How to get your data in shape to migrate and why it’s crucial to comply

Published by Gbaf News

Posted on February 26, 2013

6 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on February 26, 2013

6 min readLast updated: January 22, 2026

By Jonathan Williams

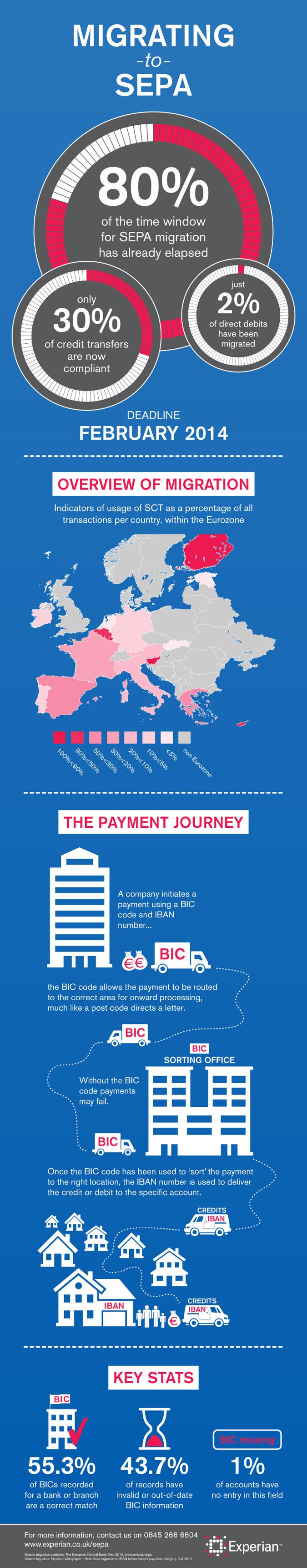

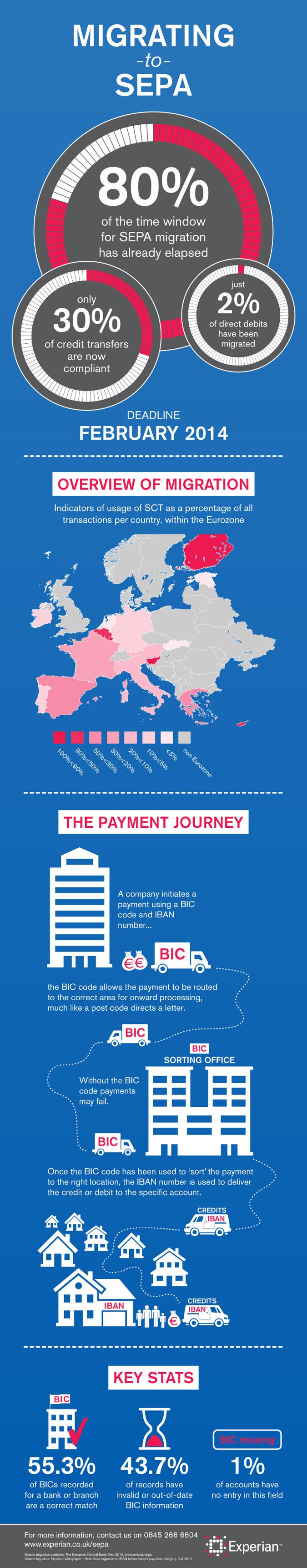

Although there is little under a year to go until the legally-binding Single Euro Payments Area (SEPA) compliance deadline is upon us, many businesses are still unprepared for its impact. The SEPA initiative removes existing differences between national and international, domestic and cross-border payments, and becomes mandatory in February 2014 for businesses in Eurozone countries, (2016 for those in non-Eurozone territories) wishing to make and receive payments in Euros.

Despite the fact that we are over 83% through the time-window of SEPA-migration, the volume of credit transfers in the Eurozone migrated to SEPA is only 30.3% . The direct debit migration situation is even more chronic, as only 2.1% currently comply.

Whilst the, albeit minor, increase in compliance is encouraging for credit transfers, the position for direct debit originators is concerning. The vast majority of transactions are still to be migrated and, in some cases, new mandates must be sought from both businesses and consumers. It is vital that organisations collecting via direct debit immediately examine their processes and plan to comply by next year’s deadline.

