Loan Product Launch: Idea to Market. Insights from Neofin.

In the ever-evolving lending landscape, a new wave of momentum is sweeping through as fintech players eagerly step into the lending arena with their own lending services. These emerging products often differ from traditional loans – they increasingly embrace alternative data, provide personalized ch...

In the ever-evolving lending landscape, a new wave of momentum is sweeping through as fintech players eagerly step into the lending arena with their own lending services. These emerging products often differ from traditional loans – they increasingly embrace alternative data, provide personalized choices, and prioritize a seamless user experience. With the demand for such offerings on the rise, having a robust and easily deployable lending infrastructure is more crucial than ever. Neofin, the no-code lending automation platform, supports players in the lending scene in launching transformative consumer loan practices within a low-risk, no-code environment. In this article, we’ll delve into the journey of a loan product, from ideation to release, and outline what fintechs, integrators or traditional financial institutions navigating this transformative lending landscape need to have and know to turn their new loan product into a reality with all the standard headaches solved.

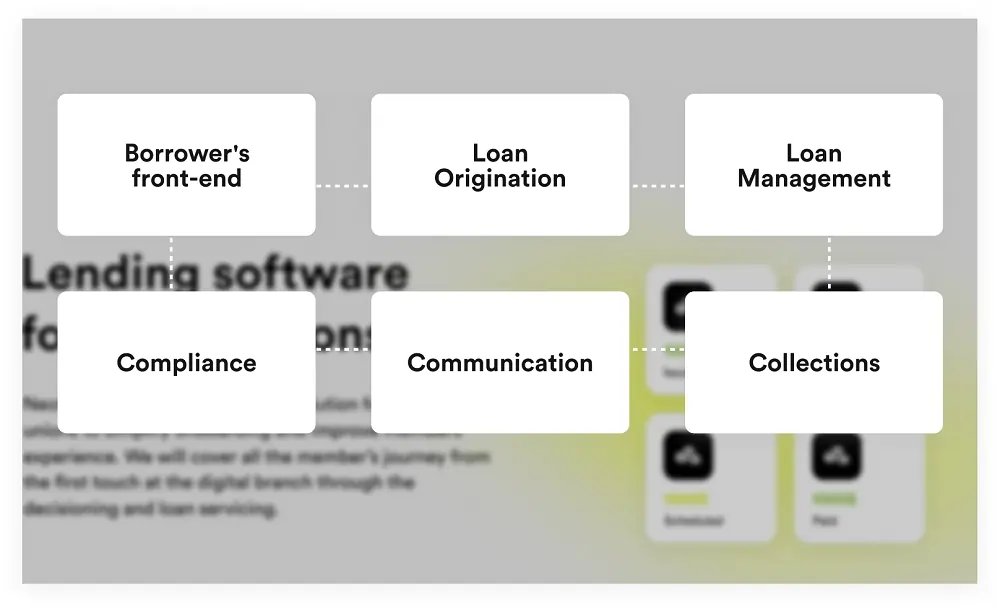

Stately Credit is a fintech company with a unique and inclusive consumer loan product based on loan repayments sourced directly from the borrower’s paycheck. Stately faced challenges in their quest to build an end-to-end and scalable infrastructure for their consumer loan product. They sought a solution that encompassed loan origination, management, compliance, communication, and collections, all within a cloud-based framework. Stately worked with two other traditional platforms, which proved insufficient before finding Neofin.

The turning point came with Neofin. Offering the API flexibility and agility they needed, without any dependence on an in-house engineering team, Stately Credit found the solution they were searching for. “Of all the solutions we’ve tried, Neofin’s product engine has been the easiest in building the product core, creating risk policies with alternative data sources, or setting up seamless user interfaces,” says Shanzaib Malik, CEO and Founder at Stately. “The first MVP was delivered in less than a month – that’s how we knew we were on the right track.” With Neofin, they gained an end-to-end system that allowed for customized loan origination, management, and servicing workflows, tailored precisely to Stately’s unique product specifications.

Today, Stately Credit is already in full lending operation, offering access to ethical, healthy loan products to borrowers nationwide. The Neofin platform has not only enabled a successful product launch but also ensured scalability, risk-based pricing, and ability to process thousands applications with minimal support staff.

Launching a lending product necessitates three critical components: a product idea, seasoned lending expertise, and a robust technological solution. In the case of Stately Credit, the technological solution that streamlined the business process for automating loan issuance came from Neofin.

