How Firms Value Alternative Datasets

Published by Gbaf News

Posted on January 21, 2019

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on January 21, 2019

4 min readLast updated: January 21, 2026

By Rich Newman. SVP and Global Head of the Content and Technology Solutions (CTS) group at FactSet.

The rise in alternative data is an important trend to watch. By 2020, the alternative data industry is projected to be worth $350mm according to the AlterativeData.org. Alternative data (content derived from varied sources of information like images, billing statements, heat maps, social media interactions), has become an increasingly common consideration over the last five years, and offers a number of interesting new possibilities. Satellite data, for example, can provide real-time insight on car traffic to a business locations and indicate how a company is performing.

While data sets like fundamentals and benchmarks are still a critical part of the quantitative analyst tool kit, identifying how these core data sets are being used can shed light on the incorporation of new and novel feeds. To determine which data sets are valued most today, FactSet partnered with Coleman Parkes to survey Heads/Directors/VPs of Quantitative Analysis, Senior Quantitative Analysts, Data Scientists, and Chief Data Officers from 50 hedge funds and institutional asset management firms across the U.S., EMEA, and APAC. The results provide insights into the types of data quantitative analysts value and use today, and what types they are likely to value more in the future.

Today’s Data Vs Tomorrow’s Data

Throughout our conversations with quants, the survey found that the core content and alternative data types most valued today are likely to change dramatically over the next several decades.

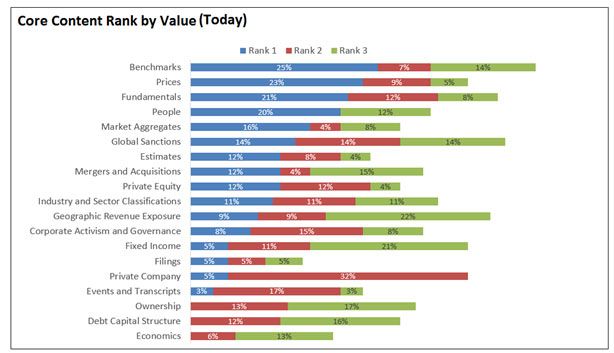

When survey respondents were asked which type of core content they currently value the most, 25% rank benchmarks first, prices closely follow at 23%, and fundamentals come in third at 21%.

core content rank by value (today)

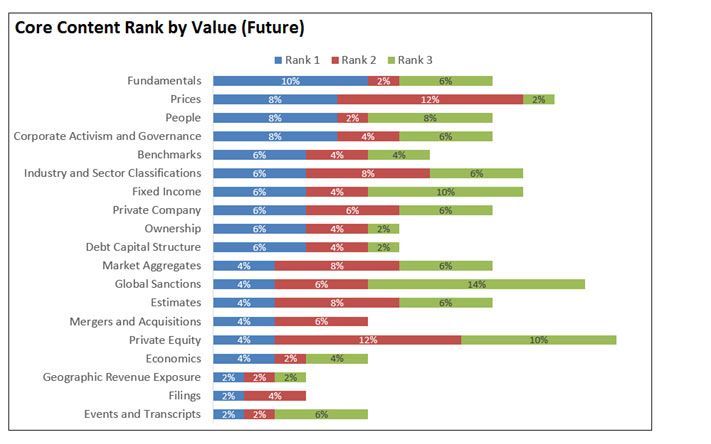

However, among core content items respondents think will be valued most in the future, benchmarks fell to fifth place, while fundamentals and prices continued to rank high (first and second place, respectively).

core content rank by value (future)

Among other core content items, the ones that drop significantly from being highly valued now to less valued in the future include market aggregates, global sanctions, estimates, mergers and acquisitions, and private equity. Items that will be more valued in the future include corporate activism and governance, fixed income, industry and sector classifications, private company, and ownership core content.

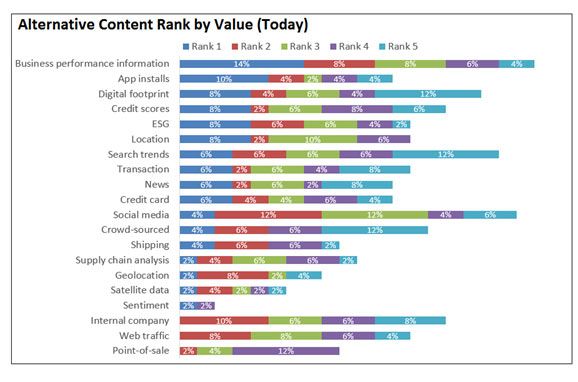

alternate content rank by value(today)

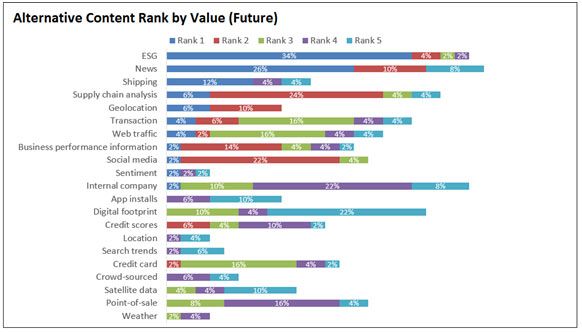

The survey also asked respondents to pick the top five alternative data sets they found most valuable. Today, those datasets include business performance information, app installs, and digital footprints. However, when asked about future data sets they’d find valuable there were considerable differences among respondents. In the future, respondents expect to rely on ESG data, news, and shipping information; however, these are ranked much further down the list when it comes to the types of alternative data valued most now. Among alternative data types, others that also rise significantly from how they are valued now to how they will be valued in the future are supply chain analysis, geolocation, web traffic, and sentiment. Data types that fall significantly from how they are valued now to how they will be valued are credit scores, location information, and search trends.

alternate content rank by value(future)

Overall, core content and alternative data types that are valued in the future will be different than those valued now, according to the survey. However, it is the types of alternative data valued the most that are being shaken up and changing to a greater extent, whereas the types of core content used most today will not change as much in the future.

Take Aways

Alternative data is becoming more mainstream and important to the broader field of traditional asset managers, as opposed to just hedge fund managers. Fundamentals are still a key consideration for investors. When it comes to alternative data, it’s critical to ensure that organizations are getting data from the correct sources and in a timely fashion. A service provider partner can be instrumental in helping financial firms tackle and address data management issues they now realize they have.

Explore more articles in the Technology category