FICO FRAUD MAP: EUROPEAN CARD FRAUD LOSSES HIT NEW HIGH

Published by Gbaf News

Posted on August 7, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on August 7, 2014

3 min readLast updated: January 22, 2026

Interactive FICO fraud map shows region’s struggle with financial crime

FICO, a leading predictive analytics and decision management software company, published its latest map of card fraud in Europe, showing that card fraud losses in 2013 for the 19 European countries studied reached €1.55 billion. This figure was a new high, and slightly more than the previous peak in 2008, according to data supplied by Euromonitor International, a provider of global strategic market intelligence.

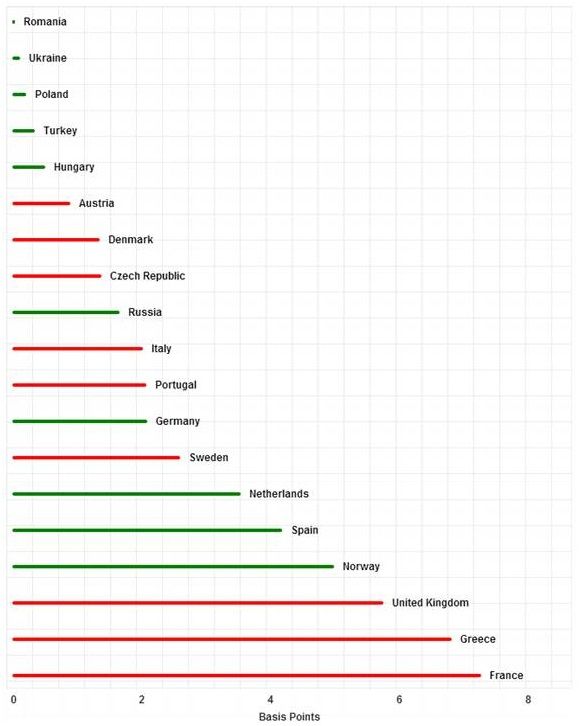

While the UK experienced £450 million in losses, the highest level since 2008, both France and Greece had higher ratios of fraud losses to card sales, at 7 basis points (.07 percent). The fastest growth of card fraud losses in Europe occurred in Russia, where losses jumped nearly 28 percent since 2012.

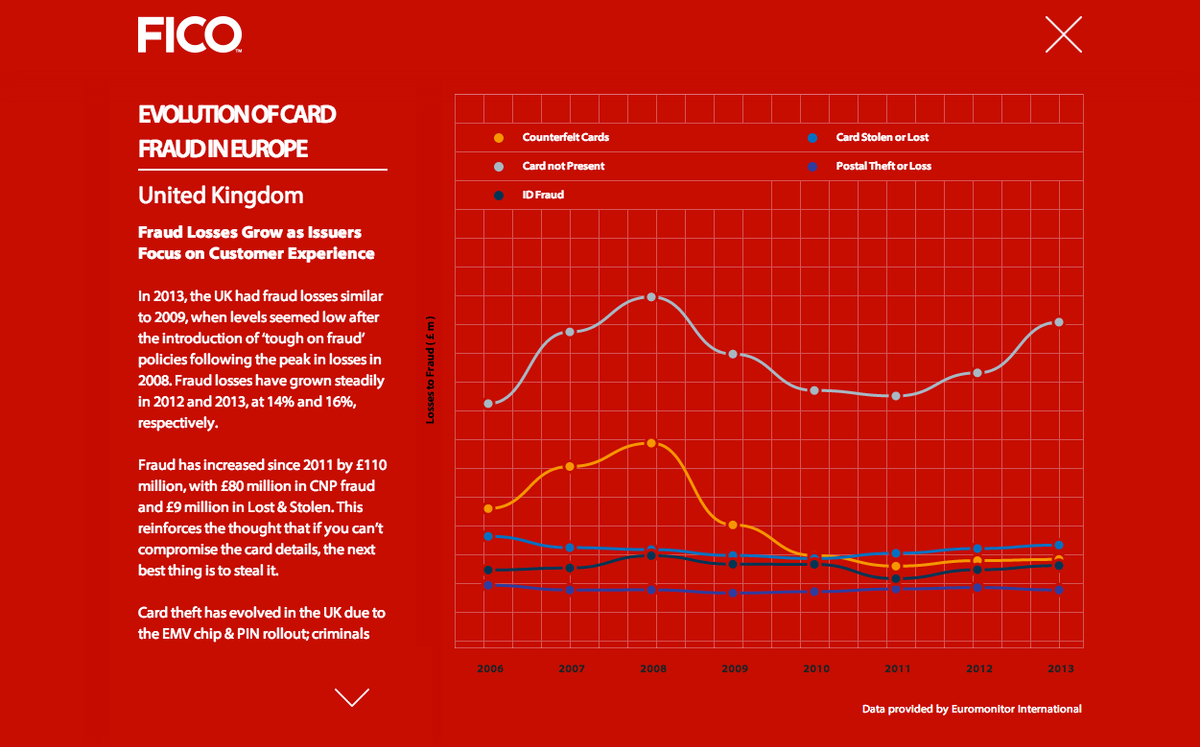

“When fraud losses peaked in 2008, UK issuers sharply reduced card fraud through chip and PIN and fraud analytics,” said Martin Warwick, a principal fraud consultant at FICO in EMEA, who provided the commentary for the map. “However, tougher fraud detection policies and thresholds also block more genuine transactions, and now the focus for UK banks and regulators is very much on improving the customer experience. To counteract the resulting increase in fraud, we’re beginning to see issuers look to such technologies as interactive, automated customer communication services that contact customers in real time when a transaction triggers a fraud alert. This technology helps balance the need to protect customers from fraud with the need to provide a positive purchase experience.”

FICO Fraud Map: European Card Fraud Losses Hit New High

The UK and France suffered 62 percent of the total fraud losses for the 19 countries in the fraud map, reflecting their higher rates of card usage, which make them targets for criminals. Ten of the countries saw a rise in fraud compared to 2012, while nine stayed the same or saw reduced losses.

“These losses are a wake-up call that should start a new wave of anti-fraud initiatives by regional bodies and card issuers,” Warwick said. “After the previous peak, in 2008, this led to new fraud migration patterns. Unfortunately, many organisations do not maintain continuous investment in fraud prevention systems and staff — they invest only when the problem grows. The companies and countries that aren’t investing this year will be the new targets for criminal activity.”

FICO’s European Fraud Map shows card fraud losses from 2006-2013 for 19 countries across five categories, including counterfeit fraud, card stolen and ID theft. Country-specific information shows how fraud has evolved, and indicates new risks in such areas as ID theft, counterfeit cards and online fraud. Regional trends include the increase in card-not-present (CNP) fraud online. The map can be accessed at http://fico.com/landing/fraudeurope2013/

FICO fraud solutions help banks manage their enterprise-wide fraud challenges. FICO Falcon Fraud Manager is the world’s leading card fraud management solution, and protects more than 2.5 billion payment cards worldwide.

European Card Fraud Levels in 2013

Basis Points = Card Losses Due to Fraud / Card Sales

Source: Evolution of Card Fraud in Europe 2013 (www.fico.com/landing/fraudeurope2013). Data provided by Euromonitor International.

Explore more articles in the Top Stories category