Equity Monthly: Embrace volatility as trade war could escalate

Published by Gbaf News

Posted on July 4, 2018

7 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on July 4, 2018

7 min readLast updated: January 21, 2026

By Peter Garnry, Head of Equity Strategy

As the books for the first half of 2018 were closed on Friday, the disappointing reality was clear to investors: almost all asset classes delivered flat or negative returns. Only momentum stocks (mostly technology shares) seemed to deliver strong results of around 7.5% for the first half. The biggest casualties were emerging market bonds (minus 10%) and equities (minus 5%) driven lower not only by the escalating trade war between the US and China, but also because of increasing financial pressure due to a stronger USD and higher US interest rates weighing on financial conditions.

Emerging markets could easily become the biggest victim in the second half if current trends continue. One thing stands clear in July: volatility will pick up as trade war headlines intensify and increase in frequency. Our overall message in July is to stay defensive and cautious as things could easily get more ugly before things turn around.

Emerging market equities (blue) versus bonds (black, source: Bloomberg)

Stay defensive

Our dynamic asset allocation strategy (called Stronghold, which is a high-end service Saxo Bank offers to clients) went quite defensive in February due to the volatility shock altering the market structure and illuminating the fact that that tail-risks are constantly lurking around the corner.

In our Q1 Outlook, we highlighted that equities would soon take a hit as macro surprises would likely turn negative. While that call has been proven right, things have only become worse. We remain defensive on global equities as no firm positive catalyst is seen as ready to take equity markets to new highs. With the escalating trade war between the US and its biggest trading partners, uncertainty is going up and macro data will soon start to show the initial havoc from the tit-for-tat trade tactics.

In terms of industries, we recommend underweight exposure to semiconductors, industrials, and especially the car industry as these industries will become the battleground of the ongoing trade war. The best way to protect your portfolio (save for going all-cash or heavily into bonds) is to reduce cyclical sector exposure and increase exposure to health care, consumer staples, utilities, and telecom.

Outside these sectors, we believe software companies can also provide a good shield against volatility due to expected strong earnings in Q2.

Source: Saxo Bank

Underweight trade surplus countries

June showed quite clearly where investors believe the biggest pain will be felt from the trade war. All countries with a significant trade surplus against the US performed worse than global equities. These countries are Canada, Mexico, Germany, China, Japan, and South Korea. It is our recommendation that investors reduce exposure to these countries for now. In the short term, China stands to lose the most as its hand is the weakest; the Chinese economy still needs a strong export sector to print high growth rates and thus an escalating trade war with the US is not in Beijing’s interest.

Single stocks

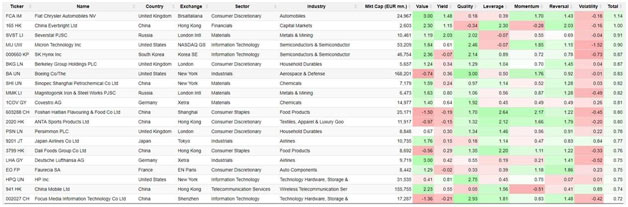

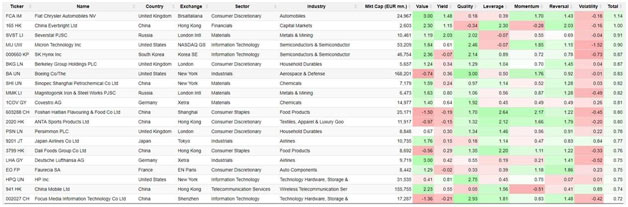

For the regular reader it should be no surprise that we run our equity research by quantitative methods. Our flagship model is called Equity Radar and is basically a factor model scoring around 1,800 global stocks across seven parameters: value, yield, quality, leverage, momentum, reversal, and volatility.

The table below shows the model’s top 20 picks based on the total score (a simple average of the seven factor scores). What has been interesting to note lately is that more Chinese companies have moved into the top 20 list; the main driver has been the reversal factor tied to the recent decline in Chinese equities.

Please note the two semiconductor stocks (Micron Technology and SK Hynix) in the list. While we are tactically negative on semiconductors, we do not overwrite the Equity Radar model with our tactical views on industries and sectors.

The top 20 global stocks based on our global equity factor model (source: Bloomberg, Saxo Bank)

By Peter Garnry, Head of Equity Strategy

As the books for the first half of 2018 were closed on Friday, the disappointing reality was clear to investors: almost all asset classes delivered flat or negative returns. Only momentum stocks (mostly technology shares) seemed to deliver strong results of around 7.5% for the first half. The biggest casualties were emerging market bonds (minus 10%) and equities (minus 5%) driven lower not only by the escalating trade war between the US and China, but also because of increasing financial pressure due to a stronger USD and higher US interest rates weighing on financial conditions.

Emerging markets could easily become the biggest victim in the second half if current trends continue. One thing stands clear in July: volatility will pick up as trade war headlines intensify and increase in frequency. Our overall message in July is to stay defensive and cautious as things could easily get more ugly before things turn around.

Emerging market equities (blue) versus bonds (black, source: Bloomberg)

Stay defensive

Our dynamic asset allocation strategy (called Stronghold, which is a high-end service Saxo Bank offers to clients) went quite defensive in February due to the volatility shock altering the market structure and illuminating the fact that that tail-risks are constantly lurking around the corner.

In our Q1 Outlook, we highlighted that equities would soon take a hit as macro surprises would likely turn negative. While that call has been proven right, things have only become worse. We remain defensive on global equities as no firm positive catalyst is seen as ready to take equity markets to new highs. With the escalating trade war between the US and its biggest trading partners, uncertainty is going up and macro data will soon start to show the initial havoc from the tit-for-tat trade tactics.

In terms of industries, we recommend underweight exposure to semiconductors, industrials, and especially the car industry as these industries will become the battleground of the ongoing trade war. The best way to protect your portfolio (save for going all-cash or heavily into bonds) is to reduce cyclical sector exposure and increase exposure to health care, consumer staples, utilities, and telecom.

Outside these sectors, we believe software companies can also provide a good shield against volatility due to expected strong earnings in Q2.

Source: Saxo Bank

Underweight trade surplus countries

June showed quite clearly where investors believe the biggest pain will be felt from the trade war. All countries with a significant trade surplus against the US performed worse than global equities. These countries are Canada, Mexico, Germany, China, Japan, and South Korea. It is our recommendation that investors reduce exposure to these countries for now. In the short term, China stands to lose the most as its hand is the weakest; the Chinese economy still needs a strong export sector to print high growth rates and thus an escalating trade war with the US is not in Beijing’s interest.

Single stocks

For the regular reader it should be no surprise that we run our equity research by quantitative methods. Our flagship model is called Equity Radar and is basically a factor model scoring around 1,800 global stocks across seven parameters: value, yield, quality, leverage, momentum, reversal, and volatility.

The table below shows the model’s top 20 picks based on the total score (a simple average of the seven factor scores). What has been interesting to note lately is that more Chinese companies have moved into the top 20 list; the main driver has been the reversal factor tied to the recent decline in Chinese equities.

Please note the two semiconductor stocks (Micron Technology and SK Hynix) in the list. While we are tactically negative on semiconductors, we do not overwrite the Equity Radar model with our tactical views on industries and sectors.

The top 20 global stocks based on our global equity factor model (source: Bloomberg, Saxo Bank)

Explore more articles in the Investing category