Businesses must ensure that all their banking data adheres to the following international standards: International Bank Account Number (IBAN) – ISO13616 – Bank Identifier Code (BIC) – ISO 9362 – and payment file format ISO20022 XML. Essentially, in order to be SEPA-compliant, organisations will need to convert the bank account data they currently hold in domestic format, or BBAN (Basic Bank Account Number), to IBAN in keeping with the aim to drive down cross-border payments barriers by establishing common standards and processes.

Payment Service Providers should accept IBAN-only information from their users for domestic transactions from February 2014. They are allowed to provide BBAN to IBAN conversion services, but after this point Payment Service Providers can only accept instructions that include an IBAN. The rest of the world will need to be fully compliant by 2016. In the interbank space, the requirement is for IBAN and BIC from February 2014. So, when a Payment Service Provider has accepted an IBAN, they will need to append the necessary BIC in order for the transaction to be completed. As a result, banks throughout the SEPA zone must invest in back-office technology that supports their customers’ migration to SEPA.

The time for full data conversion depends on the size of the business; the number of suppliers it has; the staff size; and how much time it has to dedicate to contacting people for data clarification. To give an example, global retailer Levi Strauss & Co. recognised the need to convert to SEPA early and worked with Experian to validate and convert their data. Experian revealed that 91% of the data held was accurate and complete, leaving only 9% of records to be verified. Levi were then able to focus their efforts on correcting this data, saving the company the potentially huge cost of checking all 100% of the records themselves to unearth the 9% with errors, thus saving a significant amount of time, money and resource. The project had been expected to take six months, but within two months the file was 100% complete. Additionally, 95% of data was complete, correct and converted in only ten days, enabling Levi’s Shared Service Centre to start processing all payments into Europe through their bank.

Businesses should understand the timeline involved, and start preparing for migration as soon as possible. Transitioning data and amending incorrect details will take time, and the work involved should not be underestimated. Prior to data conversion, companies need to think about their business software and make sure that it is capable of handling IBANs, as well as BICs, and that they can process the correct payment files for their banks. They should be in communication with their bank and their software providers to certify they have the necessary resources and then check that all their data is correct before migrating.

Although IBANs have been in existence for many years, they are still not widely recognised. So, businesses will need to consider how they update their legacy data without confusing their customers, suppliers and staff. Businesses which currently use IBAN-format account numbers have reduced error rates in comparison with those using domestic account numbers – only 4.6% as opposed to 12.7%. However, this would still represent a significant increase in failed payments over the 1-2% currently experienced by European organisations, because of the error that a bad migration will expose.

Businesses are not currently seeing this rate of failure because there is enough information in account data to enable banks to unobtrusively correct payments with inaccurate account data. Banks frequently fix any incorrect data silently and transparently where they can without informing the originator of the payment; this is more efficient than declaring the payment failed, and also provides good customer service. For example, if a bank receives a payment including a branch code whose branch closed 3 years ago, it is known to the bank that any accounts from the old branch will have been transferred to another, and so the bank may process the payment as if to the correct branch in order to complete the payment, although the data directs otherwise. Under SEPA, the clearing system would not be able to identify the BIC, therefore couldn’t route the payment to the receiving bank that is currently able to address such errors, and so there would be a significant risk that such a payment would fail.

Migrating existing customer records to the IBAN standard will be a huge challenge given the sheer scale of records and, as a result, large creditors face notable challenges to migrate and maintain SEPA-compliant mandate information. Even then, errors will not be fully eradicated. The most common error is related to out-of-date or invalid bank or branch codes. Millions of BICs are critically impaired or out-of-date following numerous bank mergers, reorganisations, defunct branches or structural changes. Over 55% of BICs recorded for a bank or branch are a correct match, but 1.0% do not have data in this field, and a concerning 43.7% of records have invalid or out-of-date BIC information.

There is much to do and not much time to make these changes, especially for larger organisations with thousands of accounts to validate and migrate. Failure to successfully migrate before the deadline could significantly affect a business’ ability to continue making and receiving payments. Organisations need the confidence that they can continue doing business at minimal cost and risk, using the correct bank account formats. Separating the good transactions from the bad as early as possible is critical in order to quickly resolve costly problems, and performing a full validation is vital. Migrating with a service partner who can manage the process will save time and money, make the transition smoother, and ensure that all data is valid as well as correct.

The SEPA finish line is now in sight following formal ratification of the end date and, with so much still to do, there should be a sense of urgency amongst businesses. SEPA clearly has enormous benefits, and this poses a timely opportunity to permanently eliminate the long-standing costs linked to running legacy systems.

Explore more articles in the Banking category