DailyFX+: The Ultimate Forex Trading Toolbox

Published by Gbaf News

Posted on July 15, 2011

12 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 15, 2011

12 min readLast updated: January 22, 2026

The foreign exchange market, better known as #, is the most traded financial market in the world. Every trading day over $4 trillion worth of currencies are traded across the globe. Once only available to large banks and institutions, # trading is now available through the advancement of technology and the Internet to retail traders. More people are joining the # trading crowd every day to take advantage of the benefits the # market has to offer, such as liquidity and being open 24 hours a day, five days per week. But these benefits also bring along the need to fully master the # market and have constant access to trading instruments in order to be a consistent trader.

FXCM Inc. (NYSE: FXCM) is one of the largest global online providers of # trading and has proven to be a good place to trade. It boasts multiple platform offerings including Trading Station II, Strategy Trader, MT4, and Active Trader, providing clients a variety of choices to trade based on their needs. For novice traders, there is a free demo account that enables new traders to try currency trading before they commit their money, risk-free.

To begin # trading, it’s necessary to understand the market and to be able to analyze it. There are many ways to build # trading strategies. There has been a constant debate on what methods have the best performance. The # research team at DailyFX—an online provider of # news, research, analysis, and trading tools—believes that a trader should always look to expand their knowledge of the markets and test strategies. It is practically unheard of that one strategy works all the time (what is referred to as the “holy grail”); so make sure that you and your strategy adapt to prevailing market conditions. We believe that this is the best path towards consistent trading.

DailyFX is the ultimate place for news, research, and analysis specific to the niche of # trading. More than thirty articles are produced on a daily basis together with videos, webinars, and trading tools. The articles and videos can be one of the best ways to learn about what is going on in the markets and learning about possible forecasts. But the # market is constantly influenced by many different factors, so the DailyFX research team won’t be able to cover the latest movements and their analysis in full immediately. Therefore, we have formed the real-time # news section where the research team will post a short comment on what is going on in the # market at that moment. If needed, they also provide links to the source article or charts. So if DailyFX readers are present on this page, they can find out about every topic in the market and, furthermore, interact with the DailyFX research team.

DailyFX+ is an all-in-one, free # trading toolkit for all live FXCM clients, guiding them step-by-step through their trading journey, 24 hours a day. It doesn’t end with # market news, fundamental/technical analysis, and beginner’s education. DailyFX+ takes # trading education to a whole new level with Trading Signals, Speculative Sentiment Index, Technical Analyzer, and more.

Trading Course

The DailyFX+ # Trading Course is committed to providing traders with the very best educational tools and resources on the web. It is designed to introduce popular trading tools and techniques in a manner that both new and experienced traders can benefit. The course is designed to reach out to many different types of traders to help them become more educated. The course consists of sixty video lessons, spanning 15 trading subjects and over ten hours of live, instructor-led webinars each week.

The video lessons offer traders a choice of an in-depth comprehensive look or a short instructor take on # trading. Regardless of the trader’s knowledge, there is something new they can learn through the course at their own pace. The course allows a trader the ability to create a learning plan around their personal schedule.

In addition to the videos and webinars, students can complete homework assignments and further their learning through course forum discussions. Information alone is not usually all that is needed. Most individuals also want a teacher, a coach, a mentor—someone to help them along the way. The live lessons offer traders a location for more than just trading ideas—they can see how those ideas are arrived

Since trading on technical analysis can apply to any market, coaching is also offered on CFD products like commodities, gold, and oil.*

The coaching received has a lasting impact on traders as they now have the tools to find the opportunities on their own. The curriculum’s “go at your own pace” and “learn what you want” format provides traders with the flexibility and freedom to focus on the subjects they want for as long as they want. The feedback through the videos, trading strategies, and live coaching has been outstanding.

Trading Signals

An ideal scenario for a # trader is to know exactly where the markets are moving based on trading signals that are right 100% of the time. As you may have guessed, this is not possible because there are countless factors influencing the currency markets. The only remaining way is to compare the most profitable signals and choose among them.

The DailyFX+ Trading Signals are designed to tell you when to enter a trade, when to take profits, or when to cut your losses. This user-friendly gadget offers trading signals that covers 12 currency pairs together with six different trading strategies, updated 24 hours a day.

With the DailyFX+ Trading Signals you can view the performance of each of the offered strategies over the past sixty days. You also have access to view the accuracy percentage for each strategy, which will tell you the percentage of trades that have been executed as instructed by the strategy with the profitable outcome. Please be advised that past performance does not guarantee future results.

How it works

The DailyFX+ Trading Signals offers six different strategies, using three trading approaches: range, breakout, and momentum.

• Range Strategies: Often work best when the market is moving sideways with defined support and resistance levels.

• Breakout Strategies: Often work best when the price action has broken these levels, and is making new highs or new lows.

• Momentum Strategies: Work when the market has a clear short-term direction.

Click here to visit FXCM

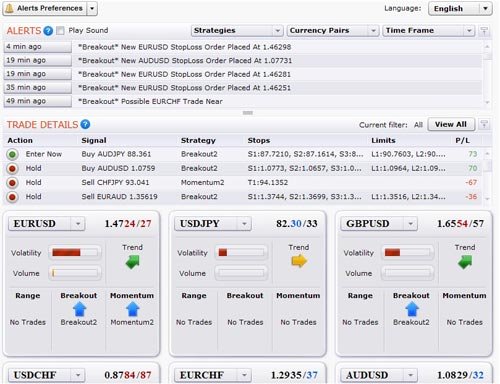

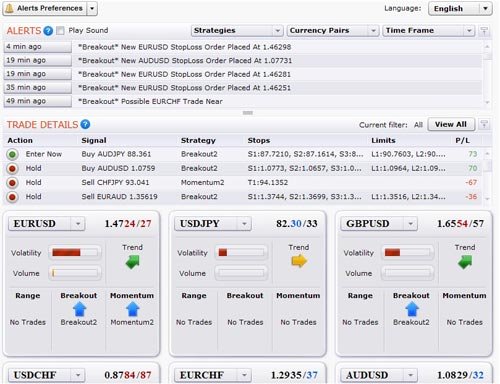

DailyFX+ Trading Signals Page Sample

At the top of the screen, you have the alerts window that gives you access to a box where all the latest action by the six different strategies are displayed, including any recent trades, levels to take profits and losses, and updates on previous signals. The software will even alert you to new signals that are likely to hit soon.

