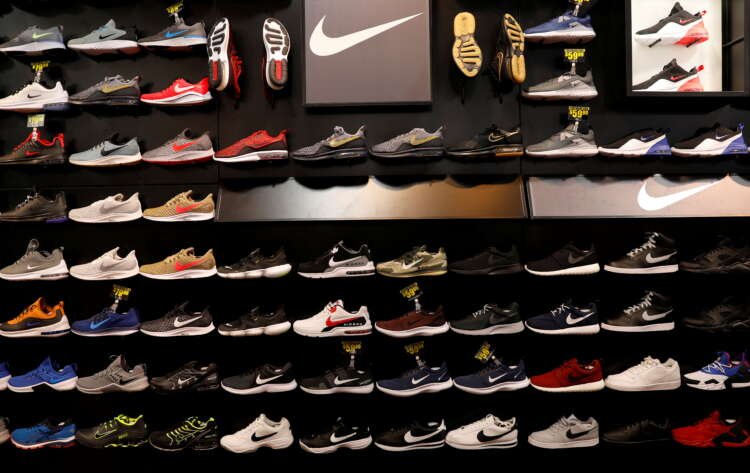

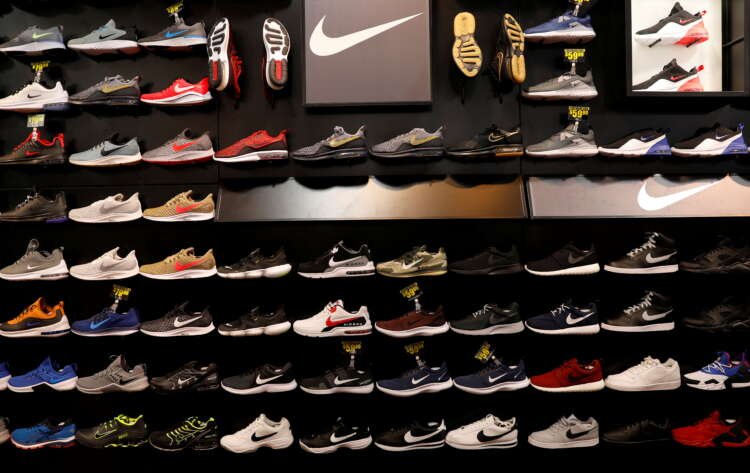

Nike’s Vietnam supply hurdles in focus ahead of quarterly results

Published by maria gbaf

Posted on September 23, 2021

3 min readLast updated: February 2, 2026

Published by maria gbaf

Posted on September 23, 2021

3 min readLast updated: February 2, 2026

Nike faces supply issues due to Vietnam factory closures, impacting holiday sales. Analysts adjust forecasts as production shifts to other countries.

By Uday Sampath Kumar

(Reuters) – Are sneakerheads in for a rough holiday season?

Nike Inc’s updates to its full-year sales outlook on Thursday will likely answer that pressing question for Wall Street as the world’s largest sportswear maker deals with unprecedented supply challenges ahead of the holiday season.

Three months ago, Nike gave a rosy outlook for the rest of the year as it benefited from consumers splurging on sneakers for running and hiking as they returned to their routines after over a year of staying at home.

Still, some analysts have cut their outlook for Nike’s sales, predicting that lockdowns and factory closures in Vietnam, where about half of all Nike footwear is manufactured, will cause shortages during the crucial shopping season.

“We believe the risk of significant cancellations beginning this holiday and running through at least next spring has risen materially for Nike as it is now facing at least two months of virtually no unit production at its Vietnamese factories,” BTIG analysts wrote in a note.

Graphic: Where Nike gets its products made: https://graphics.reuters.com/NIKE-RESULTS/zgpombjewpd/chart.png

THE CONTEXT

Many factories in Vietnam’s manufacturing hubs have been shut or are operating with drastically fewer on-floor workers since mid-July as a surge in Delta variant cases forced the government to implement tight containment policies.

Other apparel companies including Abercrombie & Fitch and Adidas AG have taken a hit to their businesses due to production issues in Vietnam.

Some analysts, however, see Nike using its scale to offset the sales impact from Vietnam shutdowns.

“The company should be able to mitigate some headwind by shifting production to other countries, like China, and prioritizing top sellers, key products, and its DTC (direct-to-consumer) channel,” Telsey Advisory Group analysts said.

THE FUNDAMENTALS

* Since the start of September, analysts have cut their full-year sales expectations for Nike to $49.81 billion from $50.34 billion due to worries about supply shortages

* Full-year earnings per share estimates have also fallen to $4.24 from $4.33, according to IBES data from Refinitiv

* Nike’s revenue for the reporting quarter is expected to have risen 17.7% to $12.46 billion from a year earlier

* The blue-chip stock has gained 11% this year, but is down about 10% from its record high hit in August

WALL STREET SENTIMENT

* The current average analyst rating on NKE shares is “buy”, with 28 rating it “strong buy” or “buy”, four rating it a “hold” and one rating it a “strong sell”.

* The median price target is $185. The stock closed at $155.02 on Tuesday

QUARTER STARMINES REFINITIV ACTUAL BEAT, SURPRISE %

ENDING MARTESTIM IBES MET,

ATE® ESTIMATE MISSED

May 0.52 0.51 0.93 Beat 82.7

31 2021

Feb. 0.77 0.76 0.90 Beat 18.1

28 2021

Nov. 0.63 0.62 0.78 Beat 25.1

30 2020

Aug. 0.44 0.47 0.95 Beat 102.5

31 2020

(Reporting by Uday Sampath in Bengaluru; Editing by Saumyadeb Chakrabarty and Anil D’Silva)

The article discusses Nike's supply challenges due to factory closures in Vietnam and its impact on sales.

Nike is considering shifting production to other countries like China to mitigate the impact.

Analysts have reduced sales forecasts due to potential shortages during the holiday season.

Explore more articles in the Business category