Government misses out on its biggest export opportunity

Published by Gbaf News

Posted on October 16, 2012

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on October 16, 2012

5 min readLast updated: January 22, 2026

Ill researched policies leave UK tax payer footing the bill as Prime London Property takes a hit

The British Government has been dealt a tough hand: a debt mountain, a Eurozone crisis and a Credit Crunch. But, in their efforts to pull the UK out of recession, the Coalition is concocting policies which could be as destructive as the crises themselves. They have demonstrated, time and time again, that there is no financial competence in government, nobody concerned with detail, nobody able to analyse the consequences of policy change.

London is a financial centre, a go-to destination, a pinnacle of culture and a centre of excellence. At its heart is Prime London Central residential (PLC). These six square miles of prime real estate house some of the world’s most iconic property. It is one of the UK’s biggest income generators and a magnet for foreign investment. So, whilst a house is rarely picked up and ‘exported’ to another country, the contribution that property sold to foreign investors generates for the UK economy makes PLC one of our top exports.

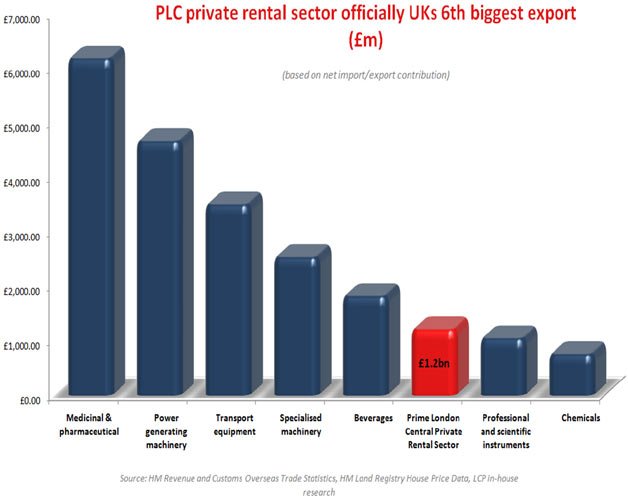

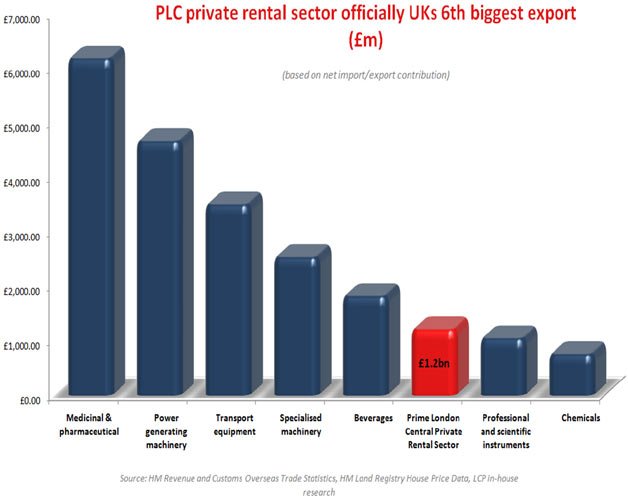

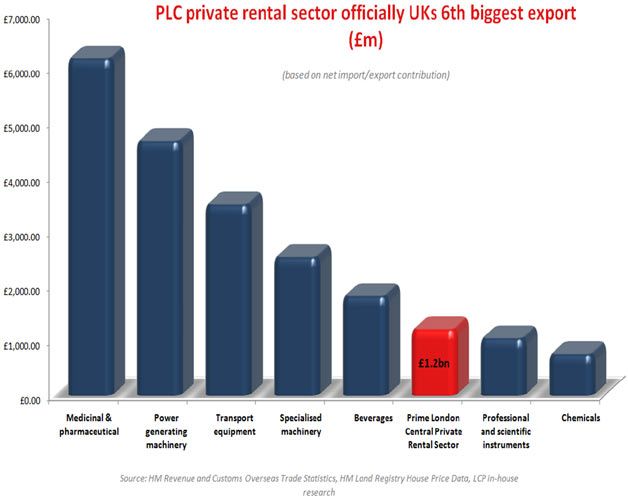

Half of PLC is bought for rental rather than owner occupation. This private rented sector represents a hive of business activity that stimulates economic growth – with foreign investors making up at least 60% of it. Specialist fund and asset manager, London Central Portfolio (LCP), have calculated that they contribute a staggering £1.2bn per annum to the economy and the national tax coffers. This makes it the UKs sixth biggest ‘export’.

How? The purchase of a flat or house brings employment to our lawyers, accountants, estate agents, architects, builders, furnishers, plumbers and electricians. Work on a London property generates business for the manufacturer of furniture in Barnsley, paints in Bournemouth and flooring in Birmingham. For every property in Central London bought for rental, the additional associated spend, to the benefit of the economy, is a further 20% of its value. On top of this, the income generated for government in stamp duty and in VAT receipts amounts to over £400m a year.

The international tenants who occupy these flats also support the economy in a major way. They contribute to the £10bn spent in PLC on the retail trade, education, the night time economy and tourism. They make up the cosmopolitan population which underpins London’s vibrant and culturally diverse community.

