Life after Lehman Brothers

Published by Gbaf News

Posted on September 22, 2018

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on September 22, 2018

4 min readLast updated: January 21, 2026

MORGAN McKINLEY LONDON EMPLOYMENT MONITOR

London Employment Monitor August 2018 highlights:

City jobs spike bucks economic and seasonal trends

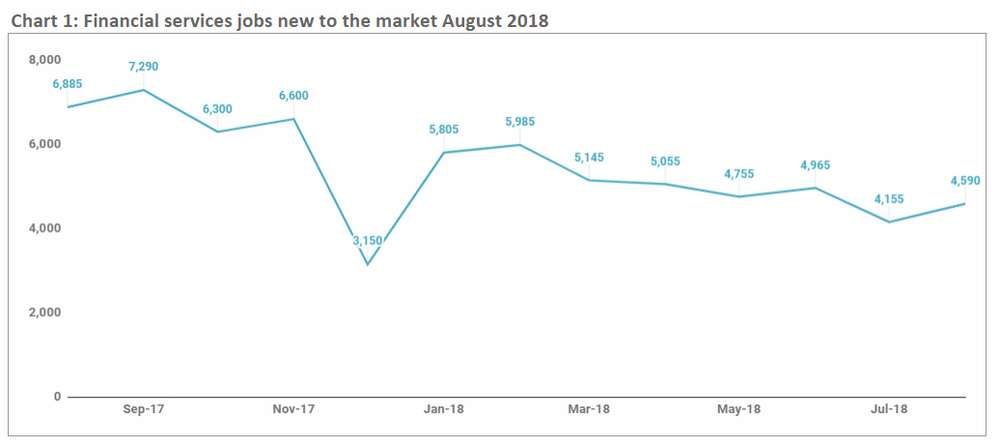

City jobs were up 10% month-on-month in August, a significant increase

“Excluding the traditional January jolt in new jobs, we haven’t seen a double digit increase in jobs since March of 2017”, said Hakan Enver, Managing Director, Morgan McKinley Financial Services. “With Brexit six months away and no consensus in sight, it’s astonishing to see so many new jobs open up”.

August_2018_Chart1 Financial services jobs new market

The increase is even more significant coming during a traditionally sleepy time of the year for hiring, when most businesses are holding off on releasing new jobs until after the summer holidays are over. It’s not all sunny skies however, as year-on-year figures paint a more sober portrait, showing a 33% decrease.

Job seeker optimism on the rise

The 2% month-on-month decrease in job seekers is also encouraging in light of July’s 21% month-on-month increase. Similarly, the 8% year-on-year decrease is an indicator of stabilisation after two years of stark decline in job seekers. “It’s too early to call an end to the City Brexodus, but this summer job seekers were out in force”, said Enver.

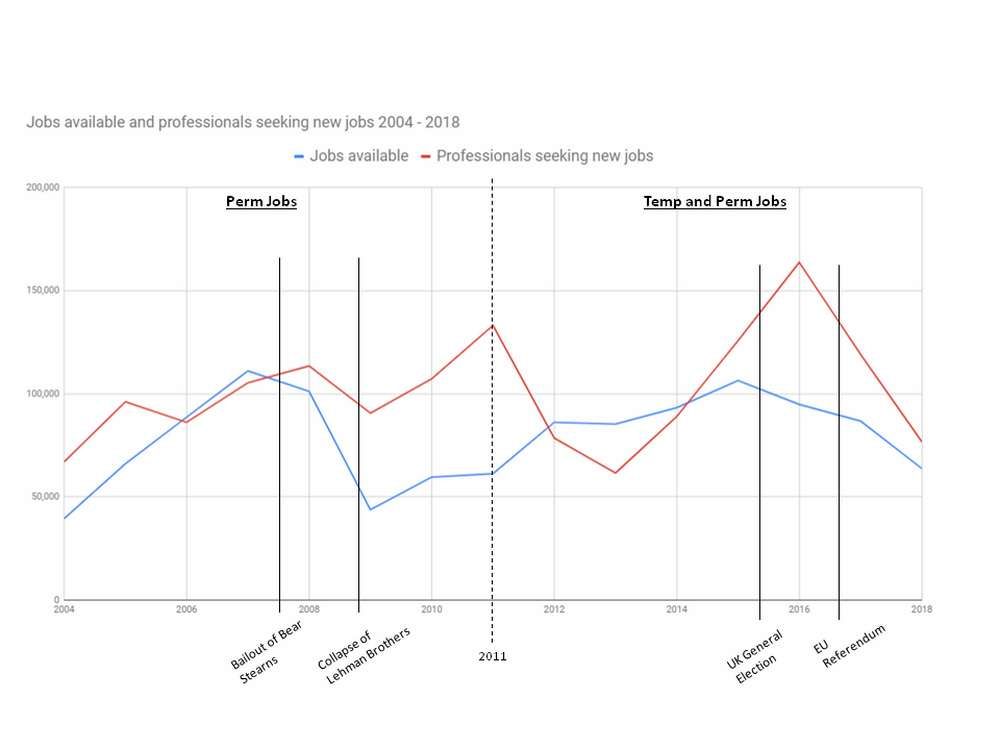

In additional good news, City salaries increased by 22% month-on-month, consistent with a positive upward salary trend throughout the summer. “The salary increases are likely the greatest contributor to why we are seeing confidence among job searchers soaring”, said Enver.