The default view will show you alerts for all currency pairs, time frames, and strategies. You can place filters if you want to refine your search.

The Trade Details section is a user-friendly and easy-to-understand trading tool that visualizes a general picture of the selected pairs. You can see the current price, the trend direction, volatility (which shows how much the pair has been moving compared to the past two months), and volume index (which shows how much has been executed at FXCM compared to the past five trading days). Furthermore, the strategies that are currently showing signals in the pairs are shown by blue or red arrows. To make it even easier for traders to know how each strategy can be used, the possible actions are shown by green or red lights. The green lights indicate “enter now,” which means the trade is still good to enter at the current market price. The red lights mean “hold.” You should not get into a new trade with this signal at that time.

The Trade Details section also guides you to find out where to exit using each of the strategies. Right next to the “Action” column are the “Signal” and “Strategy” columns that show each strategy for the selected currency pair, where the system entered, and whether it was a buy or sell. Additionally, for each strategy, the levels to take profits and losses, and an indication of the real-time profit or loss (P/L) are shown.

Now that you have all the information for your trade, it is just the matter of opening the trading station and placing your trade. The DailyFX+ signals are offered in multiple languages.

It is important to mention, once again, that no one trading signal is going to work 100% of the time. We believe that, when used properly, the signals can be an invaluable trading tool.

Technical Analyzer: Hard Stuff Made Easy

Charts, technicals, and historical data are words that can make # trading analysis sound difficult.

For those traders who don’t have the time to analyze every price movement and compare different scenarios to build a trading strategy, DailyFX+ Technical Analyzer takes the initiative to do all the hard work and provides insight on the most recent price movements with different trading strategy scenarios.

The Technical Analyzer provides the latest analysis in both a short summary and a comprehensive story for major currency pairs, gold, and crude oil. During active trading hours, the stories are often updated as frequently as every two minutes.

The Technical Analyzer offers tools such as short-term bias, medium term bias, change, and other insights about currency pairs. On the charts, the support and resistance levels are marked, and the arrows are helpful to let you know what the DailyFX analysts believe is going to happen in the movement of the selected currency pair on a day-to-day basis.

The Alerts section is another useful feature on the Technical Analyzer for traders who follow a number of technical indicators. This tool allows you to follow indicators such as the 20-day-moving average, the 50-day moving average, the cross-over between those two, the MACD, Bollinger Bands, and more all on one screen at the same time. The screen will tell you exactly what signal these popular indicators are giving at that moment.

The same set of products is also offered for candle sticks. Candle sticks are pretty complicated to actually quantify, and they can be subjective. The human eye is believed to still be more intelligent than program coding. However, this tool can be a support in recognizing the different types of candle sticks for different markets and indexes including #, Dow Jones, Nikkei, S&P 500, crude oil, and gold.

To conclude, the Technical Analyzer is a friendly tool, digesting the difficult-looking # technicals and presenting them as another ever-ready # trading tool.

Speculative Sentiment Index: # Trading Cristal Ball

One of the most exciting tools offered by DailyFX+ is the Speculative Sentiment Index (SSI).

Most # traders use fundamental and technical analysis to try to predict the direction of the # market, and to time their entries and exits. In the futures market, traders have access to a third tool to help them accomplish these goals, which provides insight to what the other traders are thinking—sentiment analysis in the form of positioning data.

Because the futures market is centralized on an exchange, traders can see where other traders are positioned in reports such as the CFTC’s weekly Commitments of Traders report. Unlike the futures markets, the # market is largely conducted “over the counter,” meaning that it is decentralized. This makes it difficult to find comprehensive volume or open interest data. But DailyFX has taken measures in an attempt to fill this gap by offering clients access to FXCM’s proprietary open-interest and positioning data. The SSI provides live FXCM clients a virtually unparalleled view of # market sentiment. What’s more, the SSI is updated twice a day with current information on DailyFX+. This is in stark contrast to the weekly Commitments of Traders reports, which only shows data that has been delayed for three days.

The SSI reports provide information on how many FXCM accounts are short or long in each of the eight currency pairs. By following the SSI’s twice daily updates, you can see how many traders are entering or exiting the markets. Many FXCM clients use the SSI as a contrarian indicator and we believe that the SSI can be a reliable index to forecast the # market.

FXCM has one of the largest cross sections of # traders in the world and, therefore, has a credible amount of client data from which to draw the SSI.

Here we conclude a sneak peak on some of the DailyFX+ gadgets. Taking advantage of this always-open # trading toolbox is easy. If you already have a live FXCM account, simply log in to DailyFX+ and start taking advantage of all it has to offer. If you don’t have a live FXCM account but are interested in taking the course or trying out the other tools, sign up for any live FXCM trading account today and gain 24-hour, seven-day-a-week access to DailyFX+.

* Please be advised that CFD accounts are not available to residents of the US or its territories.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. DailyFX will not accept liability for any loss or damage, including, without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Kiana Danial — kdanial@fxcm.com

For more information visit: http://plus.dailyfx.com/

Explore more articles in the Trading category