The harmonious synergy of these three pivotal elements was the catalyst for the success of Stately Credit. Across various ventures, the team names may vary, but the essence remains constant: the expertise of the founders and the transformative capabilities of a technological solution will always yield results. To date, Neofin has garnered the trust of tens of founders from 8 countries, being the go-to platform for them to start their lending service. Now, let’s delve into the essential prerequisites you should have at your disposal to embark on your lending journey.

The journey begins with a compelling idea for a financial product. For Stately Credit, the concept of payroll-linked lending emerged as a transformative solution, simplifying borrowers’ financial management and reducing stress.

“Throughout my career, I’ve seen well-paid people struggle with finances and fall into a cycle of debt. I have witnessed co-workers and friends take out high-risk payday loans and advances because they were made to believe it was their only option,” says Shanzaib Malik, CEO, and Founder of Stately. Stately was on a mission to make a difference and provide people with the financial support they needed. This mission influenced all subsequent product settings and offer principles.

Before diving into development, securing agreements is pivotal. This includes partnerships with lending capital providers or utilizing one’s own capital, along with obtaining the necessary licenses. Additionally, agreements with data source providers like Plaid, Equifax, or alternative analytical data sources such as PrismData for comprehensive information access are essential. Neofin is currently supporting over 10,000 data attributes from more than 20 data sources and is open to integrating new ones to meet specific customer needs.

Seamless loan repayment flows are crucial for a successful product. Partnerships with payment providers are established to ensure a frictionless experience for borrowers, while also ensuring efficient collections for lenders. Once the agreement is secured, it just takes a minute to activate the payment provider in the customer’s lending application on the Neofin platform.

Risk policies form the backbone of responsible lending. Typically outlined in Excel tables provided by the client, they play a critical role in determining loan eligibility and terms. These policies are implemented in Neofin through its Underwriting Studio, a workspace for building risk policies, scoring models, and underwriting strategies.

In the era of personalized finance, understanding client demographics is paramount. This involves creating a matrix of interest rates based on factors such as credit history and alternative consumer permissioned data. This approach ensures tailored offerings that resonate with individual borrowers.

Clear guidelines on the interest rates, accrual rules, and other financial product parameters are crucial. These elements are being set up in the Neofin’s Loan Management system, setting the foundation for the lending process.

The final step in the customer onboarding journey is signing the needed loan agreements. Neofin’s document engine allows for real-time generation of the loan documents/forms and digital signature.

A seamless user experience is critical for a high-performing loan product. Customers typically come to Neofin with their flows outlined in tools like Figma. All of these flows can be easily implemented in Neofin’s site builder — a no-code site engine tailored for lending products. With the site builder, lenders can make real-time adjustments to customer onboarding strategies.

“In the very first days after launch, we realized there have been some crucial steps in our borrowers’ onboarding process that we simply had not thought about before. Neofin’s site builder has been instrumental as we were talking to users, figuring out their needs and making changes in the front-end flow on the go” – Stately’s Shanzaib Malik shares his experience adjusting the end user’s front-end through Neofin.

In the fast-paced world of financial technology, time, money, and the fear of mistakes can be significant roadblocks for aspiring entrepreneurs looking to launch a lending product. That is why Neofin aims to address these fears by empowering founders and developers to navigate the launch process with confidence.

While a three-month launch into production may be standard, Neofin has redefined the timeline, offering a platform that allows founders to go from idea to market in as little as one month. This rapid deployment is a game-changer for startups and established companies alike, providing a competitive edge in the market.

“We help lending businesses to focus on just business, while making the technical part of the lending process radically simple to launch and manage”, says Alex Kshutashvili, Neofin’s Founder and CTO.

The cost of deploying a new CBS, Loan Origination, or Servicing software can be a significant concern for startups. The Neofin platform is built on principles of openness and accessibility. Now, freelancers, existing banking employees, and startups can test their hypotheses and launch new products without the hefty price tag. This inclusivity not only reduces costs, but also shaves off valuable time, potentially saving up to 18 months in development.

Mistakes in the loan product launch process can lead to financial losses and damage to your brand’s reputation. Neofin’s admin panel and intuitive tools significantly reduce the risk of errors. Changes and adjustments can be made on-the-fly, avoiding the need for extensive developer involvement and minimizing the likelihood of costly mistakes.

