Make it to Mayfair for £50K

Published by Gbaf News

Posted on October 1, 2012

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on October 1, 2012

6 min readLast updated: January 22, 2026

By Personal Finance Reporter, David Alexander

Diamonds, gold and prime London homes: why are they so sought-after? Why do they rise and rise in value? Why do they go on appealing to global investors? It’s simple: they are coveted and they are scarce. They are physical assets which derive value from inimitable factors such as age and aesthetics.

Prime London Central (PLC) is a financial centre, an educational hotspot, an international playground and a ‘go to’ destination. The factors affecting the UK’s housing market – lack of mortgage availability, unemployment and economic uncertainty – simply do not apply to PLC.

Since 1996, prices in PLC have gone up from £221,679 to over £1.3 million. This six-fold increase may seem incredible but it actually represents growth of 9% p.a., spot-on long term trend over the last 40 years.

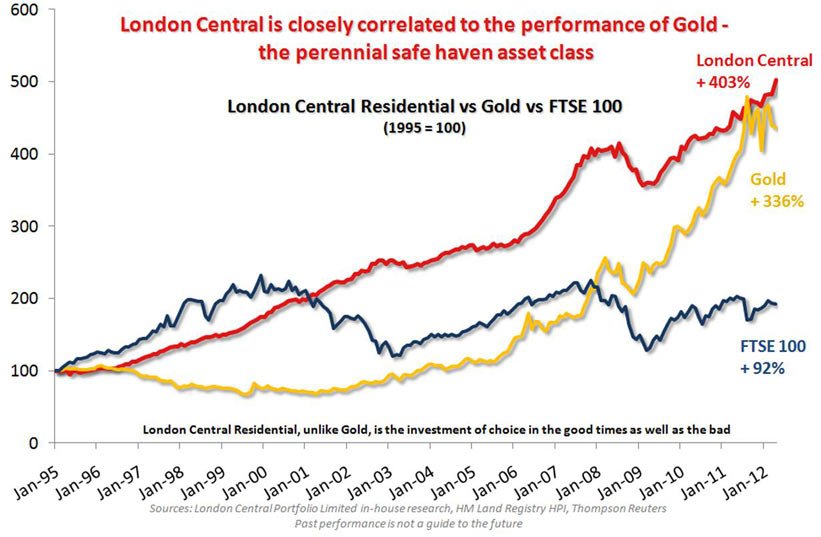

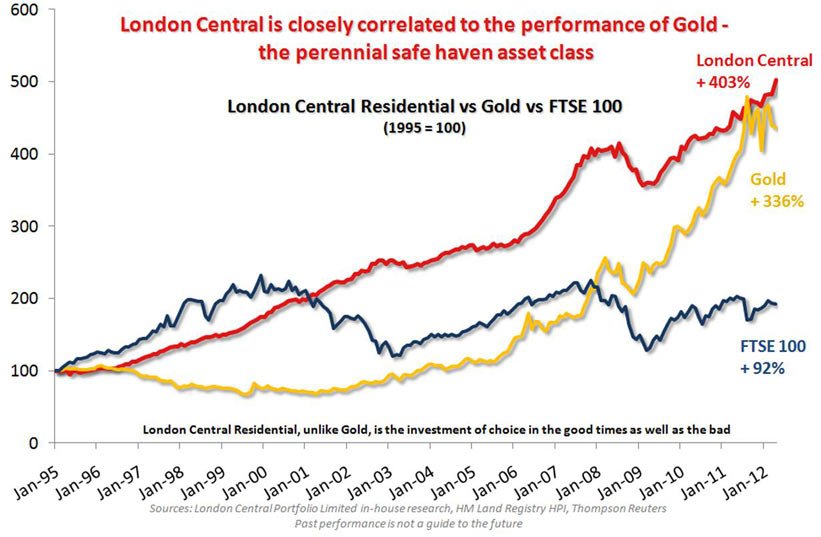

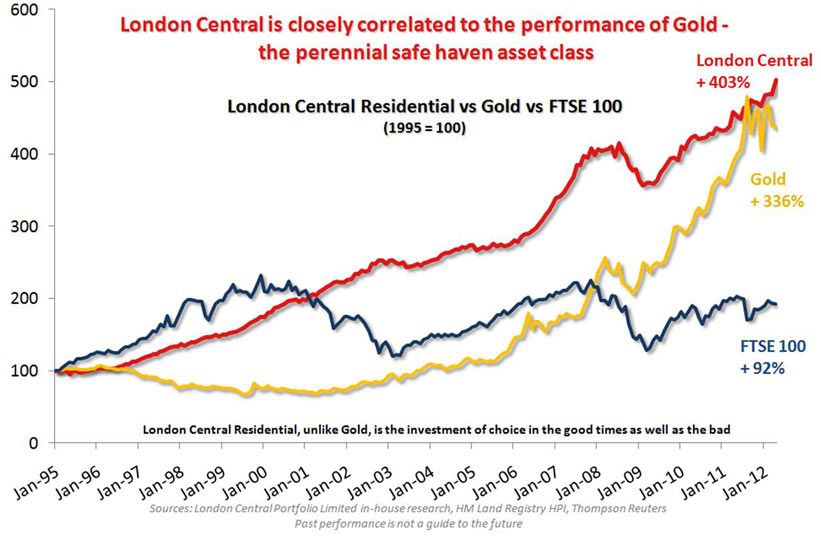

Loss of confidence in equities, concerns over the Arab Spring and the Eurozone has reinforced investors’ appetite for blue chip tangible assets. Prices are now 25% higher than in pre-credit crunch days (Q3 2007) whilst the FTSE100 is still down 12%.