It seems blindingly obvious that the Government should stimulate the growth of, what is arguably, the UK’s biggest and most successful brand. So far, the Chancellor seems determined to do the opposite. It began with their ill-conceived taxation measures unveiled at the most recent Budget. Without thought to the consequences, the government increased stamp duty to 15 per cent for companies buying residential property over £2m, announced plans to impose an annual charge of up to £140,000 per annum and a new capital gains tax on their sale. These measures clearly took aim at our capital where 60% of properties over £2m are located.

Already these proposals have had a devastating effect on investment in the capital, with a reduction in sales of around a quarter for properties over £2m. According to detailed analysis sent by LCP to HMRC and the Treasury, this will result in a loss to the economy and exchequer of £295m over the next year and put an estimated 3,000 vital jobs at risk.

The new taxes give a clear message that Britain is no longer ‘open for business’. Investors and developers are now considering other options and voting with their feet. It is reported that luxury property developers, Candy and Candy, are deserting London for New York. The government have failed to recognise that the central London private rented sector is a global ‘export’ and if the finances don’t work, people will go elsewhere. And if they go elsewhere, jobs will suffer.

“Whilst turning foreigners and investors away may be a vote winner, it is morally corrupt to roll out populist measures at the cost of jobs and a reduced exchequer tax take. PLC is our sixth biggest export; these six square miles of the world’s most sought after property should be our pride, not our shame” comments Naomi Heaton, CEO of LCP.

With three weeks of party conferences gone by, it doesn’t seem that our other leading political parties understand the importance of this major export either. The Lib-Dems do not want foreigners to have second properties in London, despite their huge contribution to the private rented sector and the economy. ‘One Nation’ Labour has a lop-sided commitment to boost spending at the bottom end of the market with no qualms about what happens at the top.

Perhaps, finally, there is a gleam of hope. The Conservatives appear to be grasping the idea that the UK should be welcoming foreign investors and international corporates, not penalising them. That is, if we are to believe David Cameron at the Tory party conference when he said “The truth is, we are in a global race and that means an hour of reckoning for countries like ours. Sink or swim”

Fine words and hopefully the practice will follow. PLC is a global brand that, above all, attracts foreign investors. These are the people who can provide jobs, boost tax revenues and help pull the UK out of recession – without the UK footing the bill.

London Central Portfolio is a specialist fund and asset manager operating in the Prime London Central residential sector. Their third fund, London Central Apartments, is currently open to subscriptions. For further information visit www.lcpfund.com or contact Hugh Best, Investment Manager, on +44(0) 20 7723 1733 or fund3@londoncentralportfolio.com

Explore more articles in the Investing category