Neofin acknowledges that while it provides a robust technological platform for launching lending products, the journey from concept to market can be daunting. To address this, the company has cultivated a community of like-minded no-code founders and enthusiasts. This collective serves as an invaluable resource for individuals seeking practical advice and insights based on firsthand experiences. By joining the Neofin Community, founders not only gain the ability to deploy their projects promptly but also access a supportive ecosystem.

Once you’ve laid the prepwork with a well-defined product strategy and necessary agreements, it’s time to bring your lending vision to life in the digital realm. Neofin offers a range of efficient features and tools to streamline the lending product launch process. As part of this step, it’s essential to leverage these features effectively.

Third-party Integrations:

Leverage Neofin’s built-in features, including integrations with credit bureaus and open banking solutions. The platform is built on the principles of radical openness. It takes just a minute to activate a data source that has been available at the platform out-of-box. At the same time, if the specifics of a certain loan product requires a data source that is not on the platform yet, integrations still take no more than a few days with Neofin.

Underwriting Studio Customization:

Neofin’s Underwriting Studio is a critical tool for tailoring your risk assessment and underwriting process. This feature allows you to fine-tune risk rules, create new ones, and ensure that your lending criteria align with your business goals. The ability to make instant changes in response to evolving market conditions or regulatory requirements is a significant advantage.

“When we built Stately Credit, achieving personalized loan offerings has been one of the challenges. With Neofin’s Underwriting Studio, we have managed to establish a viable product routing and real-time personalized offer calculation.” – says Michael Philippe, Stately’s Co-Founder and CFO.

Admin Panel for Real-time Editing:

The admin panel is crucial for the loan product and portfolio control. It enables real-time adjustments to your lending product without the need for server restarts or code updates. This means that you can quickly adapt to changing customer needs, market dynamics, or compliance requirements, all within the platform.

Community and Support:

The Neofin Community is a resource that connects you with experienced founders, no-code enthusiasts, agencies, members of the specialized organizations and lending experts who can provide insights and advice based on their experiences with Neofin. This supportive network can help you navigate challenges, brainstorm ideas, and optimize your lending product, making it a valuable asset as you prepare for launch.

Testing and Launch:

Before launching your lending product, take advantage of Neofin’s two default instances, stage and production, to thoroughly test all aspects of your product. This ensures that everything is working seamlessly and minimizes the risk of potential issues upon release.

No-Code Academy:

Neofin’s No-Code Academy is a recent addition to their offerings. This is a no-code lending automation enthusiasts’s Wikipedia which empowers the founders to deploy the new products independently without the need for external resources. It provides comprehensive training and resources to guide the founders through the no-code development process, enabling you to take control of your lending product’s journey.

Choose a Template (Optional):

Neofin offers a variety of pre-designed templates to accelerate the development and launch of lending products. These templates cover a range of loan categories, including unsecured consumer loans, embedded lending products, secured loans, and revenue-based financing. Each template comes with out-of-the-box integrations, allowing you to tailor product settings to your specific target audience. The templates are designed to save you time and effort in product setup and configuration, making it easier to bring your lending product to market swiftly and efficiently.

Post-Launch Adaptations:

After the initial launch, continue to use the admin panel to make any necessary adjustments or enhancements. This agile approach allows you to respond to evolving market needs without the need for extensive external development requests.

Stately Credit’s success story with Neofin’s no-code lending automation platform demonstrates the seamless journey accessible to entrepreneurs venturing into the lending product sphere. Furthermore, whether you belong to a professional association boasting fintech founders among its members or represent a company dedicated to serving fintechs and financial institutions, Neofin provides an expeditious route to introducing loan products for your members. All the common fears associated with building a loan product are addressed when armed with an intuitive product building environment and a supportive community.

A loan product is a financial product offered by banks or financial institutions that allows individuals or businesses to borrow money under specific terms, including interest rates and repayment schedules.

Loan origination is the process of creating a new loan, which includes application, underwriting, and approval stages before the funds are disbursed to the borrower.

A risk policy in lending outlines the criteria and guidelines used to assess the creditworthiness of borrowers, determining eligibility and terms for loans.

Personalized finance refers to financial services tailored to meet the individual needs and preferences of consumers, often using data analytics to customize products.

A seamless user experience refers to a smooth and intuitive interaction that users have with a financial product or service, enhancing satisfaction and engagement.

Explore more articles in the Finance category