MARKET READINESS FOR HOST CARD EMULATION (HCE) MOBILE PAYMENTS?

Published by Gbaf News

Posted on July 29, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 29, 2014

2 min readLast updated: January 22, 2026

Mobile payments continue to make headlines. Trials have come and gone and cross-industry relationships have been set up and crumbled after the honeymoon period. Many of us, I’m sure, have questioned whether mobile NFC payments would ever become a mass-market reality.

Google changed all of this with one announcement in 2013. The incorporation of host card emulation (HCE) into the Android platform brought significant relief to many of the key banks and service providers that have been trying to make progress in launching mobile payments using USIM secure elements.

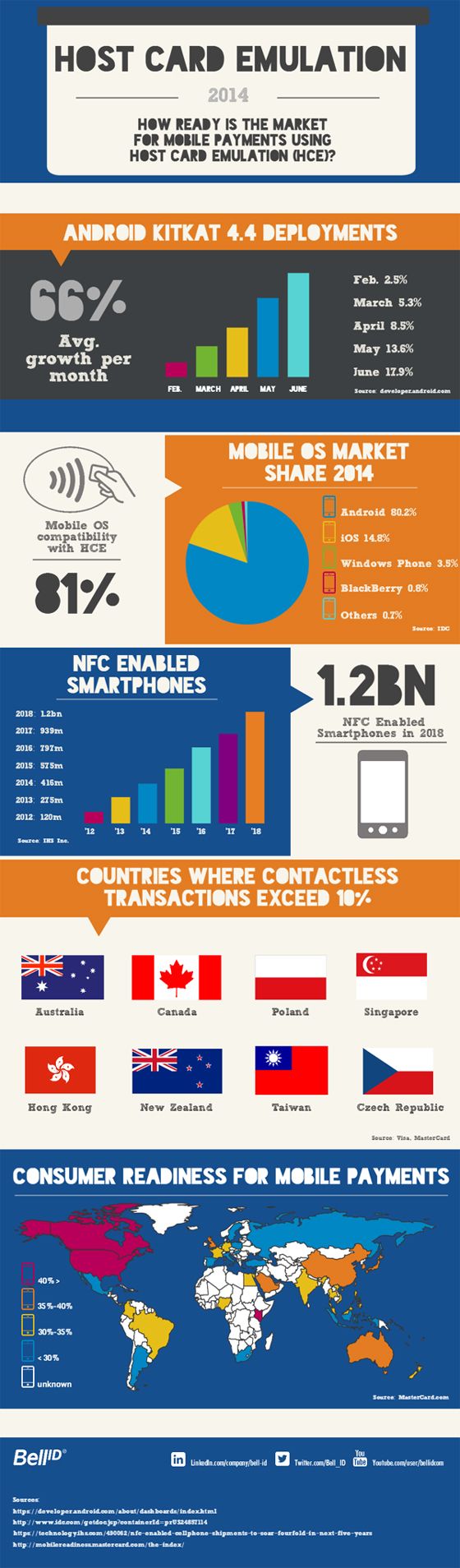

We have developed the below infographic to highlight some of the key statistics that demonstrate the readiness of the market for mass market delivery of mobile services using HCE. The infographic highlights the month-on-month growth of the deployment of Android KitKat 4.4, the percentage of global mobile operating systems that have the potential to support HCE, the countries where contactless mobile payments are likely to achieve swift adoption and global consumer readiness for mobile payments.

No more talking and no more trials. HCE is a turning point for the delivery of mobile services and many banks and services providers around the globe are already seizing this opportunity. Interested to learn more, check out our short video on HCE.

Explore more articles in the Finance category