Not surprisingly, PLC’s performance against gold, that other perennial safe haven, shows an uncanny correlation. Both are proven performers in times of trouble. But there is a big difference. Properties can be used or rented out to generate cash flow whereas gold is infamously barren – making PLC the investment of choice in good times as well as bad.

The flip side of PLC’s desirability and exclusivity is that it costs an awful lot to get hold of. The substantial entry price has made it the preserve of the super wealthy. This is where London Central Apartments (LCA), a new property fund which invests only in prime London residential, comes in. The third fund from specialist asset manager London Central Portfolio (LCP) enables investors to get into the market with a ticket size of just £50,000+.

LCA will be closing its doors to investors in just a few weeks, riding high on the successful results recently posted for LCP’s first two funds. The first, closed in 2008 has shown an above target return of 16% over the last year. The second, closed 18 months ago, has demonstrated 23% growth over the same period.

LCA, which already has commitments of £30m, will build up a diversified portfolio of one and two bedroomed properties in PLC, each under £1m each. These will be in all the prime micro markets offering strong capital growth potential. The fund is targeting a 10%-13% IRR p.a. over a five year hold.

LCP has revealed the fund has acquired its first five properties across Hyde Park, Marylebone, Kensington, South Kensington and the Pimlico grid. It has now started its refurbishment program and all the flats will be interior designed for the discerning tenant, achieving the highest possible rental yields

“There has been particular interest in LCA in light of its unique mandate to invest exclusively in prime properties under the £1m mark. It is an ideal investment solution for those wanting to access the market but nervous of the Government’s recent tax hikes for properties over £2m” explains Heaton.

This fund is attracting a new breed of investor – with more than 50% of uptake coming from the UK. Many are professionals priced out of investing directly but anxious to get a foothold in the market. With base rates at a historical low (0.5%) and cash holdings generating almost no returns, investors are also taking advantage of the fund’s SIPP and ISA eligibility.

LCA has also seen an influx of overseas investors, particularly from the Far East: investors, well aware of the value in PLC residential but historically deterred by the hassles of sourcing, buying and managing a portfolio from abroad. LCA provides a simple way in.

However, at almost one third, the second biggest up-take after the UK, comes from the Middle East. With Islamic investment options becoming increasingly important, LCA, as the UK’s first Sharia compliant residential property fund, has been a major draw. There have been few investment choices for Muslim investors and the fund is a welcome innovation. According to the Banker Magazine, there are just 765 global Islamic mutual funds, compared with 60,000 in the conventional sector.

The future of PLC looks bright. It is arguably the greatest capital city in the world with the lowest availability of property to buy. In fact, only 5,366 properties were sold last year (15 a day). Set against 10.9 million people around the world with over $1m+ of assets to invest and this makes a potential 2,000 investors for every property. Prices are fuelled by growth in demand, combined with diminishing availability and PLC has both.

“Prices in PLC have risen steadily over the last four decades (at 9% p.a.) and this trend is set to continue. In LCP’s view, sub £2m properties will be the most attractive going forward as buyers avoid the new high levels of SDLT on more expensive properties. Investors coming into LCA will be able to take advantage of the exciting growth opportunities in this sector.” says Heaton

Having uniquely approached PLC as an alternative opportunity to traditional investments for over 20 years, LCP are well positioned to call the market. They have championed the important role PLC plays in a balanced investment portfolio. Since the credit crunch LCP has seen a heightened appetite from both investors and institutions as they cotton on to the fact that PLC residential has significantly outperformed commercial property, both short and long term.

LCP pioneered the first closed ended fund targeting PLC, correctly called the bottom of the market to launch their second and have now launched the first Sharia compliant residential fund in the UK. Against this backdrop of success and innovation, LCP are bringing out two more funds in 2013.

The interest in LCA as a Sharia compliant offering has highlighted the appetite for Islamic investment options. In partnership with a large Middle Eastern organisation, LCP is developing a more substantial Sharia compliant opportunity. Alongside this, LCP are planning to launch the first residential property REIT exclusively targeting PLC. This will seek investment from large institutions that are keen to find a viable route into this sector.

Heaton adds that the new projects will not lose sight of what really works for the astute investor “Our new offerings will build on the successful model of our first three funds: investing in trophy locations but concentrating on small units. It might come as a surprise that the most profitable sector in PLC are portfolios of small units, individually commanding rents of less than £1,000 per week. Yields are highest; void periods lowest and capital growth the most consistent”.

Despite prime London houses being as expensive and desirable as diamonds and gold, LCP will continue in its goal to make the market accessible to all professional investors.

London Central Portfolio is a specialist fund and asset manager operating in the Prime London Central residential sector. Their third fund, London Central Apartments, is currently open to subscriptions. For further information visit www.lcpfund.com or contact Hugh Best, Investment Manager, on +44(0) 20 7723 1733 or fund3@londoncentralportfolio.com

Explore more articles in the Finance category