August_2018_Chart2 Jobseekers available both in out employment

Lehman Brothers’ impact still felt, decade later

A decade ago – 15th September 2008 – marked the collapse of Lehman Brothers, which sparked a financial crisis that triggered shock waves across the globe, devastating individuals from all walks of life. “Generations learned, overnight and in the most terrifying manner, just how deeply connected financial services are with every facet of our lives”, said Enver.

From foreclosed homes in Florida and to soaring childhood poverty in Greece to job losses across the board, recovery has been mixed for businesses and individuals alike. “In the blink of an eye regulatory departments went from sleepy backwaters of financial institutions to the stewards of the frontlines”, said Enver.

August_2018_Chart 3 Average change in salary

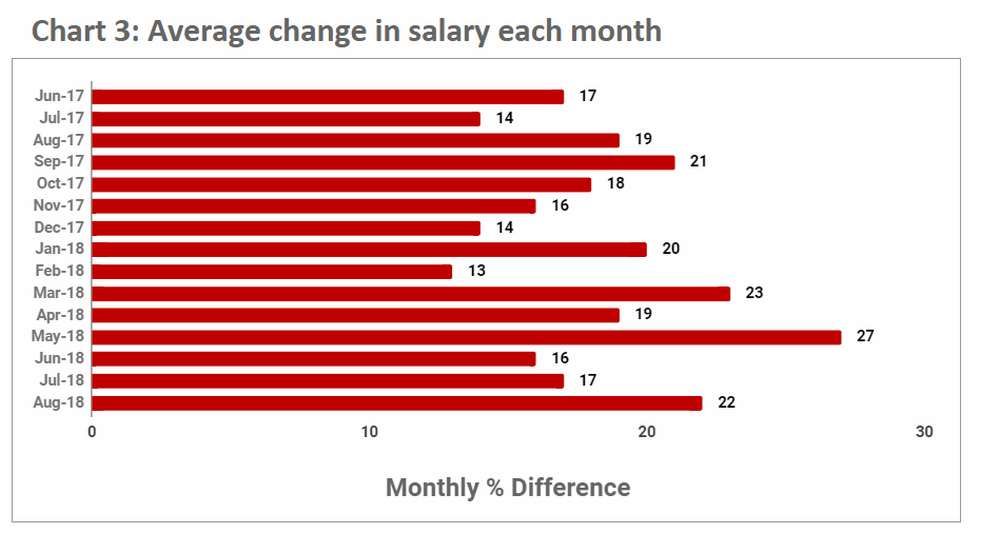

A look back at data from 2004 onwards shows the impact of the Bear Stearns bailout in March of 2018 – six months before the Lehman Brothers collapse – setting the stage for the economic crisis as it came to be known. In the years following the collapse of Lehman Brothers, a series of stressors contributed to peaks and valleys in City employment. “Remembering the devastation of the Lehman Brothers crash helps put our current situation in perspective. It was a much more treacherous storm to weather than Brexit”, said Enver.

Indeed the historic data also shows that Brexit in 2016, as well as the 2015 referendum on the Conservative government, triggered an initial spike in hiring in the Square Mile, only to decline shortly thereafter for an extended period of time, though both were less devastating than the loss of Lehman Brothers.

“Only time will tell how fully we’ve absorbed the lessons of the 2008 crisis”, said Enver. “The 14 year trend shows how far the volume of jobs dropped post 2011.* Clearly, the impact of Lehman’s has had a devastating effect on hiring numbers. Teams shrunk in size and more people were having to search for new employment. This is indicative of the increase in candidates searching for new positions between 2009 and 2011. As markets stabilised, the number of job seekers dropped considerably and it wasn’t until 2013 that confidence in searching for alternative vacancies trickled back. To some extent, much of this was a result of many financial institutions having to hire aggressively within their regulatory departments”, concluded Enver.

*Note: The chart shows only permanent jobs being reported from 2004 onwards. From 2012 Morgan McKinley reported on a combination of both permanent and temporary jobs.

Jobs available and professionals seeking new jobs 2004 – 2018

Explore more articles in the Business category